Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

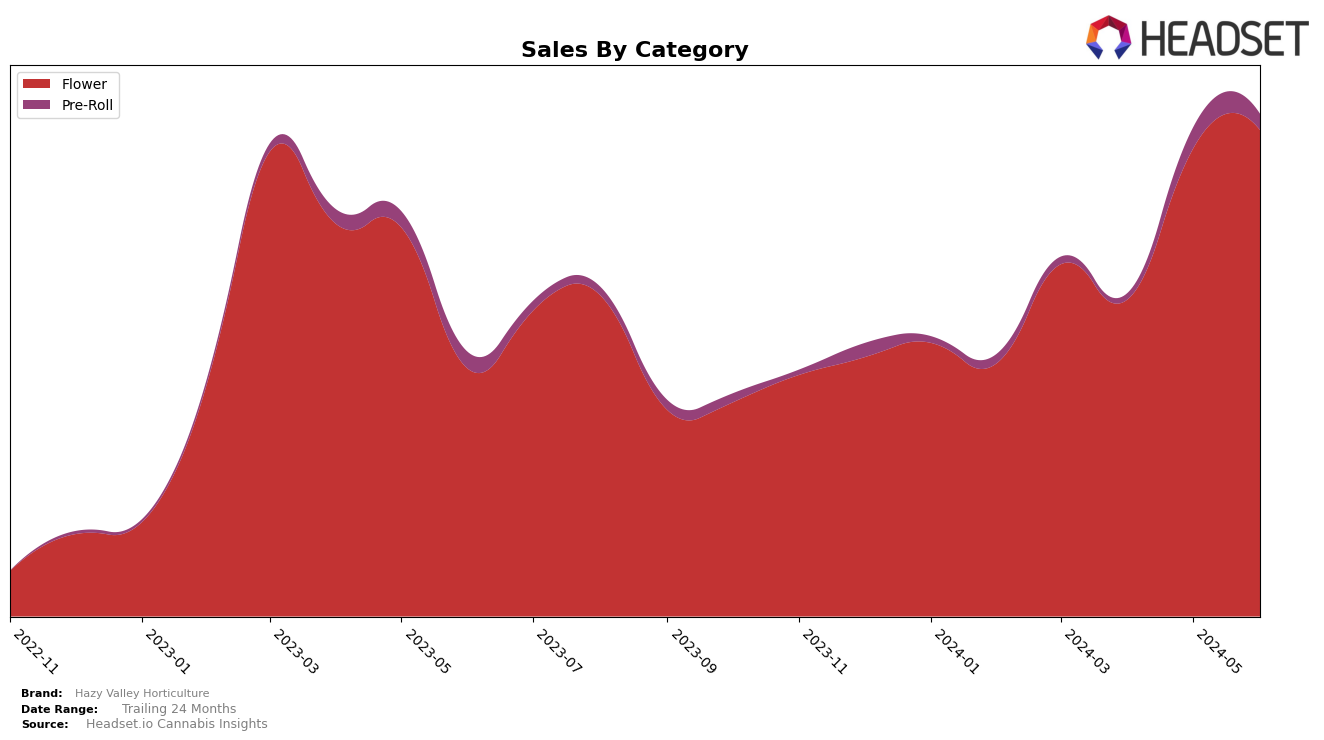

Hazy Valley Horticulture has shown notable progress in the Oregon market over the past few months. In the Flower category, the brand moved from being ranked 43rd in March 2024 to breaking into the top 30 by June 2024, landing at 28th. This upward trajectory is indicative of their growing popularity and market penetration in Oregon. Such a leap in rankings within a few months suggests that Hazy Valley Horticulture is effectively capturing consumer interest and possibly expanding their distribution or improving their product offerings.

However, it is important to note that Hazy Valley Horticulture did not appear in the top 30 brands in the Flower category for Oregon in either March or April 2024, which indicates a less favorable performance during those months. This absence from the top rankings could be seen as a challenge that the brand had to overcome. By May and June 2024, the brand's presence in the top 30 suggests a significant improvement, demonstrating resilience and strategic adjustments that have paid off. This trend of climbing the ranks is a positive sign for stakeholders and consumers who are following the brand's progress. For more detailed insights, you can explore the Oregon market through this link.

Competitive Landscape

In the competitive landscape of the Oregon Flower category, Hazy Valley Horticulture has shown a notable upward trend in rankings over the past few months. Starting from a rank of 43 in March 2024, Hazy Valley Horticulture has climbed steadily to reach the 28th position by June 2024. This improvement in rank is indicative of increasing market traction and consumer preference. Comparatively, Mother Magnolia Medicinals has also seen a significant rise, moving from 85th to 30th place, suggesting a competitive push in the market. Meanwhile, PDX Organics experienced fluctuations, dropping from 15th in March to 26th in June, which could imply challenges in maintaining consistent sales. Tao Gardens maintained a relatively stable position around the 29th rank, while Drewby Doobie / Epic Flower saw a dramatic rise from being unranked in April to 27th in June. These dynamics highlight the competitive and volatile nature of the Oregon Flower market, where Hazy Valley Horticulture's consistent upward trend positions it favorably against its peers.

Notable Products

In June 2024, the top-performing product from Hazy Valley Horticulture was GMO Cookies (Bulk) with sales reaching 1793 units. Pink Animal Crackers (Bulk) climbed to the second spot, showing a significant increase in sales from 617 units in March to 1130 units in June. Dole Whip (Bulk) secured the third position, improving from fifth place in May with sales rising to 1072 units. Super Silver Haze (Bulk), which held the top rank in the previous months, dropped to fourth place with 1052 units sold in June. Caffeine (Bulk) entered the rankings at fifth place with 858 units sold, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.