Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

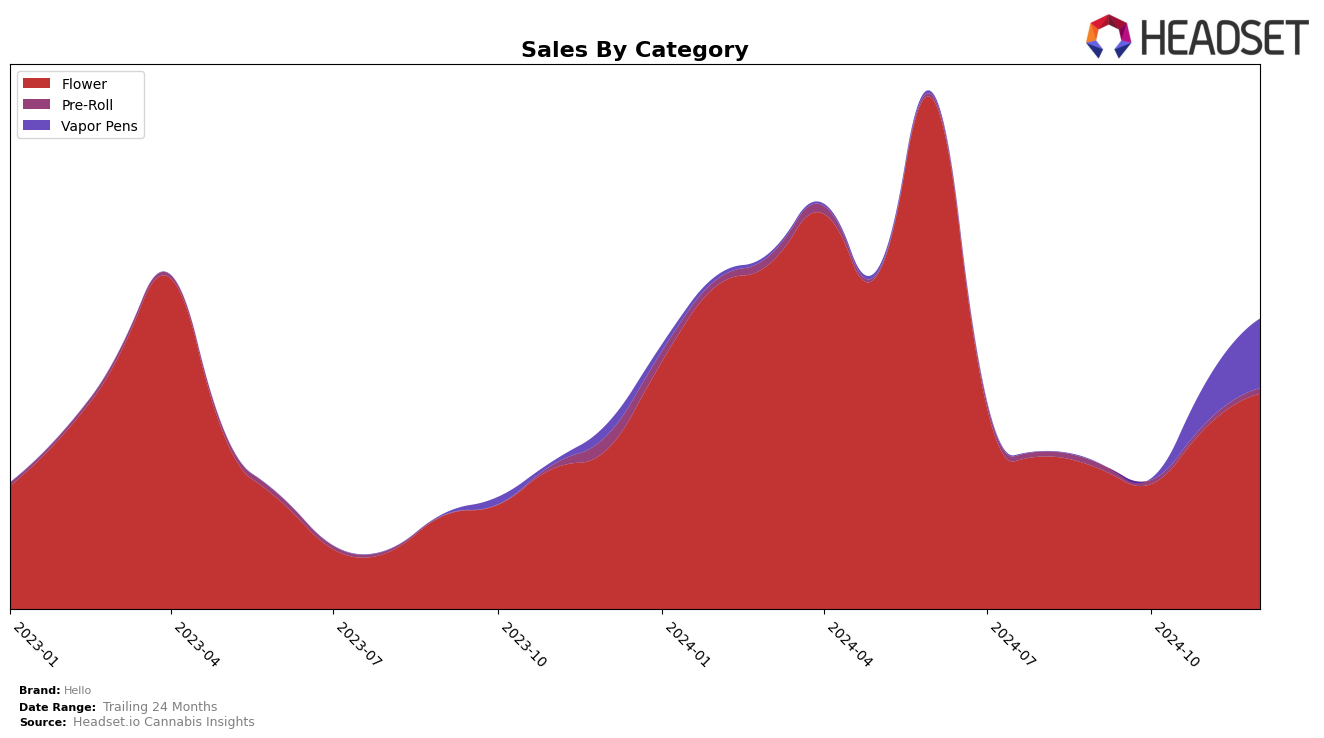

In Arizona, the performance of the Hello brand in the Vapor Pens category has shown a significant upward trajectory. Despite not being in the top 30 brands in September and October, Hello made a notable entry into the rankings in November at position 33 and climbed to 26 by December. This movement indicates a positive reception and growing consumer interest in their vapor pen offerings in the state. Such an ascent suggests strategic improvements or successful marketing efforts that have resonated with the local market. However, the absence of Hello from the top 30 in the earlier months highlights the competitive nature of the market and the challenges brands face in establishing a foothold.

Meanwhile, in Michigan, Hello has demonstrated consistent improvement in the Flower category, moving from a rank of 91 in September to 59 by December. This steady climb reflects a strengthening position within the market, likely driven by increased brand visibility or consumer preference shifts. The brand's sales figures support this trend, with a marked increase from September through December. The brand's ability to break into higher ranks consistently each month underscores a successful adaptation to market demands and possibly an expansion of their product lines or retail partnerships. Yet, the initial lower ranking also underscores the competitive landscape in Michigan, where continuous innovation and quality improvements are crucial for sustained growth.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Hello has shown a notable upward trend in rankings over the last few months of 2024. Starting from a rank of 91 in September, Hello improved to 59 by December, indicating a positive trajectory in market presence. This improvement is significant when compared to competitors such as Cloud Cover (C3) and High Life Farms, both of which experienced fluctuations in their rankings, with Cloud Cover (C3) not even making it into the top 20 during these months. Meanwhile, Redbud Roots and Crude Boys also faced ranking challenges, with Redbud Roots dropping to 58 by December. Despite these competitors having higher sales figures at times, Hello's consistent climb in rank suggests a strengthening brand presence and potential for increased sales momentum in the Michigan market.

Notable Products

In December 2024, Surfer Girl 28g maintained its top position from November, leading the sales for Hello with a notable figure of 8574 units sold. Boo Berriez 3.5g made a significant leap to the second spot from fourth in November, demonstrating a strong performance with 8016 units sold. Boo Berriez 28g entered the rankings in third place, showcasing its rising popularity. Surfer Girl 3.5g also made its debut in the rankings at fourth place, indicating a growing demand for the smaller package. Chuck Norris 3.5g, which was previously unranked in November, reappeared in fifth position, showing a slight decline from its top rank in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.