Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

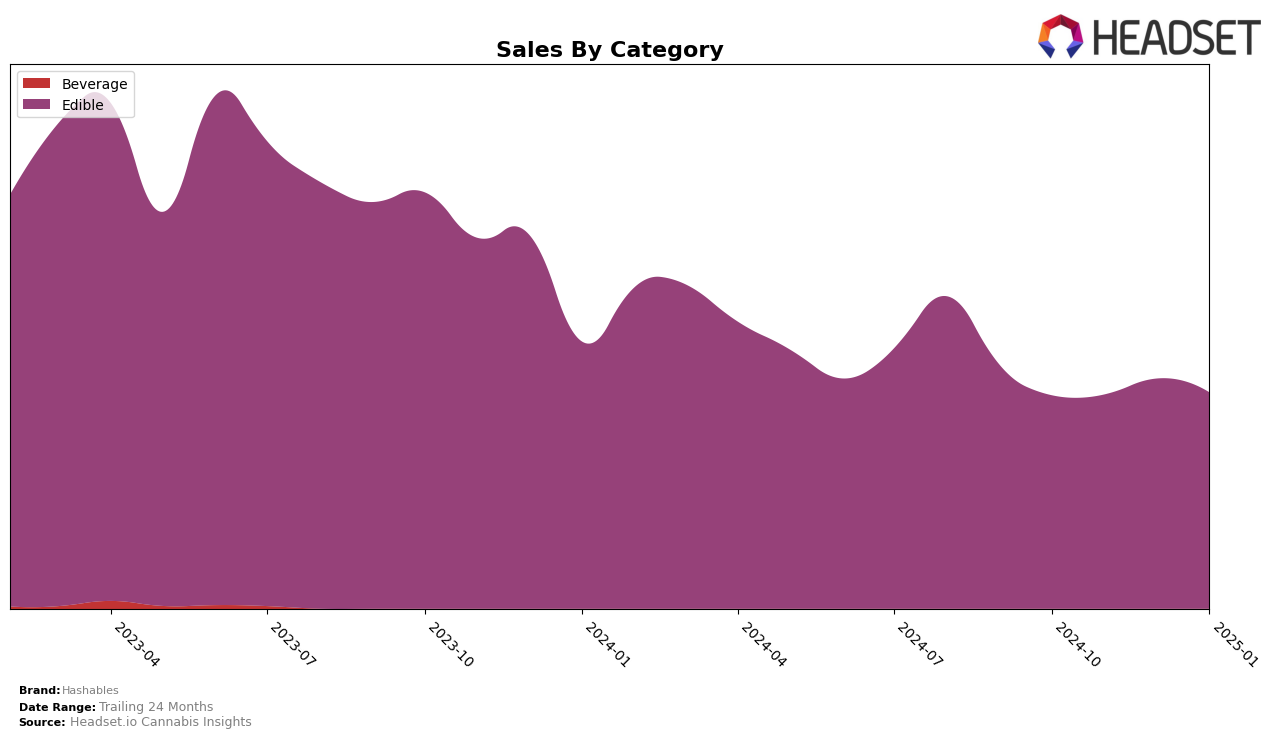

Hashables has shown a consistent presence in the edible category in Massachusetts. Over the months from October 2024 to January 2025, their rank has fluctuated slightly between 15th and 16th place. This stability in ranking indicates a steady demand for their products, although the lack of movement into higher ranks suggests potential challenges in gaining increased market share or facing strong competition. Despite these challenges, Hashables managed to increase their sales from October to December 2024, with a notable peak in December, before experiencing a slight decline in January 2025.

The absence of Hashables in the top 30 rankings across other states and categories suggests that their market presence is predominantly localized to Massachusetts within the edible category. This could be a strategic focus or a limitation in their distribution and brand awareness outside of this region. The consistent ranking within Massachusetts might indicate a loyal customer base or effective regional marketing strategies, but the lack of presence in other states could point to untapped opportunities or competitive barriers. Further analysis would be required to understand their performance dynamics in other potential markets and categories.

Competitive Landscape

In the Massachusetts edible market, Hashables has maintained a consistent presence, ranking between 15th and 16th from October 2024 to January 2025. Despite this stability, Hashables faces notable competition from brands like In House, which improved its rank from 16th to 12th over the same period, indicating a potential threat to Hashables' position. Meanwhile, Encore Edibles displayed a fluctuating rank, dropping from 14th to 18th, which suggests a less stable competitive stance compared to Hashables. Additionally, Lost Farm consistently ranked higher than Hashables, although it experienced a slight decline from 12th to 13th, which could present an opportunity for Hashables to close the gap. Overall, while Hashables' sales have shown a steady increase, the competitive landscape indicates both challenges and opportunities for improving its market position.

Notable Products

In January 2025, Hashables' top-performing product was Watermelon Jolt Solventless Hash Infused Gummies 20-Pack (100mg), maintaining its number one rank for four consecutive months with sales reaching 2994 units. Following closely, Tropical Typhoon Solventless Gummies 20-Pack (100mg) held the second position, consistent with its ranking from December 2024. Bangin' Berry Solventless Gummies 20-Pack (100mg) ranked third, dropping from its second position in November 2024. Electric Grape Gummies 20-Pack (100mg) remained in fourth place, showing a slight decline in sales compared to previous months. Peachy Mango Solventless Gummies 20-Pack (100mg) ended January in fifth place, a position it had maintained since November 2024, despite a decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.