Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

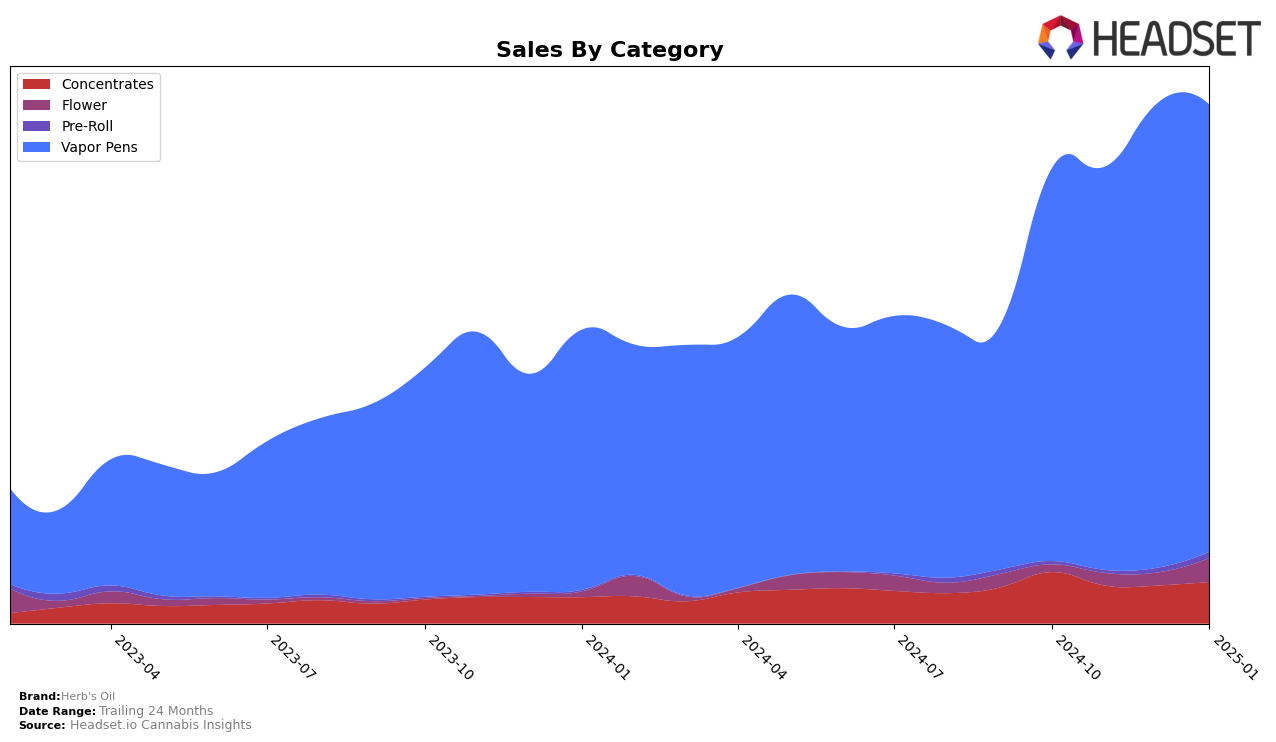

Herb's Oil has exhibited varied performance across different product categories and regions. In the state of Washington, the brand has shown a fluctuating presence in the Concentrates category, where it did not make it into the top 30 brands over the months from October 2024 to January 2025. Despite this, Herb's Oil managed to improve its ranking slightly from 57th in November 2024 to 48th by January 2025. This upward movement indicates a potential recovery or increased market penetration in the Concentrates category, although the brand still has significant ground to cover to break into the top 30.

In contrast, Herb's Oil has maintained a more stable and stronger presence in the Vapor Pens category within Washington. The brand consistently ranked within the top 30, showing a positive trend from 25th in October 2024 to 20th in December 2024, before a slight drop to 22nd in January 2025. This suggests that Herb's Oil is more competitive and possibly more popular in the Vapor Pens market. The sales data reflects this trend, with a notable increase from October to December 2024, followed by a slight decrease in January 2025. This category performance highlights Herb's Oil's potential strength and consumer appeal in the Vapor Pens sector, contrasting with its challenges in the Concentrates market.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Herb's Oil has shown a dynamic shift in its market position over the past few months. Starting at rank 25 in October 2024, Herb's Oil improved its standing to 22 by November and reached its peak at rank 20 in December before slightly dropping back to 22 in January 2025. This fluctuation indicates a competitive yet promising position in the market. Notably, AiroPro consistently maintained a higher rank, starting at 18 and ending at 20, suggesting a stable performance with sales figures that slightly decreased over time. Meanwhile, O'Geez showed a steady climb, ending January 2025 at rank 21, just ahead of Herb's Oil, with a notable increase in sales. Lifted Cannabis Co and 5Th House Farms both experienced declines in rank and sales, indicating potential challenges in maintaining market share. These insights suggest that while Herb's Oil faces stiff competition, its ability to improve rank amidst fluctuating sales positions it as a resilient player in the Washington vapor pen market.

Notable Products

In January 2025, the Blackberry Kush Distillate Cartridge (1g) emerged as the top-performing product for Herb's Oil, maintaining its lead from December with a notable sales figure of 2961 units. The Strawberry Cough PHO Cartridge (1g) climbed to the second position, improving from a fourth-place ranking in December, with sales reaching 1950 units. The AK-47 Distillate Cartridge (1g) slipped to third place after topping the charts in December, recording sales of 1539 units. Wedding Cake Distillate Cartridge (1g) fell to fourth place from third in the previous month, with sales slightly decreasing to 1523 units. Grape Stomper Distillate Cartridge (1g) entered the rankings for the first time in January, securing the fifth position, marking its debut in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.