Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

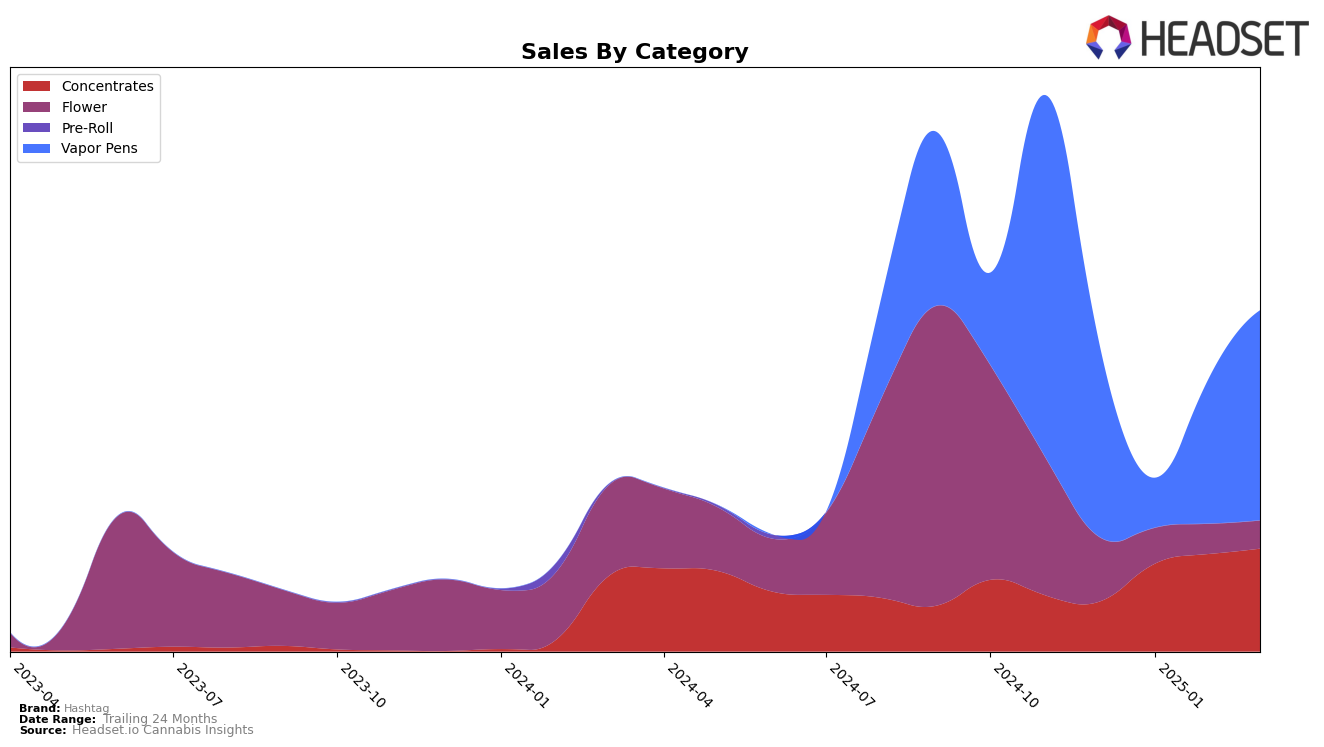

In the dynamic landscape of cannabis products, Hashtag has shown notable performance across different states and categories. In California, Hashtag's presence in the Concentrates category has improved significantly. Starting from a rank of 54 in December 2024, the brand climbed to the 28th position by February 2025, although it slightly dipped to 30th in March 2025. This upward trend in California is accompanied by a consistent increase in sales, reflecting a growing consumer interest in their Concentrates offerings. However, the fact that Hashtag was not in the top 30 in December 2024 indicates that there is still room for growth and potential market capture in this category.

Meanwhile, in New York, Hashtag's performance in the Vapor Pens category presents a somewhat fluctuating trajectory. The brand was ranked 29th in December 2024 but dropped to 49th in January 2025, before recovering to 32nd by March 2025. Despite these fluctuations, there is a positive sales trend, particularly from February to March 2025, suggesting a resurgence in consumer demand. The initial drop out of the top 30 in January 2025, however, highlights the competitive nature of the Vapor Pens market in New York, indicating that Hashtag needs to strategize effectively to maintain and improve its standing in this category.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Hashtag has experienced notable fluctuations in its market position from December 2024 to March 2025. Starting at rank 29 in December, Hashtag saw a significant drop to rank 49 in January, which coincided with a substantial decrease in sales. However, the brand rebounded to rank 35 in February and further improved to rank 32 in March, indicating a positive recovery trajectory. In contrast, Olio consistently climbed the ranks, reaching the 30th position by March, and maintained a strong sales growth throughout the period. Meanwhile, Hepworth showed a slight decline in rank but remained ahead of Hashtag, suggesting a stable market presence. Flav and Kushy Punch also presented competition, with Flav maintaining a position close to Hashtag by March and Kushy Punch re-entering the top 40. These dynamics highlight the competitive pressures Hashtag faces and underscore the importance of strategic initiatives to sustain its upward momentum in the New York vapor pen market.

Notable Products

In March 2025, the top-performing product for Hashtag was Permanent Marker Distillate Disposable (1g) in the Vapor Pens category, which climbed to the number one rank with sales reaching 1557 units. Wedding Cake Distillate Disposable (1g) secured the second position, dropping from its previous top spot in February. Super Jack Distillate Disposable (1g) maintained its third-place ranking from February, showing consistent performance. Strawberry Diesel Distillate Disposable (1g) held steady at fourth position while RS-11 Distillate Disposable (1g) re-entered the rankings at fifth place after being absent in January and February. These shifts indicate a dynamic market where consumer preferences can change rapidly from month to month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.