Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

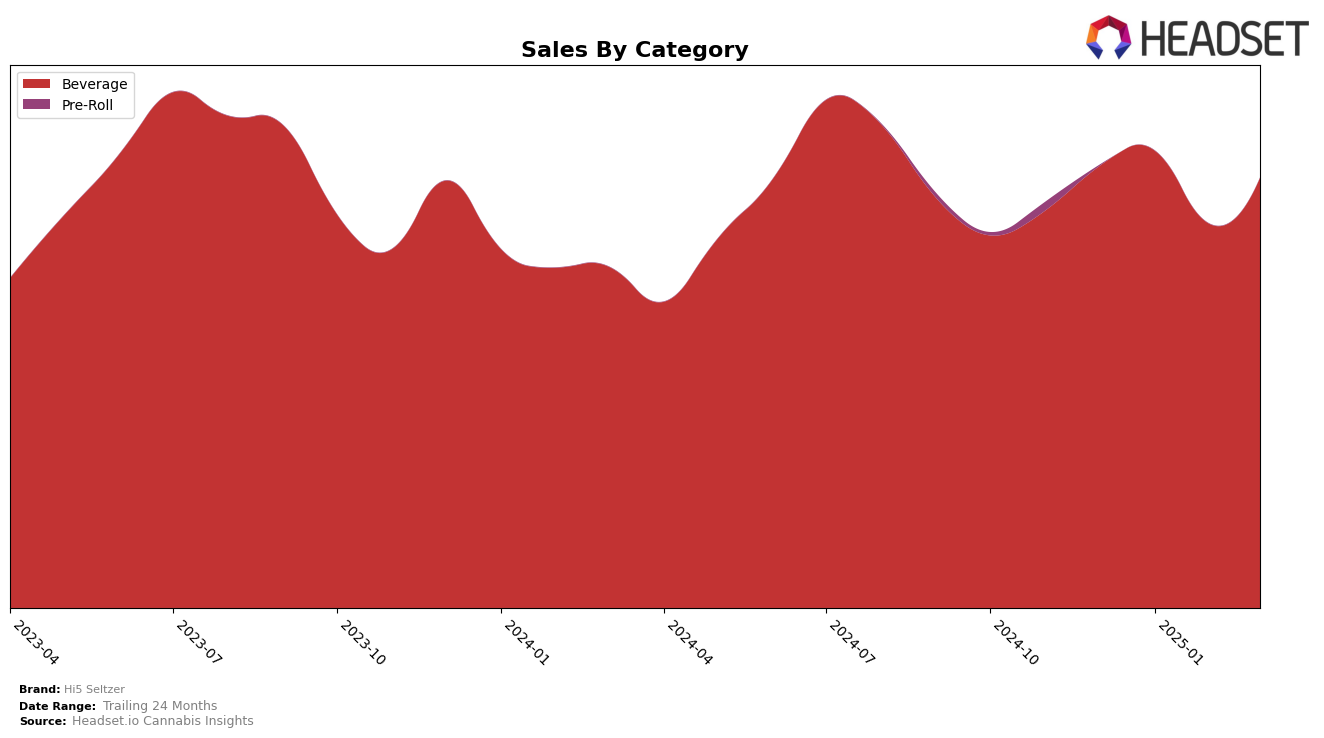

Hi5 Seltzer has demonstrated impressive performance in the Beverage category within the state of Massachusetts. Over the span of four months, the brand consistently maintained its position near the top of the rankings, starting at rank 2 in December 2024 and January 2025, before climbing to the top position in February and March 2025. This upward movement indicates a strong market presence and consumer preference for Hi5 Seltzer in Massachusetts. The brand's ability to ascend to the number one spot suggests effective marketing strategies and possibly a loyal customer base that contributed to its success.

While Hi5 Seltzer's performance in Massachusetts is noteworthy, the absence of rankings in other states or provinces signifies either a lack of penetration or competition that prevents it from entering the top 30 brands in those markets. This gap presents both a challenge and an opportunity for the brand to explore expansion strategies beyond Massachusetts. In terms of sales, the brand experienced a slight dip in February 2025 compared to the previous month, but it rebounded in March, indicating resilience and potential seasonality effects. The trends observed in Massachusetts could serve as a benchmark for Hi5 Seltzer as it evaluates potential growth opportunities in new regions.

Competitive Landscape

In the Massachusetts beverage category, Hi5 Seltzer has demonstrated impressive growth, rising to the top rank by February 2025 and maintaining this position through March 2025. This ascent is particularly notable given that Levia, a key competitor, held the top spot in December 2024 and January 2025 before Hi5 Seltzer overtook it. The sales trajectory of Hi5 Seltzer indicates a robust performance, with a slight dip in February followed by a recovery in March, suggesting resilience and effective market strategies. Meanwhile, Buzzy has shown steady improvement, climbing from fifth to third place over the same period, although it remains behind Hi5 Seltzer and Levia in terms of rank. This competitive landscape highlights Hi5 Seltzer's successful strategies in capturing market share and suggests potential for continued leadership in the Massachusetts beverage market.

Notable Products

In March 2025, Hi5 Seltzer's top-performing product was the Black Cherry Infused Seltzer 4-Pack (20mg), maintaining its number one rank consistently since December 2024, with a notable sales figure of 2369 units. The Watermelon Seltzer 4-Pack (20mg) jumped to the second position from fifth in February 2025, indicating a significant resurgence in popularity. The Pomegranate Seltzer 4-Pack (20mg) secured third place, showing a slight decline from its second-place rank in February. The CBD/THC 2:1 Micro Peach Mango Seltzer 4-Pack (20mg CBD, 10mg THC) held the fourth spot, recovering from a fifth-place ranking in January. The Lime Infused Seltzer 4-Pack (20mg) dropped to fifth place, experiencing a consistent decline in ranking over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.