Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

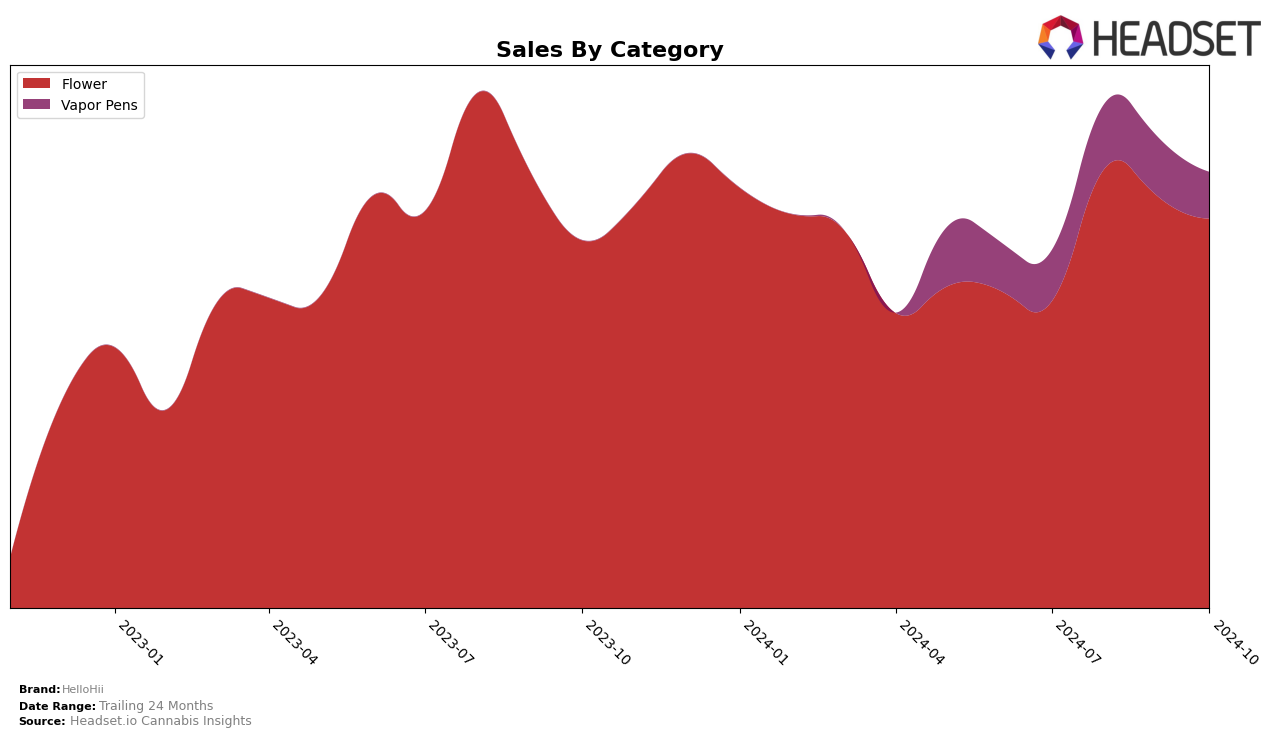

In the state of Massachusetts, HelloHii has shown a commendable upward trajectory in the Flower category. Beginning in July 2024 at a rank of 36, the brand has steadily climbed the ranks to position 26 by October 2024. This consistent improvement reflects a positive reception and growing consumer base for HelloHii's Flower products. The brand's sales figures in this category also indicate a robust performance, with a peak in August followed by a slight decline, suggesting potential seasonal trends or competitive pressures.

Conversely, HelloHii's performance in the Vapor Pens category in Massachusetts has been less stable. Starting outside the top 30 at rank 58 in July, the brand made slight gains by September, only to drop back to rank 59 in October. This fluctuation could point to challenges in maintaining a foothold in a competitive market segment or shifts in consumer preferences. The ranking volatility, coupled with the sales data, might suggest that the brand is still finding its niche within the Vapor Pens category. Observing these trends could provide insights into strategic adjustments needed for sustained growth in this category.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, HelloHii has shown a steady improvement in its ranking from July to October 2024, moving from 36th to 26th place. This upward trend in rank is indicative of a positive reception in the market, despite facing stiff competition. Notably, Nature's Heritage and Grassroots have fluctuated in their rankings, with Nature's Heritage not even making it to the top 20 during these months, while Grassroots improved from 38th to 28th. Meanwhile, Simpler Daze maintained a consistent rank around the mid-20s, similar to HelloHii's recent performance. However, Rev Farms experienced a significant drop from 16th to 27th, which could potentially benefit HelloHii as it climbs the ranks. These dynamics suggest that while HelloHii is gaining ground, the market remains highly competitive, with fluctuating performances among its rivals.

Notable Products

In October 2024, HelloHii's top-performing product was Guava IX (3.5g) from the Flower category, which ascended to the number one spot with impressive sales of 3,387 units. Drunken Monkey (3.5g) followed closely, ranking second after previously leading in September. Twin Flame (3.5g) maintained its position at third, showing consistent performance across the months. Wedding Cake (3.5g) and Do-Si-Pie (3.5g) entered the rankings at fourth and fifth, respectively, indicating a strong debut in October. Notably, Guava IX's rise from second place in August and September to the top spot in October highlights its growing popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.