Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

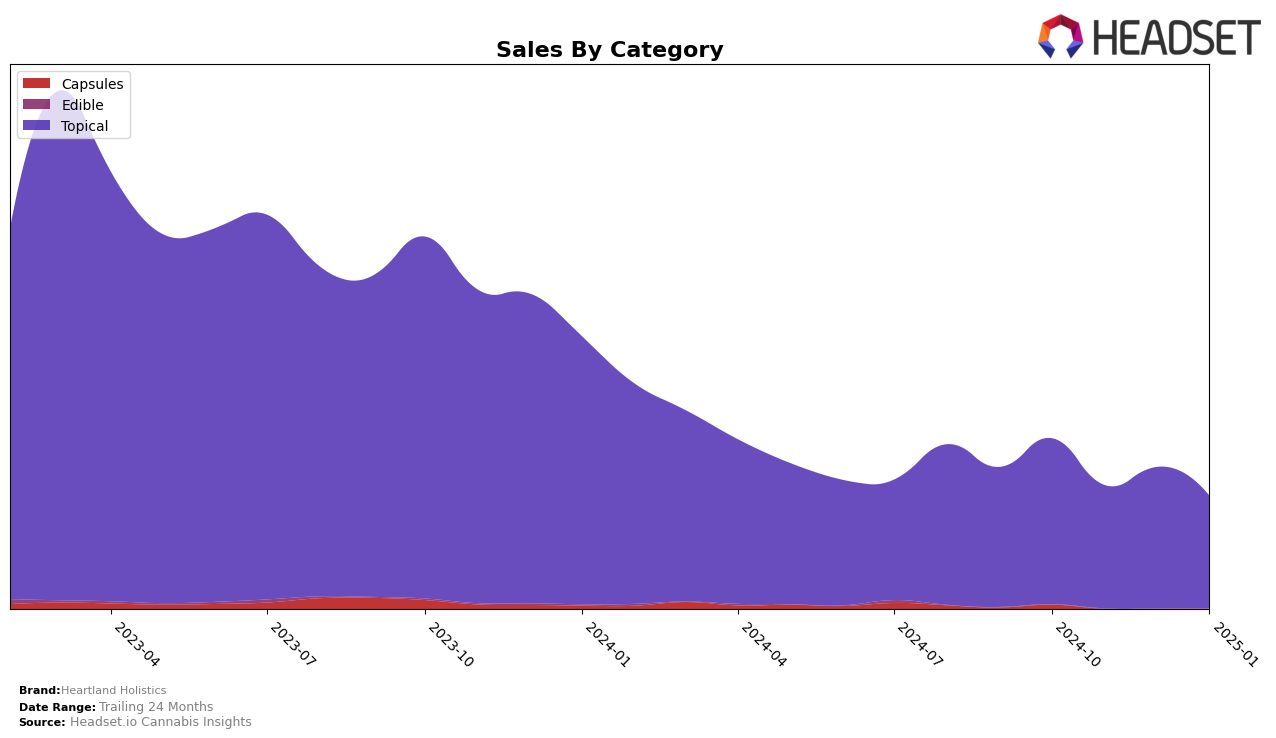

Heartland Holistics has shown consistent performance in the Topical category across the state of Missouri. The brand maintained a steady third-place ranking from October 2024 through January 2025, indicating a strong foothold in this category. Despite a slight decrease in sales from October to January, the brand's ability to hold its rank suggests a loyal customer base and effective market strategies within the state. This stable ranking amidst fluctuating sales figures could imply that Heartland Holistics is successfully managing external market pressures or competition.

Notably, Heartland Holistics does not appear in the top 30 rankings for any other states or categories during the same period. This absence could be seen as a missed opportunity for expansion or a strategic focus on consolidating their presence in Missouri. The lack of presence in other markets may suggest potential areas for growth or a need to reassess market strategies to increase brand visibility and competitiveness outside their current stronghold. Understanding these dynamics could be crucial for stakeholders looking to explore Heartland Holistics' future market strategies and potential areas for brand development.

Competitive Landscape

In the Missouri Topical category, Heartland Holistics consistently maintained its position as the third-ranked brand from October 2024 through January 2025. Despite this stable ranking, the brand faces significant competition from top contenders such as Mary's Medicinals and Escape Artists, which have held the first and second positions, respectively, throughout the same period. The sales trajectory for Heartland Holistics shows a downward trend from October to January, which could indicate a need for strategic adjustments to boost sales and close the gap with these leading competitors. Meanwhile, Vlasic Labs and Heartland Labs are also showing dynamic movements in the rankings, with Vlasic Labs improving its rank over time, potentially posing a future threat to Heartland Holistics' current standing.

Notable Products

In January 2025, Heartland Holistics' top-performing product was the CBD/THC 1:1 24 Hours Extended Release High Dose Patch, which climbed to the number one position from its previous rank of second in December 2024, with sales reaching 515 units. The FECO Transdermal Patch, previously the top seller in December, moved to the second position, showing a slight decline in sales. The CBD/THC/CBG 1:2:2 Morning Transdermal Patch maintained a consistent presence in the top three, holding the third rank as in December. The CBD/CBN/THC 1:1:1 Night Time Transdermal Patch showed a slight drop, moving from the fourth position in December to remain at fourth in January. Notably, the CBD/THC 3:4 High Dose Transdermal Patch dropped from third to fifth, reflecting a significant decrease in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.