Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

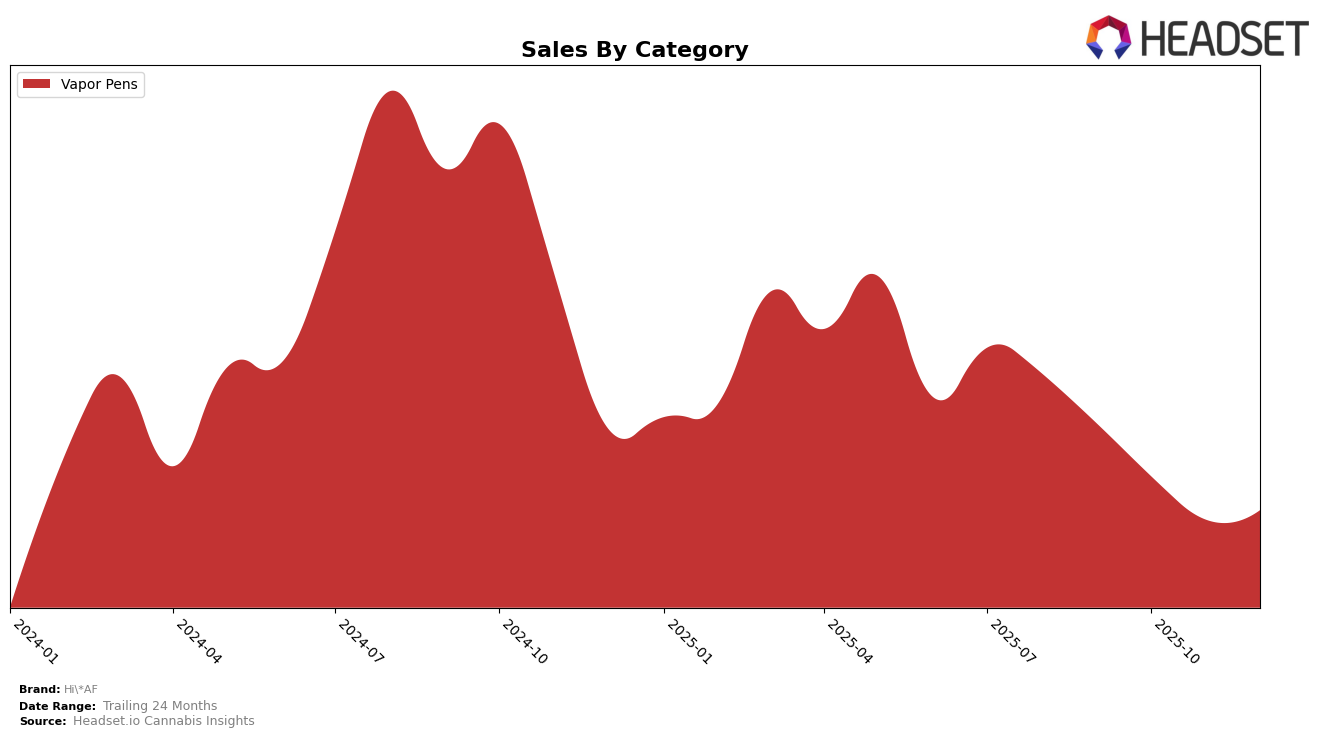

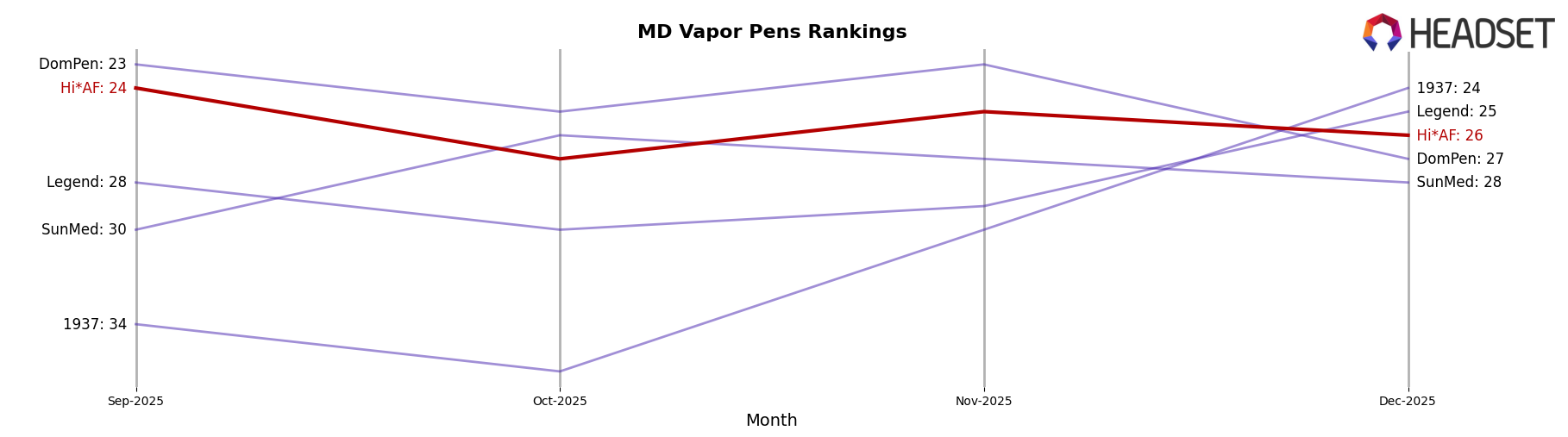

In Maryland, Hi*AF has maintained a consistent presence within the Vapor Pens category, although their ranking has seen some fluctuations. Starting at rank 24 in September 2025, they experienced a slight dip to rank 27 in October, before climbing back to 25 in November, and settling at 26 in December. This movement indicates a relatively stable position within the top 30, despite a declining trend in sales from September to November, with a slight recovery in December. The brand's ability to remain in the top 30 suggests resilience in a competitive market, even as they face challenges in maintaining higher sales figures.

In contrast, Hi*AF's performance in New York presents a more challenging scenario. The brand was not ranked within the top 30 in the Vapor Pens category for November and December 2025, highlighting a significant drop from its previous positions of 90 in September and 95 in October. This absence from the top 30 could indicate increased competition or a strategic shift in focus away from this market. The inability to maintain a presence in the rankings suggests that Hi*AF may need to reassess its approach in New York to regain traction and improve its market position.

Competitive Landscape

In the competitive landscape of Vapor Pens in Maryland, Hi*AF has experienced fluctuating rankings over the last few months, which reflects the dynamic nature of this market segment. Despite a dip from 24th in September 2025 to 27th in October, Hi*AF managed to regain some ground, ranking 25th in November and 26th in December. This indicates a resilience in maintaining a competitive position amidst shifting consumer preferences and market dynamics. In comparison, DomPen consistently ranked lower, with a downward trend from 23rd in September to 27th in December, suggesting a more significant decline in market presence. Meanwhile, 1937 showed a notable improvement, jumping from 36th in October to 24th in December, which could pose a potential threat to Hi*AF if this upward trajectory continues. SunMed and Legend also demonstrate competitive pressure, with Legend showing a strong finish at 25th in December. These dynamics underscore the importance for Hi*AF to innovate and adapt to maintain and potentially improve its market position in the Maryland Vapor Pens category.

Notable Products

In December 2025, Citrus Circus Distillate Disposable (1g) emerged as the top-performing product for Hi*AF, climbing from third place in November to secure the first rank. Cherry Limeade Distillate Disposable (1g) maintained its strong performance, holding steady at the second rank with notable sales of 386 units. Sour Patch Watermelon Distillate Disposable (1g) experienced a slight drop, moving from first to third place compared to the previous month. Pineapple Whip Distillate Disposable (1g) entered the rankings for the first time, taking fourth place. Lemon Cake Distillate Disposable (1g) consistently held the fifth position, showing stable sales figures across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.