Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

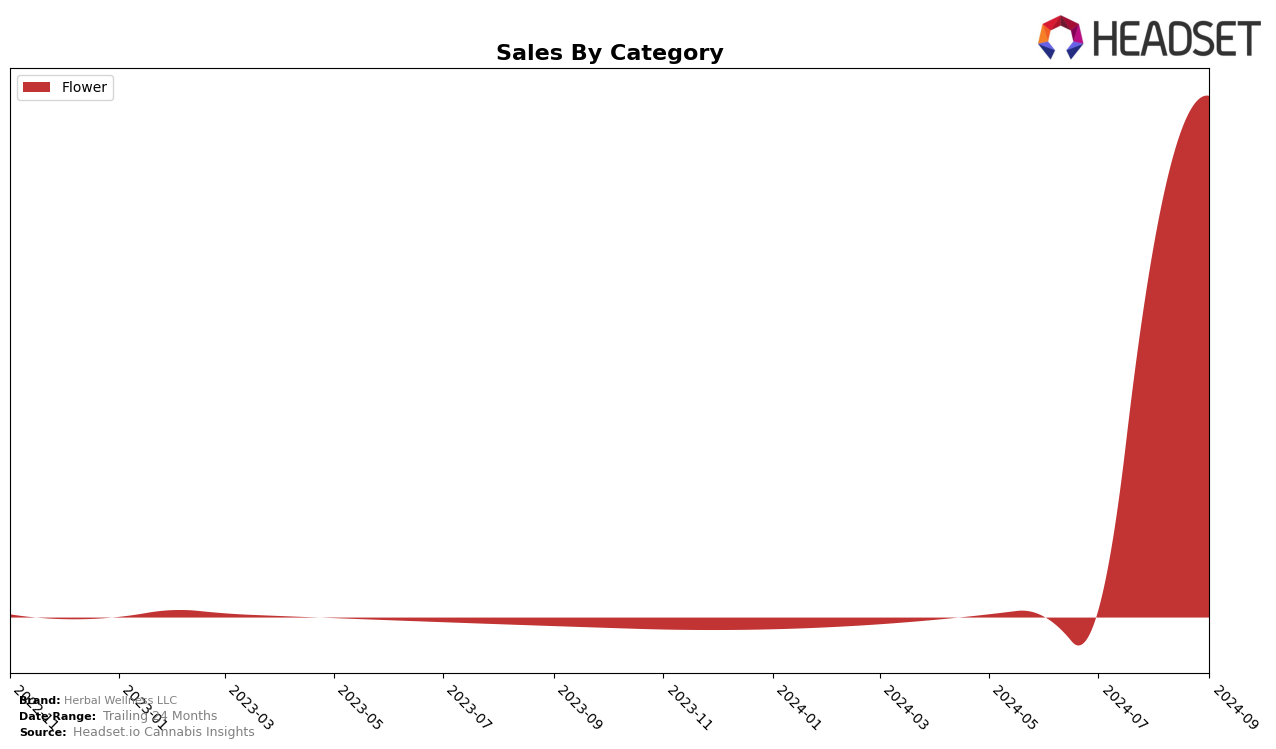

Herbal Wellness LLC has shown a notable improvement in the Ohio market, particularly in the Flower category. After not being ranked in the top 30 brands for June and July 2024, the company made a significant leap to 36th place in August and further climbed to 28th in September. This upward movement indicates a strong growth trajectory and suggests effective strategies in increasing market share and consumer preference within the state. Such a trend is particularly impressive given the competitive nature of the Flower category in Ohio.

The brand's performance in other states and categories, however, remains undisclosed, which could imply either a strategic focus on the Ohio market or challenges in penetrating other regions. The absence of rankings in additional states might be a point of concern if the company aims for broader geographical expansion. Nonetheless, the substantial sales increase from August to September in Ohio reflects positively on their efforts and could serve as a foundation for future growth in other markets.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, Herbal Wellness LLC has shown a promising upward trajectory in recent months. After not ranking in the top 20 in June and July 2024, Herbal Wellness LLC climbed to 36th place in August and further improved to 28th in September. This positive trend is indicative of a significant increase in sales, suggesting effective marketing strategies or product offerings that resonate with consumers. In contrast, competitors like &Shine and Appalachian Pharm have experienced fluctuations, with &Shine dropping from 15th to 26th place and Appalachian Pharm from 13th to 27th place over the same period. This shift in rankings highlights Herbal Wellness LLC's growing market presence amidst a competitive field, where brands like Ascension and Ohio Clean Leaf also vie for consumer attention, albeit with less dramatic changes in rank.

Notable Products

In September 2024, the top-performing product for Herbal Wellness LLC was Appalachian Snow (2.83g) in the Flower category, securing the number one rank with sales of 3401 units. Super Dawg OG Smalls (14.15g) climbed to the second position from third in August, showcasing a significant increase in popularity. Appalachian Snow Smalls (14.15g) entered the rankings at third place, while Cherry Gem Smalls (14g) and Cherry Gem (14.15g) held the fourth and fifth positions, respectively. Notably, Super Dawg OG Smalls saw a substantial jump in sales, moving from 440 units in August to 1692 units in September. This shift in rankings highlights the growing consumer preference for these specific Flower products from Herbal Wellness LLC.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.