Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

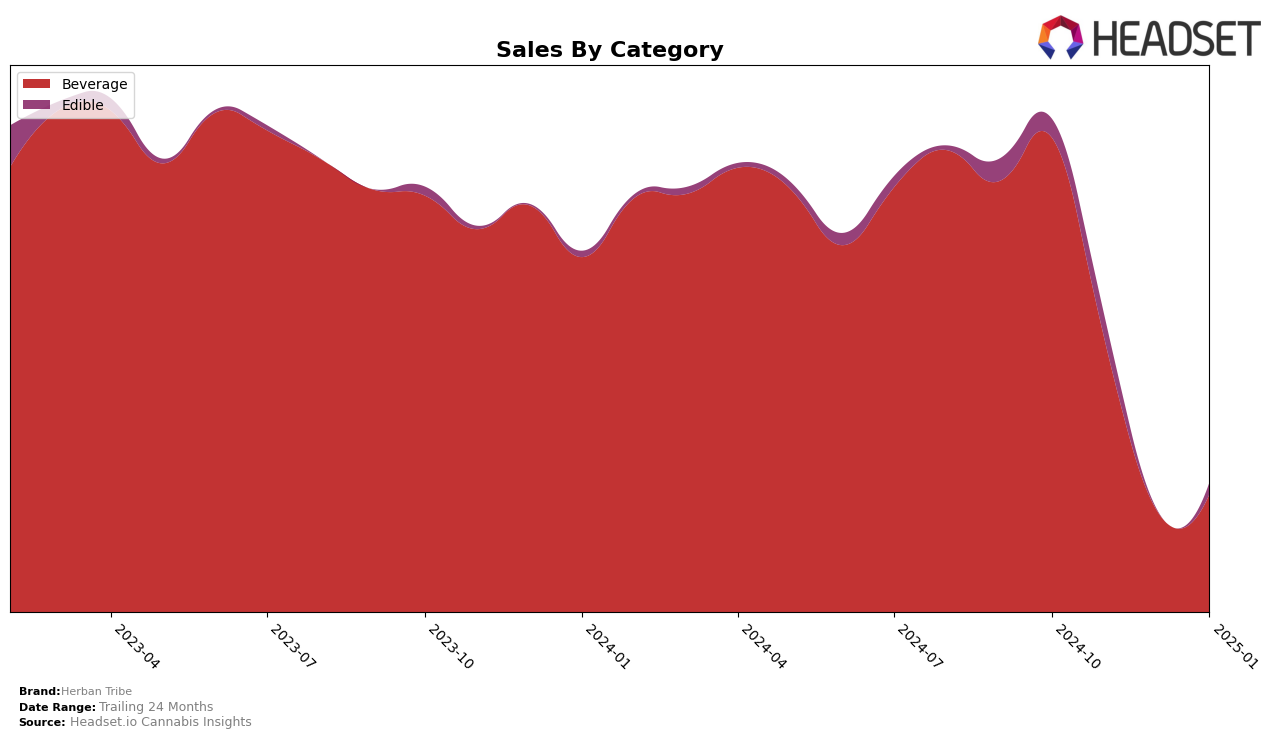

Herban Tribe has shown varied performance across different states and categories. In the state of Oregon, the brand has been active in the Beverage category, where it ranked 7th in October 2024 but saw a decline to 9th in November 2024. This drop in ranking corresponds with a noticeable decrease in sales from $36,494 in October to $20,825 in November. The absence of ranking data for December 2024 and January 2025 suggests that Herban Tribe did not maintain a position in the top 30 brands during these months, indicating a potential area of concern for the brand's performance in Oregon's beverage market.

While the data from Oregon provides a glimpse into Herban Tribe's challenges, it also highlights the competitive nature of the cannabis beverage market in the state. The brand's initial strong position in October suggests that there is a demand for its products, but the subsequent decline raises questions about market dynamics and consumer preferences during the latter months. The lack of data for December and January might suggest that Herban Tribe needs to reassess its strategy to regain its standing or explore other categories or states for growth opportunities. Understanding these trends can offer valuable insights for stakeholders looking to navigate the cannabis market effectively.

```Competitive Landscape

In the competitive landscape of the Oregon beverage category, Herban Tribe has experienced notable fluctuations in its market position and sales performance. Initially ranked 7th in October 2024, Herban Tribe saw a decline to 9th place by November, with subsequent months missing from the top 20 rankings, indicating a significant drop in market presence. This contrasts with Uncle Arnie's, which maintained a stable 6th position in November and December, showcasing stronger market resilience. Meanwhile, Fruit Lust improved its rank from 8th to 7th in November, before settling at 8th in January 2025, demonstrating a more consistent performance compared to Herban Tribe. Medicine Farm also showed stability, holding the 9th position in December and January. These trends suggest that while Herban Tribe initially had a competitive edge, its recent decline in rank and absence from the top 20 in later months highlights a potential challenge in maintaining market share against more stable competitors.

Notable Products

In January 2025, the top-performing product for Herban Tribe was the Grape Juice Drink (100mg THC, 8.1oz, 240ml) in the Beverage category, climbing from the second position in December 2024 to first place with sales reaching 130 units. Following closely was the Strawberry Lemonade Juice (100mg), which moved up from fifth to second place, showing a remarkable recovery with 123 units sold. The Passion Orange Guava Juice (100mg) dropped from first to third place, indicating a significant decrease in demand compared to previous months. Sour Apple Gummies 20-Pack (100mg) debuted in the rankings at fourth place, highlighting a growing interest in the Edible category. Fresh Squeezed Orange Juice (100mg) maintained a steady performance, remaining in fifth place with consistent sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.