May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

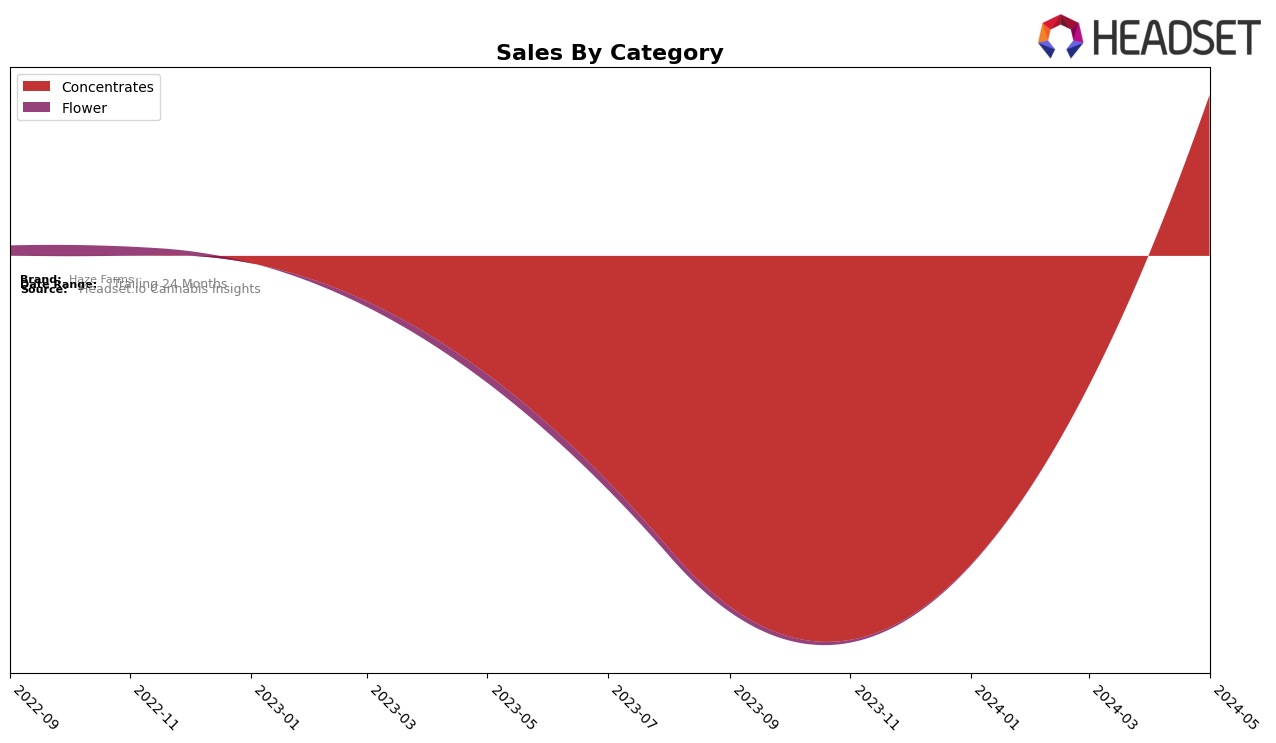

Haze Farms has seen notable movements in its performance across various states and categories in recent months. In Nevada, the brand was not ranked in the top 30 for the Concentrates category until May 2024, when it entered the list at rank 24. This indicates a positive trend for Haze Farms in the Nevada market, suggesting a growing acceptance and demand for their concentrate products. The sales figures for May 2024 were $22,265, showcasing a tangible improvement from previous months when they were not in the top 30.

However, outside of Nevada, Haze Farms has not made a significant impact in other states or categories as evidenced by their absence from the top 30 rankings. This could be seen as a challenge for the brand, indicating areas where there is room for growth and market penetration. The mixed performance highlights the importance of strategic focus on specific markets to bolster their presence and improve overall brand performance. By analyzing these trends, stakeholders can identify opportunities and strategize accordingly to enhance Haze Farms' market position.

Competitive Landscape

In the competitive landscape of the Nevada concentrates market, Haze Farms has seen notable fluctuations in its rank, particularly in May 2024, where it entered the top 25 at rank 24. This is a significant development given that Haze Farms was not in the top 20 for the preceding months. Competitors such as Mo-jo (NV) have maintained a more consistent presence, although they experienced a drop from rank 13 in February to rank 22 in May. Meanwhile, Mammoth Labs showed an upward trend, moving from rank 30 in March to rank 23 in May. Another competitor, Sauced, remained relatively stable, hovering around the 25th rank. The entry of Haze Farms into the top 25 indicates a positive shift in market dynamics for the brand, suggesting potential growth opportunities if this trend continues.

Notable Products

In May-2024, the top-performing product from Haze Farms was OG Runtz #14 Cured Resin Badder (1g) in the Concentrates category, maintaining its number one rank from April-2024 with a significant sales increase to 1007 units. Iced Runtz Live Resin Sugar (1g), also in the Concentrates category, rose to the second position with 128 units sold, despite not being ranked in April-2024. The notable jump in sales for OG Runtz #14 indicates a growing consumer preference for this product. The consistent category dominance by Concentrates suggests a strong market trend. Overall, Haze Farms saw a positive shift in sales rankings and volumes for its top products in May-2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.