Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

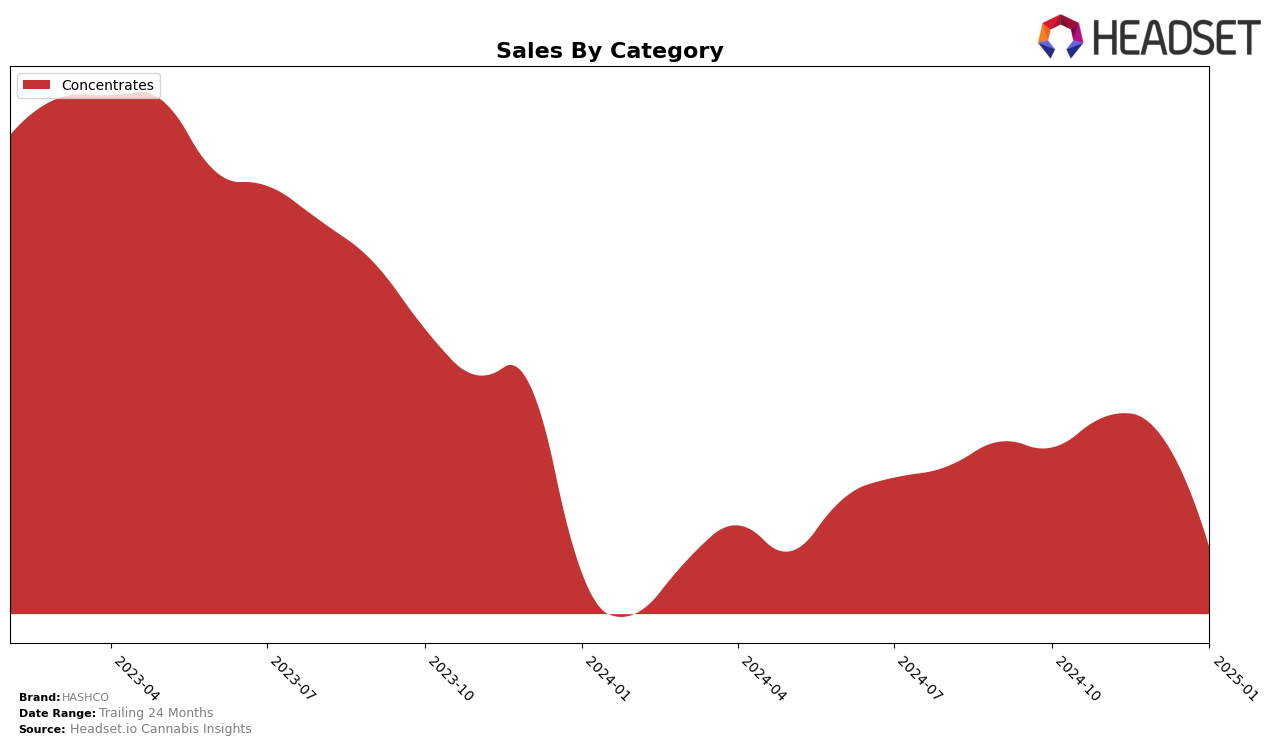

HASHCO's performance in the Ontario market for the Concentrates category has shown some fluctuations over the months from October 2024 to January 2025. Starting at a rank of 26 in October, HASHCO improved slightly to 25 in November, indicating a positive trend. However, the brand experienced a slight decline in the following months, dropping to 28 in December and 29 in January. This downward movement in the rankings could suggest increased competition or market challenges in Ontario. Despite these changes in rank, HASHCO managed to maintain a presence in the top 30 throughout this period, which is a noteworthy achievement in a competitive market.

In terms of sales, HASHCO saw a peak in November 2024, with sales reaching a notable figure, which suggests successful marketing or product launches during that period. However, sales dipped significantly by January 2025, which might be a point of concern for the brand as it reflects a potential decrease in consumer demand or market penetration. The consistency in maintaining a top 30 position, despite the sales decline, demonstrates resilience but also highlights the need for strategic adjustments to regain momentum. Overall, while HASHCO has managed to stay relevant in the Ontario market, the brand's trajectory indicates areas for improvement to enhance its standing and sales performance in the Concentrates category.

Competitive Landscape

In the competitive landscape of the concentrates category in Ontario, HASHCO has experienced a slight decline in its ranking over the past few months, moving from 26th in October 2024 to 29th by January 2025. This downward trend in rank is accompanied by a decrease in sales, particularly noticeable in January 2025. In contrast, Chillum has shown a more stable performance, even improving its rank from 29th in October to 27th in January, with a notable sales spike in December. Meanwhile, Polar has made significant strides, climbing from 40th to 28th, indicating a strong upward trajectory in both rank and sales. Other competitors like Sheeesh! and Double J's have also maintained relatively stable positions, with Double J's consistently improving its rank. These dynamics suggest that while HASHCO remains a key player, it faces increasing pressure from competitors who are gaining momentum in the Ontario concentrates market.

Notable Products

In January 2025, HASHCO's top-performing product was Blonde Hash 2g, maintaining its number one rank consistently since October 2024, with sales reaching 841 units. Following closely, Gold Seal Hash 2g and Gold Seal Hash 1g held steady at the second and third positions, respectively, throughout the same period. Hybrid Single Source Kief 1g, while consistently ranked fourth, saw a significant drop in sales from 79 in October 2024 to 22 in January 2025. Notably, all top products have retained their rankings from the previous months, indicating stable customer preferences. However, the sales figures for January show a general decline across the board compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.