Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

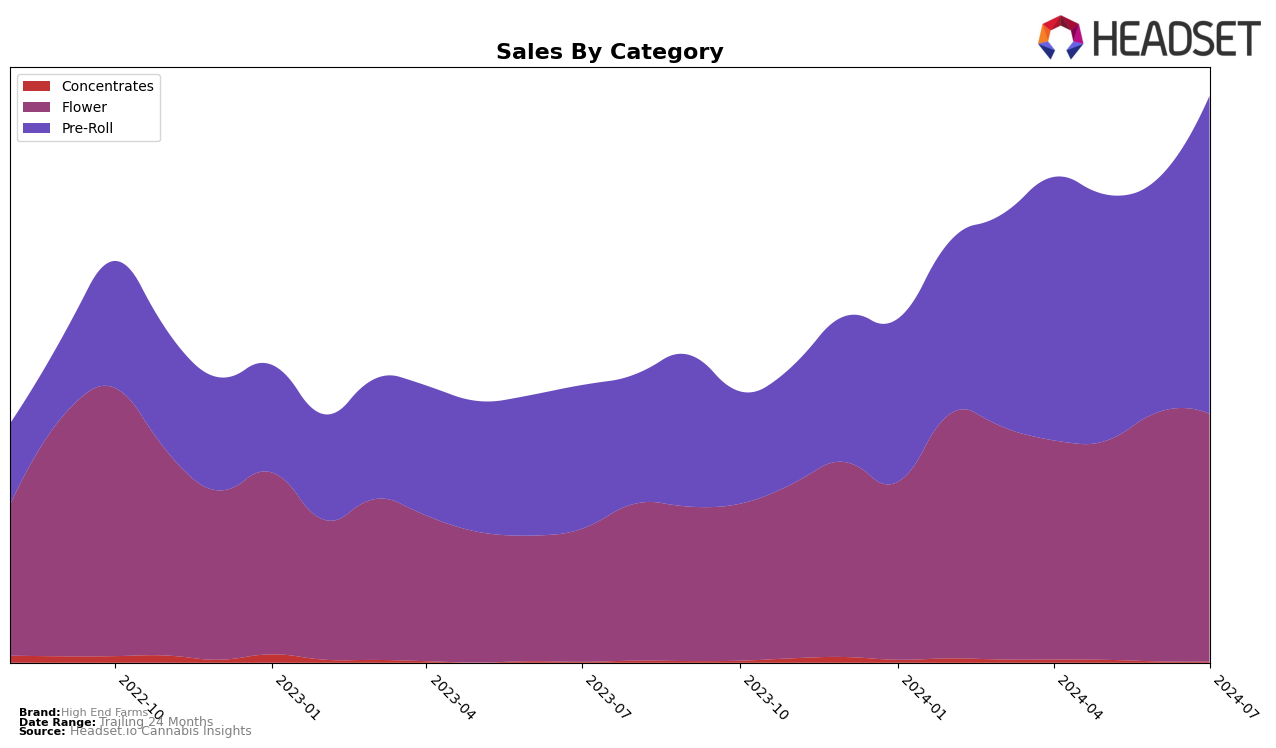

High End Farms has demonstrated varying performance across different categories and states over the past few months. In Washington, their presence in the Flower category has been notably absent from the top 30 rankings from April through July, which could be a point of concern for the brand as it indicates a lack of competitive edge in this category. Conversely, in the Pre-Roll category, High End Farms has shown a steady presence, ranking 33rd in April and making a notable improvement to 30th by July. This upward trend suggests a strengthening position in the Pre-Roll market, which could be indicative of effective marketing strategies or product improvements.

When analyzing sales performance, High End Farms' Pre-Roll category in Washington has experienced some fluctuations. Despite a dip in sales from April to June, the brand saw a significant increase in July, with sales reaching $137,905. This rebound could indicate seasonal trends or successful promotional activities. However, the absence from the top 30 rankings in the Flower category for the same period highlights a potential area for growth and improvement. Understanding these dynamics can help stakeholders make informed decisions about resource allocation and strategic focus areas.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Washington, High End Farms has experienced notable fluctuations in its ranking over the past few months. Starting at rank 33 in April 2024, the brand saw a dip to rank 39 in May, and 38 in June, before making a significant recovery to rank 30 in July. This recovery in July is particularly impressive given the competitive pressure from brands like Saints and Seattle Marijuana Company, which have also shown strong performances. For instance, Seattle Marijuana Company climbed from rank 38 in April to an impressive rank 29 in July, indicating a competitive edge. Meanwhile, Plaid Jacket showed a strong performance in May and June but dropped to rank 36 in July. High End Farms' sales trajectory, with a notable increase in July, suggests a positive directional trend that could potentially bolster its market position if sustained. This competitive analysis highlights the dynamic nature of the Pre-Roll market in Washington and underscores the importance of strategic positioning for High End Farms amidst strong competitors.

Notable Products

In July 2024, the top-performing product for High End Farms was Blue Dream Pre-Roll 2-Pack (1g) in the Pre-Roll category, achieving the number one rank with sales of $745. Cat Piss Cookies Pre-Roll 2-Pack (1g) secured the second position in its debut month. Blue Dream (3.5g) in the Flower category maintained a steady performance, ranking third, consistent with its June 2024 ranking. Lemon Skunk Pre-Roll 2-Pack (1g) entered the charts at fourth place. Blueberry Pie Pre-Roll 2-Pack (1g) returned to the rankings in fifth place, showing a recovery from its absence in June 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.