Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

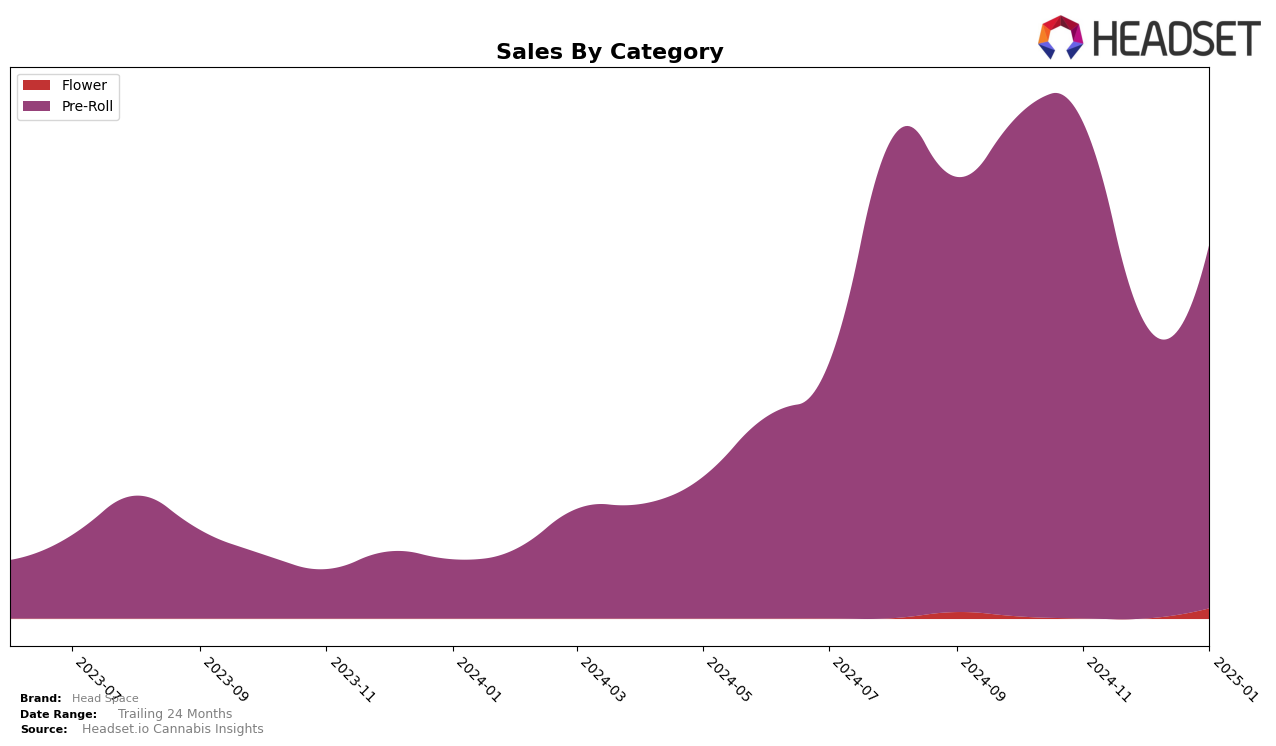

Head Space has shown a fluctuating performance across different states and product categories. In the New York market, their presence in the Pre-Roll category has been somewhat volatile. Starting at 17th place in October 2024, the brand slipped to 22nd in November and further down to 27th in December. However, by January 2025, they managed a slight recovery, climbing back to the 26th position. This suggests a potential struggle in maintaining a steady foothold in the competitive New York Pre-Roll segment, with sales reflecting a dip in December but showing a resurgence by January.

Interestingly, the absence of Head Space from the top 30 rankings in other states and categories indicates either a lack of presence or competitiveness in those markets. This could be seen as a strategic opportunity for the brand to expand or improve its offerings in those areas. The fluctuations observed in New York emphasize the need for Head Space to potentially reassess their market strategy, especially during the holiday season when December sales were notably lower than other months. Overall, these insights suggest that while Head Space is making efforts to stabilize its position in New York, there is room for growth and improvement in other markets and categories.

Competitive Landscape

In the competitive landscape of the New York Pre-Roll category, Head Space has experienced notable fluctuations in its rank over the months from October 2024 to January 2025. Starting at 17th place in October 2024, Head Space saw a decline to 27th by December, before slightly recovering to 26th in January 2025. This trajectory indicates a competitive struggle amidst brands like Electraleaf, which started strong at 11th in October but fell to 27th by January, and Flamer, which made a significant leap from 31st in October to 24th in January. Despite the challenges, Head Space's sales figures show resilience, with a notable rebound in January 2025, suggesting potential for regaining higher ranks. The competitive dynamics, particularly with brands like Lobo and FlowerHouse New York, both of which hovered around the lower ranks, highlight the volatility and opportunities within this market.

Notable Products

In January 2025, the top-performing product from Head Space was the Private Party Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank consistently from October 2024. It achieved sales of 5,568 units. The Kiwi Kush x Lemon Cherry Gelato Pre-Roll (1g) held the second position throughout the months, showing a slight decrease in sales from December. The Kush Mintz x Gelato #41 Pre-Roll (1g) remained third, with steady sales figures. Notably, the Kush Mintz Pre-Roll (1g) entered the rankings in January at fourth place, while the Kush Mintz x Gelato Landing Sequence Pre-Roll (1g) also made an appearance at fifth, improving from its previous rank in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.