Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

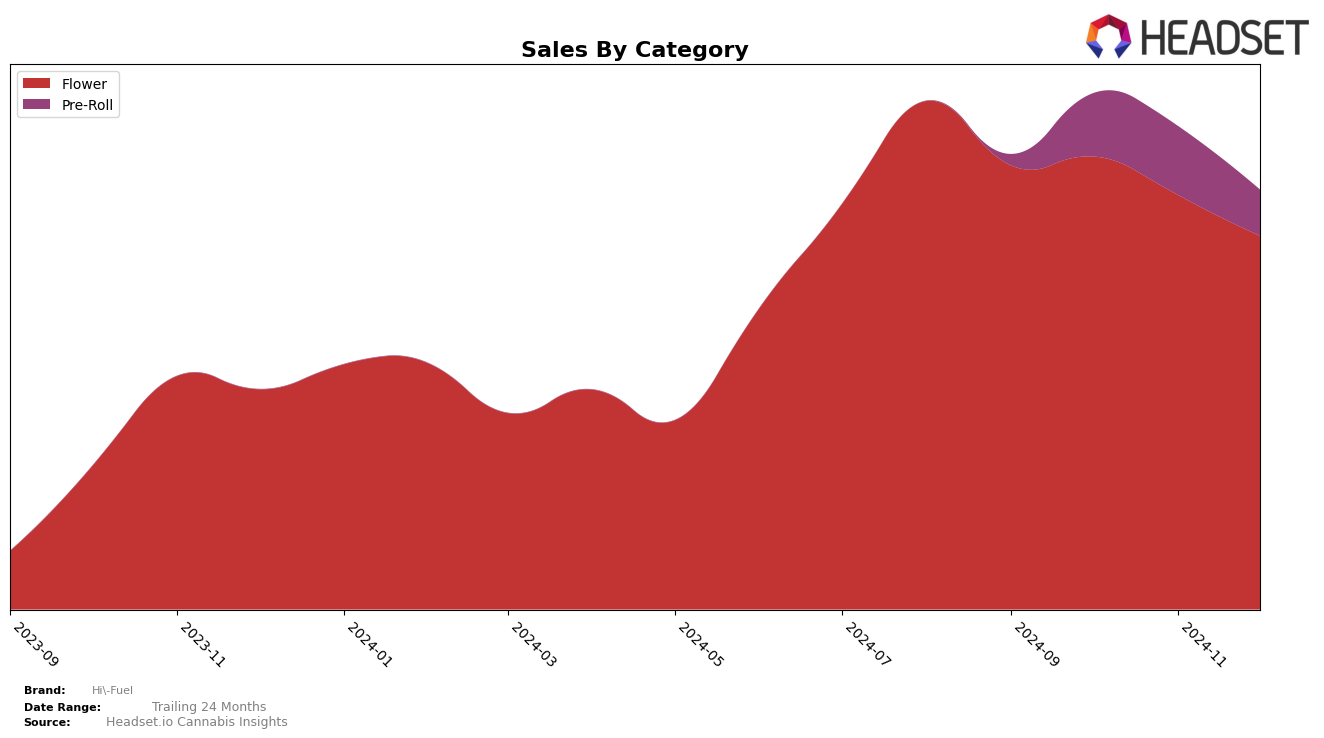

In the state of Colorado, Hi-Fuel has demonstrated notable performance within the Flower category. The brand has maintained a steady presence in the rankings, starting at 27th place in September 2024 and experiencing slight fluctuations, ultimately reaching 24th place by December 2024. This upward movement suggests a strengthening position in the market, despite a decrease in sales from October to December. This indicates that while they may be selling less overall, their market share or competitive positioning might be improving relative to other brands.

Conversely, Hi-Fuel's performance in the Pre-Roll category in Colorado highlights some challenges. The brand did not make it into the top 30 rankings in September, which could be seen as a significant gap in their market presence. However, they entered the rankings in October at 51st place and improved to 44th place in November, before slipping slightly to 48th in December. This trajectory indicates an ongoing struggle to secure a top position, but also suggests potential for growth if they can maintain upward momentum and address the factors contributing to their fluctuating rank.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Hi-Fuel has shown a relatively stable performance in the latter months of 2024, with its rank fluctuating slightly between 24th and 28th place. This stability contrasts with the more volatile rankings of competitors such as Silver Lake, which experienced a notable rise to 15th place in November before dropping to 25th in December, and Del Mundo, which climbed from 31st in October to 18th in November. Despite these fluctuations, Hi-Fuel's consistent presence in the rankings suggests a steady consumer base, although its sales figures have shown a downward trend, similar to LoCol Love (TWG Limited), which did not make it into the top 20 during this period. As competitors like Silver Lake and Del Mundo demonstrate potential for rapid growth, Hi-Fuel may need to innovate or enhance its offerings to maintain or improve its market position.

Notable Products

In December 2024, the top-performing product for Hi-Fuel was Pu Tang 2.0 (Bulk) in the Flower category, maintaining its number one rank from November with sales of 3,159 units. Tricho Jordan Pre-Roll (1g) emerged as the second-highest seller, having not been ranked in previous months, indicating a significant rise in popularity. Dante's Inferno (3.5g) secured the third position, while Permanent Chimera (3.5g) and White Truffle Pre-Roll (1g) followed closely in fourth and fifth place, respectively. Notably, Pu Tang 2.0 (Bulk) consistently held the top rank since October, showcasing its sustained demand. The introduction of Tricho Jordan Pre-Roll (1g) into the top rankings suggests a shift in consumer preference towards pre-rolls.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.