Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

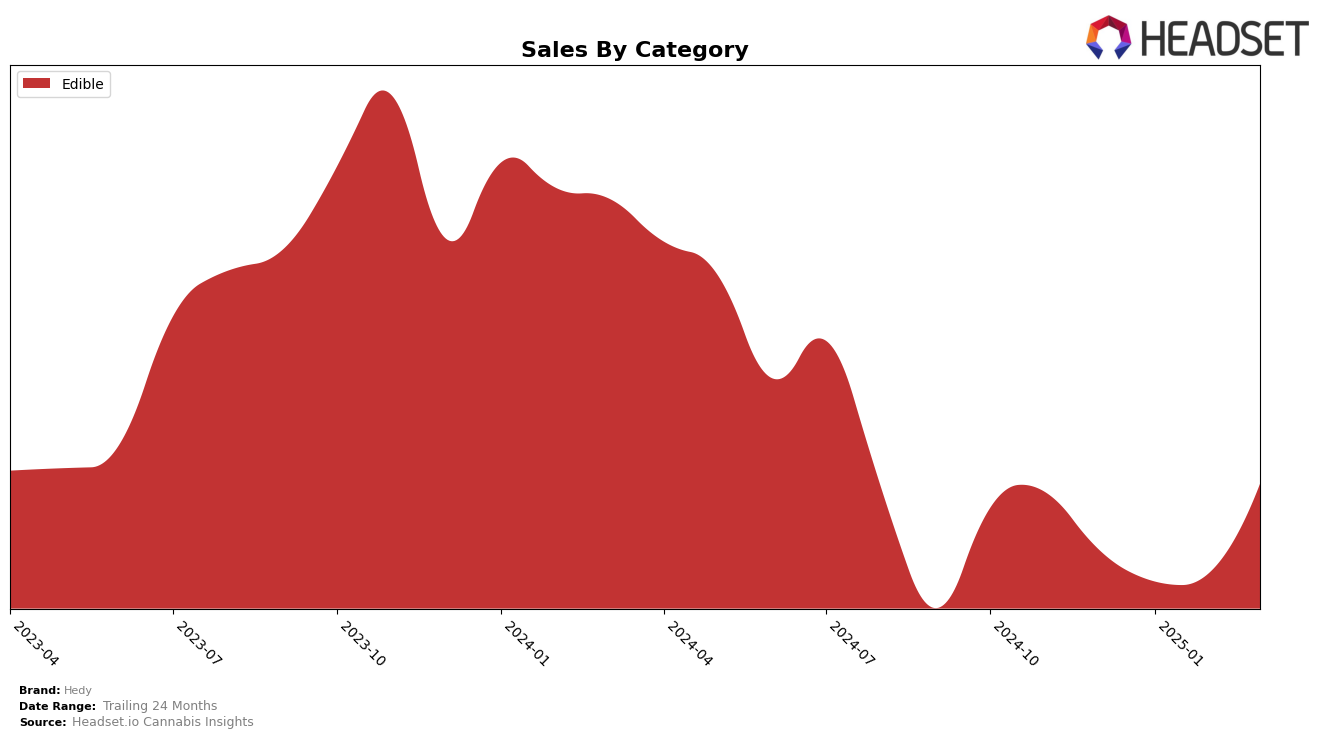

Hedy's performance in the Edible category has shown notable variations across different states. In Colorado, the brand has maintained a strong presence, consistently ranking within the top 15, with a notable improvement from 13th to 10th place between January and February 2025. This upward trend is accompanied by a significant increase in sales, indicating a growing consumer preference for Hedy's products in the state. Conversely, in Illinois, Hedy has struggled to break into the top 30, maintaining a steady position around the 50th mark. This stagnation in ranking, coupled with declining sales figures, suggests challenges in capturing market share in Illinois.

In New Jersey, Hedy has consistently held a strong position, ranking 13th from January through March 2025. This stability in ranking, along with a rebound in sales in March, highlights a resilient market presence. Meanwhile, in Maryland, Hedy's ranking fluctuated slightly but remained within the top 31, indicating a competitive but stable market position. The absence of Hedy from the top rankings in Massachusetts since December 2024 suggests limited market penetration or competitive challenges in that region. These insights reflect the varied dynamics and competitive landscapes Hedy faces across different states, providing a snapshot of its market positioning and performance trends.

Competitive Landscape

In the competitive landscape of the edible category in Colorado, Hedy has shown a notable upward trajectory in rankings and sales over the first quarter of 2025. Starting from a rank of 12th in December 2024, Hedy improved to 10th by February 2025, maintaining this position through March, indicating a positive reception and increased market penetration. This upward movement is significant when compared to competitors like Incredibles, which experienced a slight decline in rank from 8th to 9th by March 2025, and Smokiez Edibles, which remained stable but did not improve its position. Meanwhile, Revel (CO) showed a strong performance, moving from 9th to 8th, suggesting a competitive edge. Hedy's sales growth from $159,850 in January to $275,542 in March reflects a robust increase, outpacing the sales of Mr. Moxey's, which also showed growth but at a slower pace. This data highlights Hedy's strengthening presence and competitive positioning in the Colorado edible market, suggesting a strategic opportunity for further market share expansion.

Notable Products

In March 2025, the top-performing product from Hedy was Sour Green Apple Chews 10-Pack (100mg), which ascended to the number one position with sales reaching 6321. Sour Watermelon Gummies 10-Pack (100mg) followed closely in second place, maintaining its rank from February. Cherry Lime Gummies 10-Pack (100mg) slipped to third place, despite strong sales, indicating a competitive market. Blueberry Acai Gummy 10-Pack (100mg) held steady at fourth place, showing consistent performance across the months. Notably, Orange Cream Gummy 10-Pack (100mg) remained in fifth place, having entered the rankings only recently in February 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.