Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

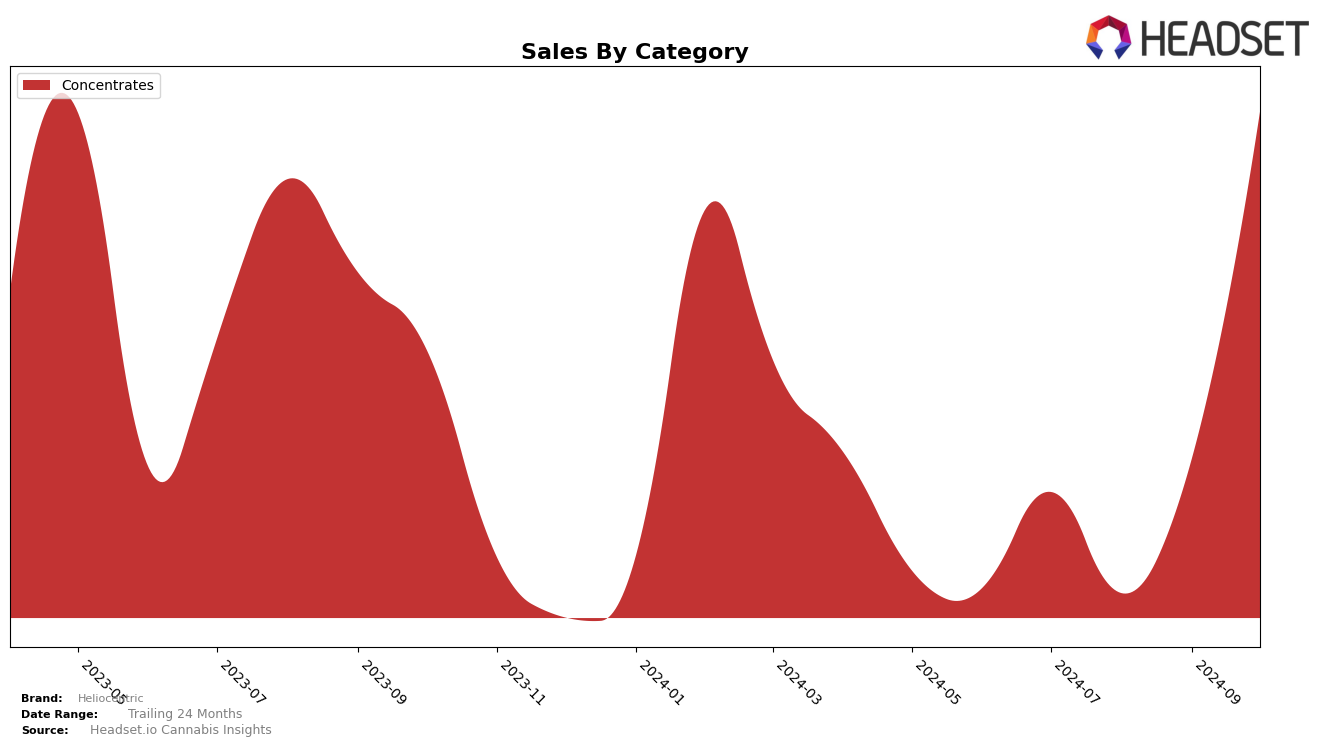

Heliocentric has shown a notable improvement in the Concentrates category in Missouri over the past few months. In July 2024, the brand was ranked 39th, but it did not make it into the top 30 in August. However, by September, Heliocentric had climbed back to 38th place, and in October, it broke into the top 30, securing the 29th spot. This upward trajectory is underscored by a significant increase in sales, with October's figures reaching $34,339, indicating a strong market presence and growing consumer interest in their concentrates.

While Heliocentric's performance in Missouri is encouraging, the absence of data for August suggests a temporary dip in their ranking, which might have been due to increased competition or other market factors. Despite this, the brand's ability to rebound and improve its position by October is a positive sign of resilience and strategic market engagement. This trend of fluctuating rankings highlights the dynamic nature of the cannabis industry and the importance of maintaining a consistent presence to capitalize on market opportunities. As Heliocentric continues to expand its footprint, monitoring their performance across other states and categories will provide further insights into their overall market strategy and success.

Competitive Landscape

In the Missouri concentrates market, Heliocentric has shown a notable fluctuation in its ranking over the past few months, indicating a dynamic competitive landscape. Starting at rank 39 in July 2024, Heliocentric was not in the top 20 in August but climbed back to rank 38 in September, and further improved to rank 29 in October. This upward trajectory in October suggests a positive reception or strategic changes that have bolstered its market presence. Comparatively, Dabstract maintained a relatively stable position, hovering around rank 31 in September and October, which suggests a consistent performance but not enough to surpass Heliocentric's recent gains. Meanwhile, Covert Extraction experienced a significant drop from rank 16 in September to 28 in October, potentially opening up opportunities for Heliocentric to capture more market share. Additionally, Nomad Extracts and The Standard entered the top 30 in October, indicating increased competition. These dynamics highlight the competitive pressures and opportunities for Heliocentric to leverage its recent momentum to further enhance its market position.

Notable Products

In October 2024, Mac & Cookies Shatter (1g) maintained its top position in Heliocentric's product lineup, with an impressive sales figure of 778 units. Jealousy Sugar (1g) climbed back to the second spot after a brief dip to fifth in September, showing a strong recovery with 314 units sold. Ghost OG Sugar Wax (1g) consistently held the third position, indicating stable demand across the months. Sunshine Blend #1 Shatter (1g) improved from fifth in August to fourth in October, suggesting a growing interest in this product. Mountain Mint Live Resin (1g) debuted in the rankings at fifth place, showing promising sales momentum since its introduction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.