Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

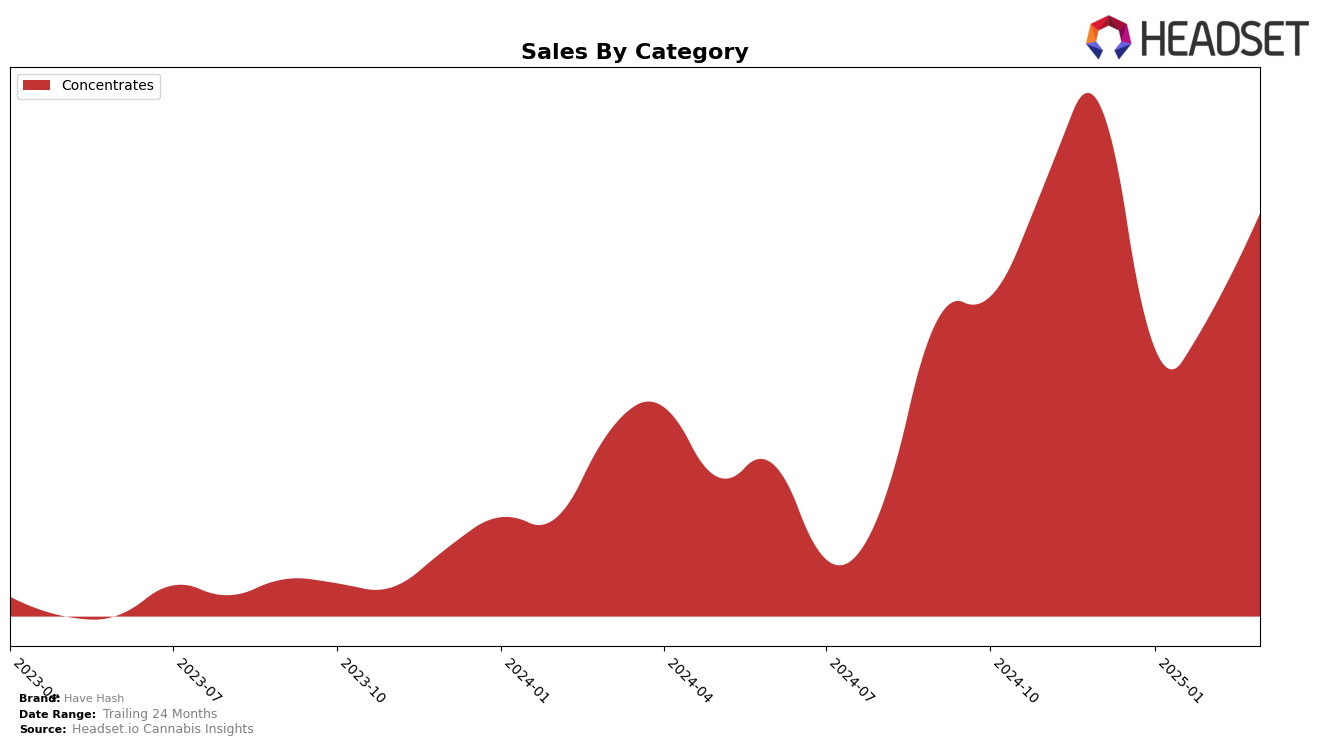

Have Hash has demonstrated a dynamic performance across various categories and states, with notable fluctuations in its ranking positions. In California, the brand experienced a significant drop in the Concentrates category from December 2024 to January 2025, moving from 18th to 40th place. However, this decline was short-lived as the brand improved its position to 29th in February and further to 21st in March 2025. This recovery indicates a positive trend and suggests that the brand may have implemented strategies to regain its market share. The initial drop could be seen as a warning sign, but the subsequent rise in rankings suggests resilience and adaptability in a competitive market.

While the Concentrates category in California has shown variability in rankings, the absence of Have Hash from the top 30 in some months could be seen as a concern for stakeholders who are closely monitoring its performance. The fluctuation in sales figures, with a notable dip in January followed by a recovery, highlights the volatile nature of the cannabis market and the challenges brands face in maintaining a steady position. As Have Hash continues to navigate these market dynamics, understanding the factors behind these movements could offer insights into broader industry trends and the brand's strategic responses. For those interested in a deeper dive, the sales data and movements across other states and categories could reveal more about the brand's overall performance trajectory.

Competitive Landscape

In the competitive landscape of the California concentrates market, Have Hash has experienced notable fluctuations in its ranking and sales over the past few months. Starting from December 2024, Have Hash was ranked 18th but saw a significant drop to 40th in January 2025, before rebounding to 29th in February and 21st in March. This volatility in rank reflects a challenging market environment, where competitors such as Rosin Tech and Globs have shown more consistent performance. For instance, Rosin Tech improved its rank from 27th in December to 15th in February, before slipping to 23rd in March, while Globs maintained a relatively stable position, peaking at 15th in January. Despite the fluctuations, Have Hash's sales have shown a recovery from January to March, suggesting potential for regaining market share if the brand can stabilize its ranking trajectory.

Notable Products

In March 2025, Have Hash's top-performing product was Bag Clogger Cold Cure Live Rosin (1g) in the Concentrates category, securing the number one spot with notable sales of 369 units. Pure Guava Cold Cure Live Rosin (1g) followed as the second best-seller, while Pistachio Runtz Cold Cure Live Rosin (1g) and Pistachio Runtz Live Rosin (1g) claimed the third and fourth positions, respectively. Notably, Tallymon Cold Cure Live Rosin (1g) dropped from the top position in February to fifth place in March, indicating a shift in consumer preference. This change in rankings suggests a dynamic market where new products can quickly rise to prominence. The consistent performance of the top products highlights a strong consumer demand for high-quality concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.