Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

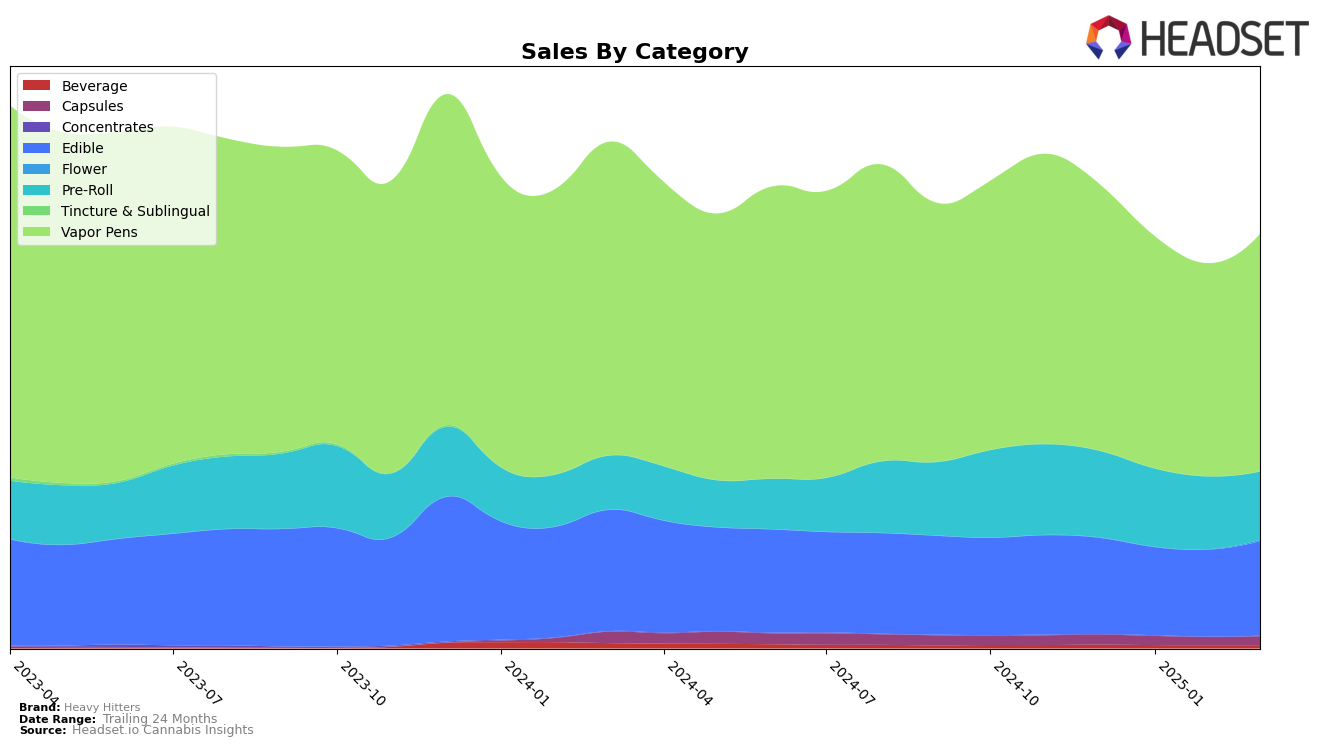

In California, Heavy Hitters has shown a consistent presence across multiple categories, with notable fluctuations in rankings. In the Vapor Pens category, the brand maintained a stable position, holding the 8th rank from January to March 2025, despite a dip in sales in January and February, followed by a recovery in March. The Edible category saw a slight decline from 6th to 7th place in March, indicating a competitive landscape. Meanwhile, the Pre-Roll category experienced a more significant drop, falling from 10th to 14th place by March, highlighting a potential area of concern for the brand. The Capsules category, however, showed resilience, maintaining the 7th rank in March after a brief absence in February.

In New York, Heavy Hitters faced a more challenging environment. The brand's presence in the Edible category improved, moving from 18th to 16th place between February and March 2025, indicating potential growth opportunities. However, in the Pre-Roll category, the brand did not maintain a top 30 position after December, suggesting a need for strategic adjustments. The Vapor Pens category also witnessed a decline in rankings, slipping from 9th in December to 14th by March, despite a slight rebound in sales in March. This mixed performance across categories in New York underscores the competitive dynamics and the necessity for targeted strategies to bolster market presence.

Competitive Landscape

In the competitive landscape of vapor pens in California, Heavy Hitters has experienced some fluctuations in its market position, which could impact its sales trajectory. Over the four-month period from December 2024 to March 2025, Heavy Hitters consistently ranked 8th, except for December when it held the 7th spot. This slight decline in rank is notable, especially when compared to competitors like Jetty Extracts, which maintained a strong position within the top 6, and Turn, which saw a dip but remained competitive. Meanwhile, Rove and Cold Fire hovered around the 9th and 10th positions, indicating a stable yet less aggressive market presence. The sales figures for Heavy Hitters showed a decrease from December to February, followed by a recovery in March, suggesting a potential rebound. These dynamics highlight the importance for Heavy Hitters to strategize effectively to regain and potentially improve its standing in this competitive category.

Notable Products

In March 2025, Heavy Hitters' top-performing product was the Lights Out - THC/CBN 1:1 Midnight Cherry Gummies 5-Pack, maintaining its consistent first-place ranking since December 2024, with sales of 22,438 units. The Light On - THC/THC-V 2:1 Green Crack Gummies 5-Pack also held steady in second place throughout the same period. The Blue Dream Distillate Cartridge ranked third, showing stability in its position from December 2024 to March 2025. Similarly, the Pineapple Express Distillate Cartridge remained in fourth place, with a slight increase in sales from February to March. The Holy Grape x God's Gift Ulta Gummies 5-Pack entered the rankings in February and held the fifth spot in March, indicating a positive reception since its introduction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.