Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

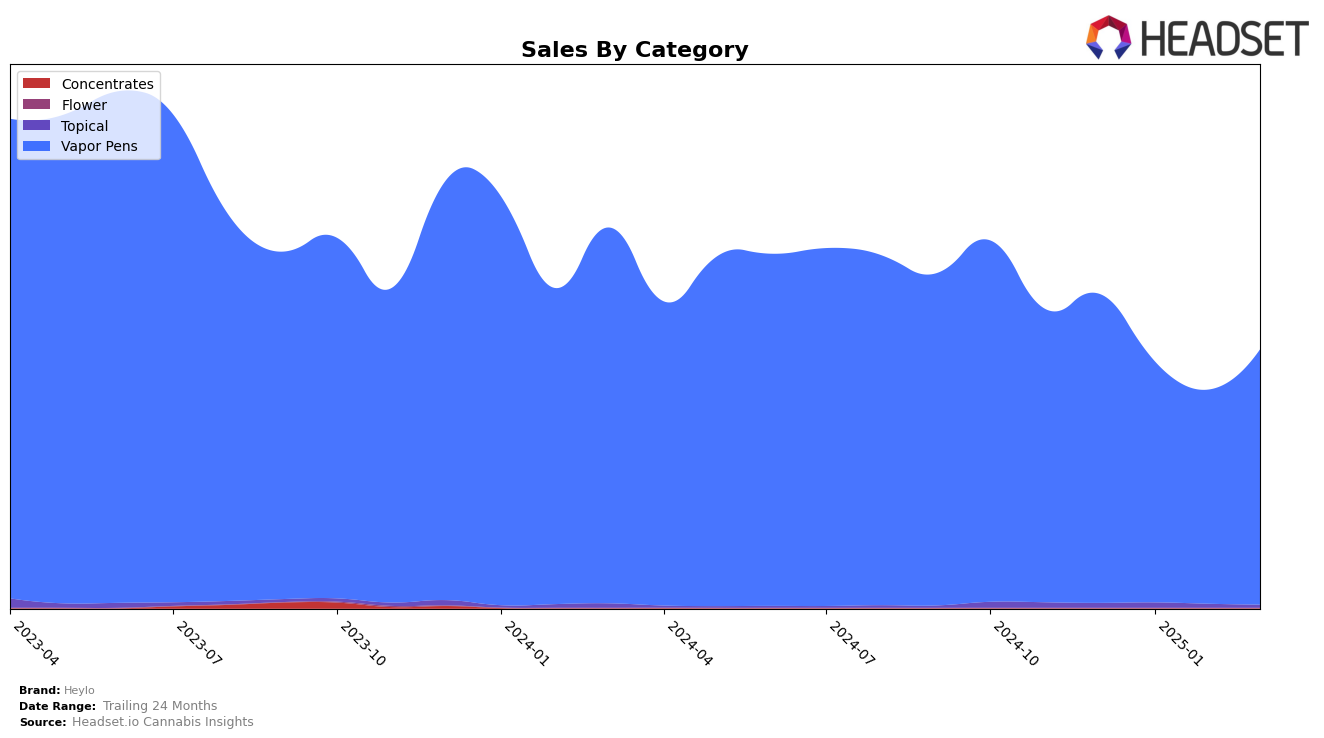

Heylo's performance in the Vapor Pens category in Washington shows a fluctuating trend over the recent months. Despite not making it into the top 30 brands, there was a noticeable improvement from February to March 2025, with the rank moving from 71st to 68th. This upward movement could suggest a positive reception of their product adjustments or marketing strategies. However, the brand's inability to break into the top 30 indicates that there's still significant competition and room for growth in this category within the state.

Sales figures reflect a similar pattern of fluctuation, with a dip in January and February followed by a recovery in March 2025. This suggests that while Heylo is making strides, they are still navigating challenges in maintaining consistent sales performance. The decline in sales during the early months of 2025 might have been influenced by seasonal trends or competitive pressures, but the rebound in March indicates resilience and potential for future growth. Observing how Heylo adjusts to these fluctuations will be crucial for understanding its long-term position in the Washington market.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Heylo has experienced fluctuating rankings and sales from December 2024 to March 2025. Heylo's rank shifted from 66th in December to 68th in March, indicating a slight decline in its competitive position. In contrast, Stingers showed a more robust performance, improving from 73rd to 65th during the same period, suggesting a stronger market presence. Meanwhile, Seattle Marijuana Company made a significant leap from 85th to 67th, surpassing Heylo by March. Although Flawless experienced a drop in rank from 69th to 73rd, its sales remained competitive. Honey Tree Extracts also improved its rank from 74th to 69th, closely trailing behind Heylo. These dynamics suggest that Heylo faces increasing competition, particularly from brands like Stingers and Seattle Marijuana Company, which have shown upward trends in both rank and sales, potentially impacting Heylo's market share and necessitating strategic adjustments to maintain its competitive edge.

Notable Products

In March 2025, the top-performing product for Heylo was the Wedding Cake CO2 Cartridge (1g) in the Vapor Pens category, which climbed from fourth place in February to first place, with sales reaching 270 units. The Hindu Kush Full Spectrum CO2 Cartridge (1g) maintained its second-place position from February, showing strong consistency in sales performance. Snorlax Distillate Cartridge (1g) dropped from first place in February to third place in March, indicating a slight decline in its sales momentum. Demon Slayer CO2 Cartridge (1g) entered the rankings for the first time at fourth place, suggesting a positive reception in the market. Lastly, CBGeezus RawX CO2 Cartridge (1g) debuted in the rankings at fifth place, marking its introduction to the top-performing list for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.