Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

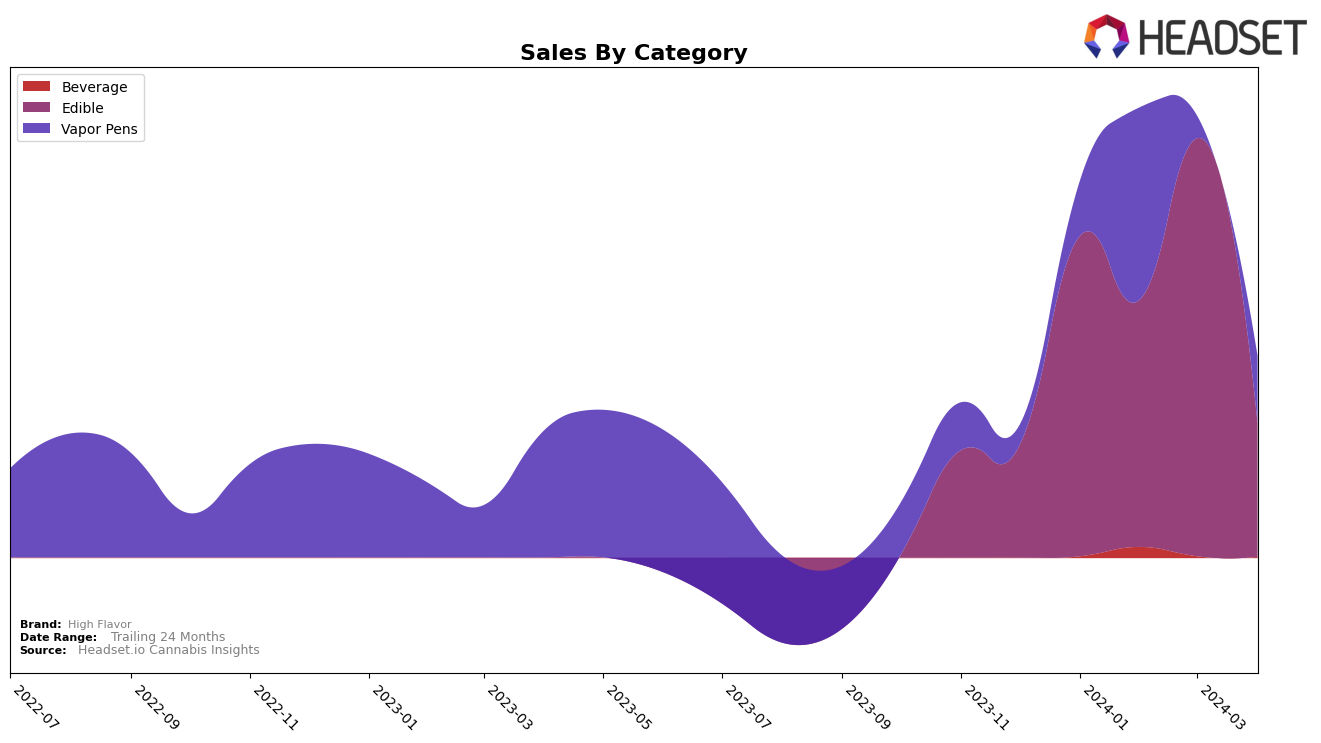

In the Massachusetts market, High Flavor has shown a notable presence in the Edibles category, with a gradual improvement in its ranking from January to March 2024, moving from 55th to 50th place. This upward trend is significant, especially considering the sales in March reached 24,537, marking a substantial increase from January's 18,815. However, the absence of a ranking in April suggests a potential decline or a lack of data, which could be concerning for the brand's visibility in the Massachusetts market. In contrast, their performance in the Vapor Pens category is less consistent, with the brand only appearing in the rankings in February at the 83rd position. This indicates a challenge for High Flavor in gaining a foothold in the highly competitive Vapor Pens market, at least in the early part of 2024.

Interestingly, the presence of High Flavor in different categories within the same state highlights the brand's diverse product offerings but also showcases the varying degrees of success across these categories. The significant sales increase in the Edibles category from January to March suggests a growing consumer interest or effective marketing strategies in that segment. However, the brand's sporadic appearance in the rankings for Vapor Pens, only making it onto the list in February, points to potential struggles in capturing a steady market share or facing stiff competition in that category. This mixed performance across categories could indicate the need for High Flavor to reassess their market strategies or product offerings in the Massachusetts market. Without information for April across both categories, it's difficult to predict the brand's trajectory but highlights an area for close observation in the coming months.

Competitive Landscape

In the competitive landscape of the edible category in Massachusetts, High Flavor has shown a notable trajectory in terms of rank and sales among its competitors. Despite starting at a lower rank in January 2024 (55th) and maintaining this position into February, High Flavor experienced a positive shift in March, moving up to the 50th rank. This upward movement is significant when considering the sales increase from February to March, indicating a growing consumer interest or successful marketing efforts. Competing brands such as Bountiful Farms and In House have shown fluctuating ranks but generally maintained higher positions than High Flavor, with In House consistently staying within the top 31 ranks from January to March. Meanwhile, Petra, another competitor, displayed a similar rank trajectory to High Flavor but remained slightly ahead in April. This competitive analysis highlights High Flavor's potential to climb further in rank and sales within Massachusetts' edible market, especially if it continues to build on the momentum gained in March 2024.

Notable Products

In April 2024, High Flavor saw its Sativa Electric Citrus Gummies 10-Pack (100mg) from the Edible category maintain its position as the top-selling product, with sales reaching 756 units. The Cherry Lime Distillate Cartridge (0.5g) from the Vapor Pens category improved its ranking to second place, showing a notable recovery from its previous positions. Blood Orange Distillate Cartridge (0.5g), also in the Vapor Pens category, secured the third spot, demonstrating consistent performance by moving up one rank from March. The Cherry Lime Enhancer (100mg) in the Beverage category climbed to fourth place, indicating a steady demand for beverage products. Meanwhile, the Hawaiian Mango Distillate Cartridge (0.5g) saw a slight decline, moving to fourth place in April, underscoring the competitive nature of the Vapor Pens category within High Flavor's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.