Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

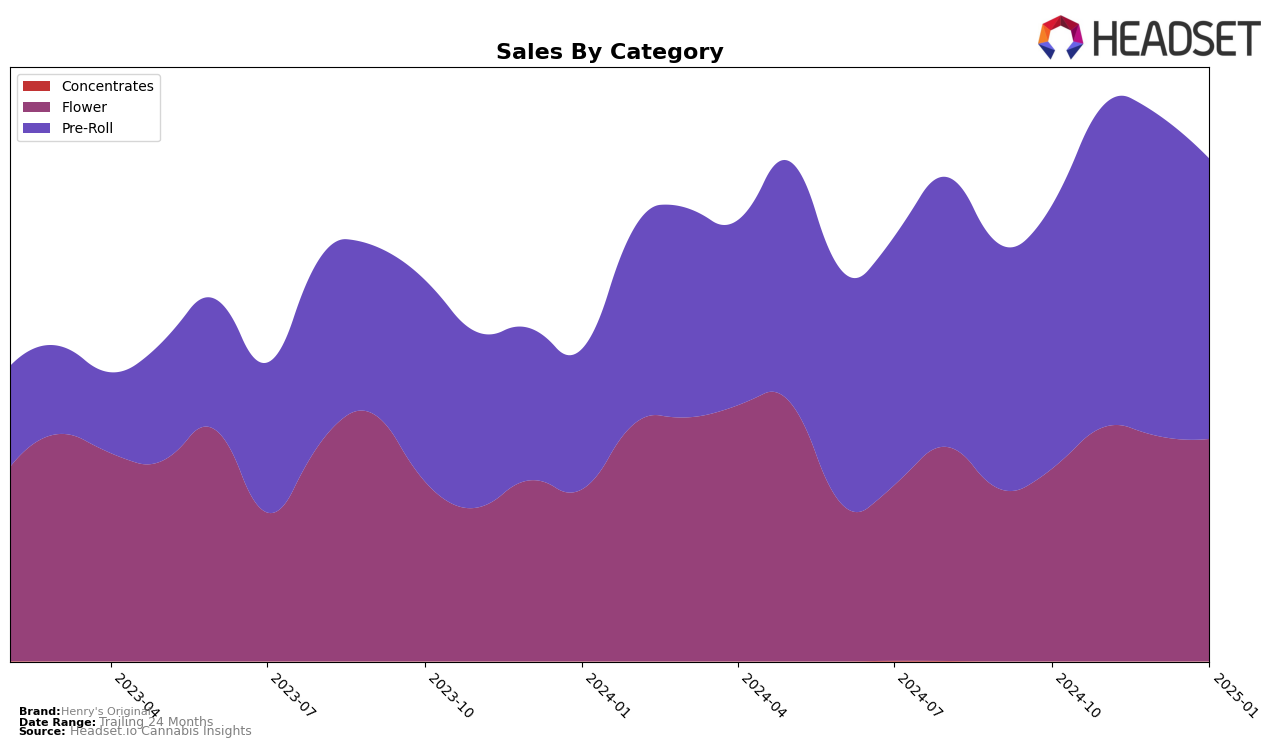

Henry's Original has shown a varied performance across different categories in California. In the Flower category, the brand has not managed to break into the top 30 rankings, with its position slightly improving from 43rd in October 2024 to 35th by January 2025. This indicates a slow but steady upward movement, suggesting some positive momentum despite not yet reaching the top tier. On the other hand, their sales figures in this category have remained relatively stable, with a slight dip from November to January. This stability in sales, even without a top 30 ranking, could imply a loyal customer base or consistent demand.

In contrast, Henry's Original has performed significantly better in the Pre-Roll category in California, consistently maintaining a top 20 position. The brand improved its rank from 16th in October 2024 to 12th in November, and then settled at 13th by January 2025. This consistent high ranking is complemented by strong sales figures, with a notable peak in November. The brand's ability to maintain a strong presence in the Pre-Roll category suggests a competitive advantage or a particularly appealing product offering in this segment. While these rankings provide a glimpse into their market performance, there are additional insights to uncover about their strategies and consumer appeal.

Competitive Landscape

In the competitive landscape of the California Pre-Roll category, Henry's Original has demonstrated a notable performance trajectory over the past few months. Starting from October 2024, Henry's Original ranked 16th, showing a significant improvement to 12th place in November, before stabilizing at 13th in December and January 2025. This upward movement in November was accompanied by a boost in sales, indicating a successful strategy or product launch during that period. However, despite this improvement, Henry's Original faces stiff competition from brands like Sparkiez, which consistently maintained a higher rank, peaking at 12th in January 2025. Similarly, Lowell Herb Co / Lowell Smokes experienced a decline to 14th place in January, potentially opening a window for Henry's Original to capitalize on. Meanwhile, Caviar Gold and Sunset Connect have shown varied performances, with Caviar Gold maintaining a steady position around 11th and Sunset Connect climbing from 20th to 15th. These dynamics suggest that while Henry's Original has made strides, continued efforts are needed to surpass competitors and secure a more dominant position in the market.

Notable Products

In January 2025, the top-performing product for Henry's Original was the Oakland Piff Pre-Roll (1g) in the Pre-Roll category, maintaining its leading rank from October 2024, with notable sales reaching 4754 units. Dream Walker Pre-Roll (1g) emerged as the second-best seller, while Lamb's Bread Pre-Roll 4-Pack (2g) secured the third position. Acapulco Gold Pre-Roll 4-Pack (2g) and Headband Pre-Roll 4-Pack (2g) followed closely, ranking fourth and fifth, respectively. The Oakland Piff Pre-Roll (1g) consistently held the top rank since October 2024, while the other products appeared in the rankings for the first time in January 2025. This shift indicates a significant introduction of new products that have quickly gained traction among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.