Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

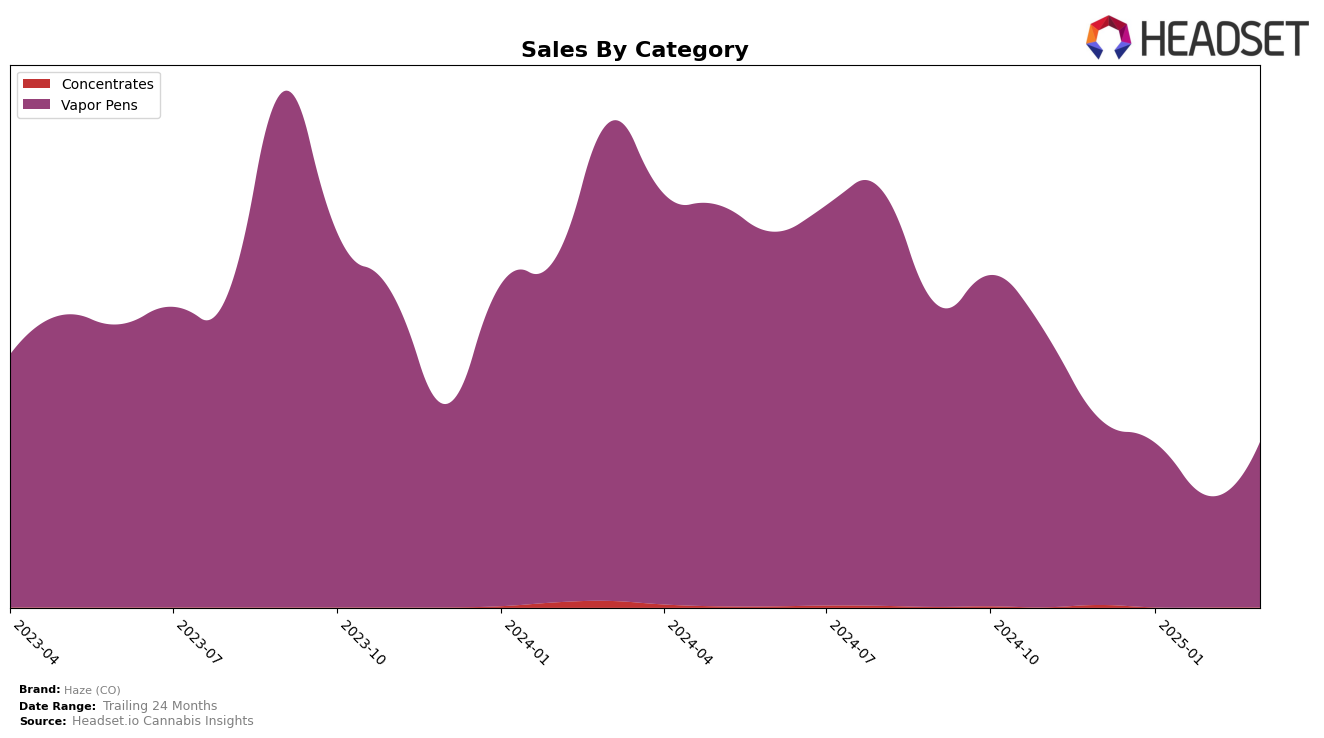

Haze (CO) has demonstrated a fluctuating performance in the Vapor Pens category across the state of Colorado. Starting from a rank of 30 in December 2024, the brand experienced a dip in January and February 2025, moving out of the top 30 altogether in February. However, March 2025 saw a resurgence with Haze (CO) climbing back to 29th position. This indicates a potential recovery phase for the brand in this category, suggesting that strategic adjustments or market conditions might have played a role in their improved ranking by March.

Sales figures for Haze (CO) also reflect this volatility, with a notable decline from December 2024 to February 2025, followed by a recovery in March. The sales in March 2025, although not fully recovering to December levels, show a positive trend compared to the previous month. This rebound in March could be indicative of successful marketing strategies or product innovations that resonated well with consumers. The absence of a top 30 ranking in February should be a point of concern, highlighting the competitive nature of the Vapor Pens market in Colorado and the challenges Haze (CO) faces in maintaining a consistent market position.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Haze (CO) has shown a dynamic shift in rankings over the months from December 2024 to March 2025. Despite a dip in February 2025, where Haze (CO) fell to 38th place, it rebounded to 29th in March 2025, indicating resilience in a competitive market. In comparison, Dutch Botanicals consistently improved its position, climbing from 33rd in December 2024 to 27th in March 2025, showcasing a steady increase in market presence. Meanwhile, Sunshine Extracts made a significant leap from 59th to 28th, highlighting a remarkable growth trajectory. Conversely, West Edison and Sano Gardens experienced a decline in rankings, with both brands dropping out of the top 20 by March 2025. This fluctuation in rankings and sales among competitors underscores the volatile nature of the vapor pen market in Colorado, where Haze (CO) must continue to innovate and adapt to maintain and improve its market position.

Notable Products

In March 2025, the top-performing product from Haze (CO) was the Papaya Distillate Cartridge (1g) in the Vapor Pens category, securing the number one rank with notable sales of 880 units. Following closely is the Hazy- Pink Runtz Distillate Cartridge (1g), which climbed to the second position from fourth in February. The Tropical Lime Portal Distillate Cartridge (1g) maintained a steady third place, consistent with its previous performance. Oranges and Apricots Portal Distillate Cartridge (1g) remained in the fourth spot, showing stable demand. The Banana Distillate Cartridge (1g) held its fifth position, demonstrating consistent sales across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.