Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

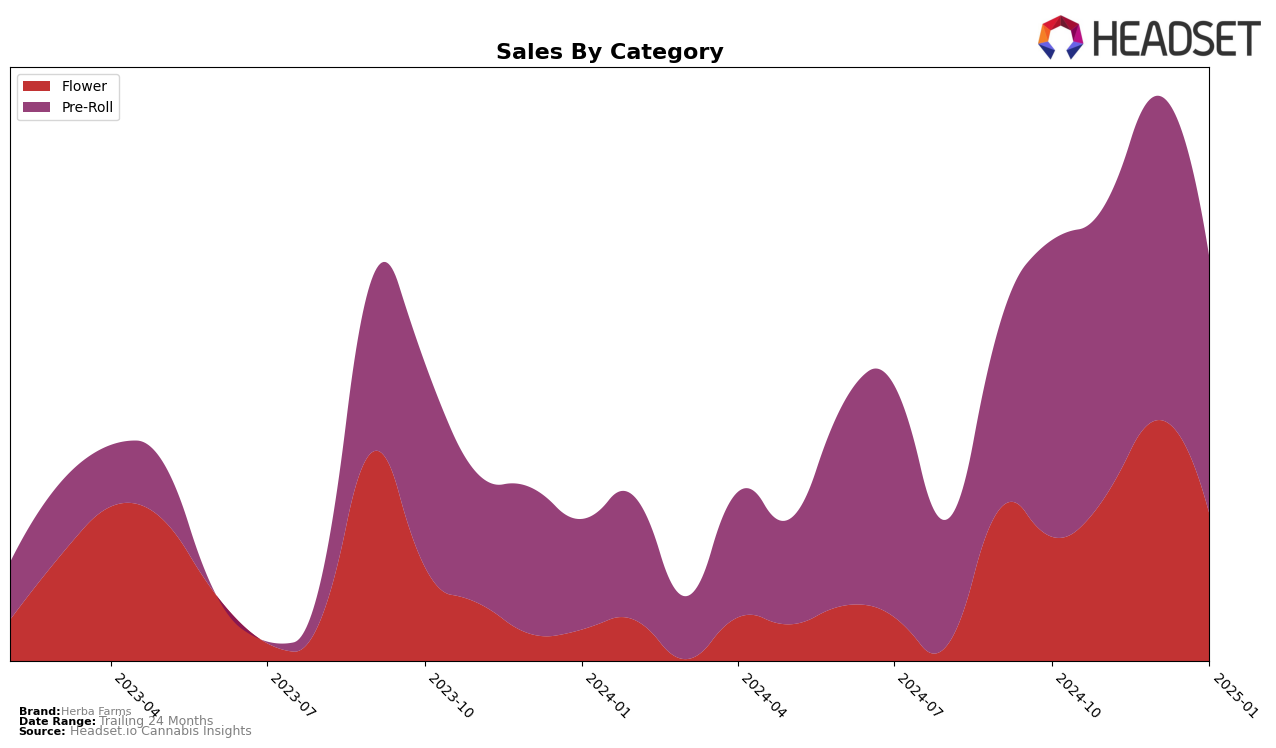

In the Saskatchewan market, Herba Farms has shown noteworthy performance in the Flower category. Despite not making it into the top 30 rankings in October 2024, the brand climbed to 31st place by November and further improved to 29th in December. However, in January 2025, there was a slight dip back to 32nd place. This fluctuation in rankings could be indicative of seasonal trends or competitive pressures in the region. The sales figures reflect a significant increase from October to December, suggesting a strong growth trajectory, although January saw a reduction in sales, which may warrant further investigation into market dynamics during that period.

Herba Farms has consistently maintained a stronger position in the Pre-Roll category within Saskatchewan. The brand secured the 11th spot in October 2024 and, while it experienced a slight decline to 12th in November, it remained within the top 15 through to January 2025. The minor fluctuations in rankings suggest a stable presence in the Pre-Roll segment, with sales peaking in December. This stability may be attributed to consumer loyalty or effective product offerings that resonate well with the market demands. The slight drop in sales from December to January might be a seasonal effect, which is common in retail sectors. Overall, Herba Farms' performance in the Pre-Roll category suggests a solid market position that could be leveraged for future growth.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Saskatchewan, Herba Farms has experienced fluctuations in its ranking over the past few months, which could have implications for its market positioning and sales strategy. Herba Farms started strong in October 2024 with an 11th place rank, but saw a slight decline to 12th in November and further to 15th in December, before improving slightly to 14th in January 2025. This downward trend in rank coincides with a decrease in sales from November to January, suggesting a potential need for strategic adjustments to regain momentum. In comparison, Thumbs Up Brand maintained a relatively stable position, ending January at 11th, while Kingsway improved significantly from 17th in December to 12th in January, indicating a competitive threat. Meanwhile, Space Race Cannabis and 5 Points Cannabis have shown varied performance, with Space Race Cannabis achieving a notable rank of 14th in December. These dynamics highlight the competitive pressures Herba Farms faces and underscore the importance of strategic marketing and product differentiation to enhance its market share in Saskatchewan's Pre-Roll category.

Notable Products

In January 2025, Herba Farms' top-performing product was the Orange DrAAAAnk Pre-Roll 3-Pack (3g) in the Pre-Roll category, climbing to the first rank with notable sales of 1778 units. The Orange DrAAAAnk Pre-Roll 3-Pack (1.5g) also performed well, securing the second position, improving from third in December 2024. Frosted Cream Cake Pre-Roll (1g) maintained its strong presence, ranking third, though it slipped from second in November 2024. The once-leading Orange DrAAAAnk Pre-Roll (1g) saw a significant drop to fourth place, despite being the top-ranked product in previous months. Notably, Bubbalicious (3.5g) entered the top five in January, highlighting a new interest in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.