Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

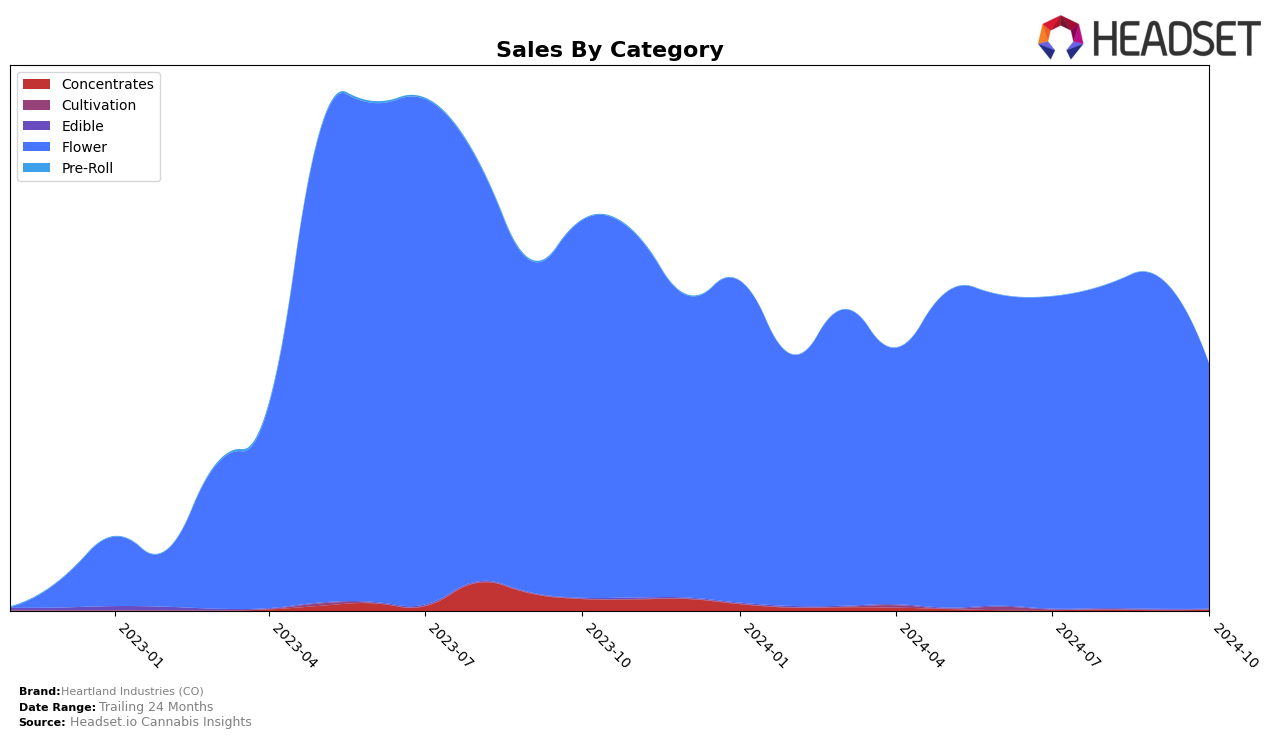

Heartland Industries (CO) has shown varied performance across different cannabis categories and states. Notably, in the Flower category of Colorado, the brand experienced fluctuations in its rankings from July to October 2024. Starting at 6th place in July, it slipped to 8th in August, briefly improved to 7th in September, and then dropped to 10th by October. This downward trend in October is particularly concerning, especially considering that the brand was able to achieve higher sales figures in the earlier months. Despite the decline in rank, the peak in sales during September indicates a potential strategy that might have worked temporarily but was not sustained in the following month.

In other states and categories, Heartland Industries (CO) did not appear in the top 30 rankings, which could be seen as a missed opportunity for market penetration outside of Colorado. This lack of presence in the top rankings in other regions suggests that the brand's focus might be heavily concentrated in its home state, potentially limiting its growth and visibility elsewhere. The absence from top rankings in other states could be due to various factors, including market competition and consumer preferences, which may differ significantly from those in Colorado. Observing these patterns can provide insights into where Heartland Industries (CO) might need to adapt or expand its strategies to capture a broader market share.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Heartland Industries (CO) experienced notable fluctuations in its market position from July to October 2024. Initially ranked 6th in July, the brand saw a decline to 10th by October, despite a peak in sales in September. This downward trend in rank contrasts with the performance of competitors like Billo, which maintained a consistent rank of 9th from August to October, indicating a stable market presence. Meanwhile, The Health Center and 14er Gardens also showed fluctuating ranks, with The Health Center dropping from 7th in July to 11th in October, and 14er Gardens moving from 9th to 12th in the same period. Interestingly, TREES demonstrated a significant rebound, climbing from 16th in August to 8th in October, surpassing Heartland Industries (CO) in the final month. These dynamics suggest that while Heartland Industries (CO) has faced challenges in maintaining its rank, the competitive environment remains fluid, offering opportunities for strategic adjustments to regain market share.

Notable Products

In October 2024, Ice Cream Cake (Bulk) from Heartland Industries (CO) maintained its top position as the leading product in the Flower category, with sales amounting to $65,174. Golden Goat (Bulk) emerged as the second top-performing product, marking its debut in the rankings. Garlic Breath (Bulk) climbed to the third position after being ranked first in July 2024 and third in September 2024, indicating a consistent presence in the top three. Divine Kush Breath (Bulk), which held the second position in July and August, fell to fourth place in October. Meanwhile, Strawberry Cough (Bulk) entered the top five for the first time, securing the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.