Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

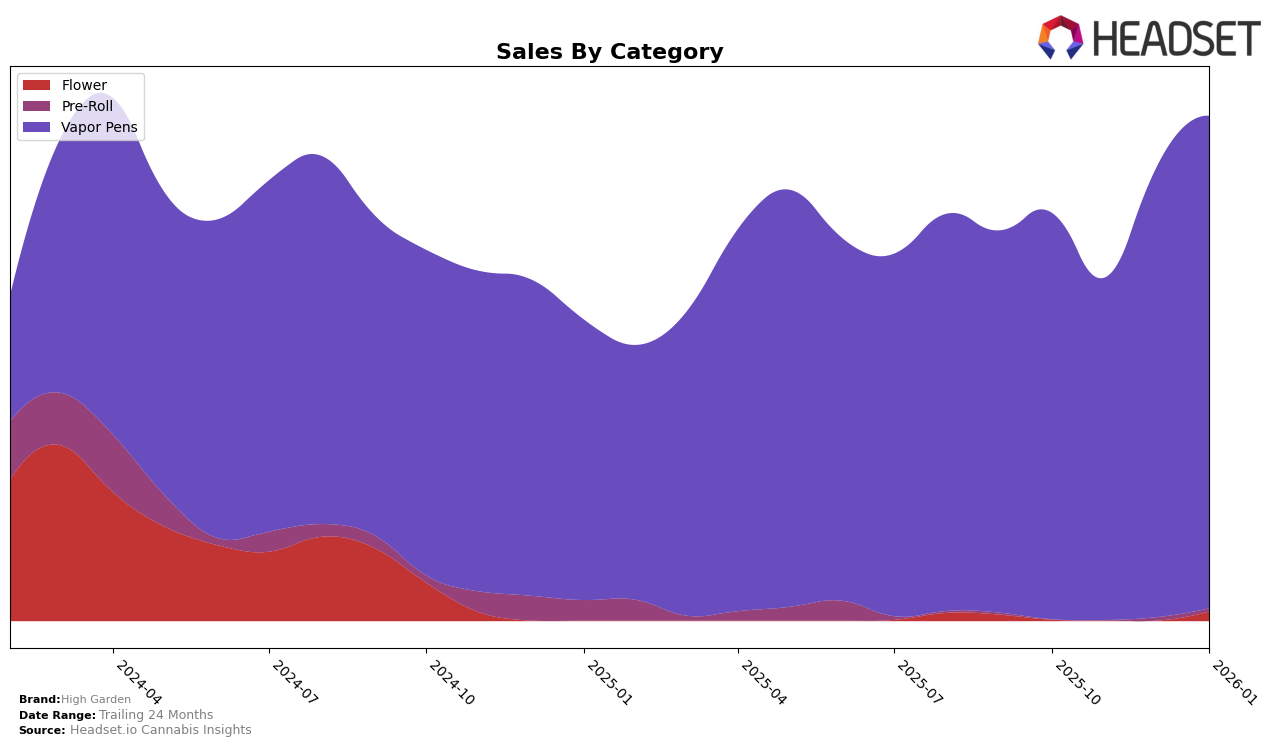

High Garden has shown notable performance in the Vapor Pens category in New York. Over the past few months, the brand has demonstrated a consistent presence in the top 30 rankings, with a slight fluctuation in its position. Starting at rank 27 in October 2025, High Garden experienced a minor dip to rank 29 in November, but quickly rebounded to 28 in December, and further improved to rank 25 by January 2026. This upward trend suggests a growing consumer preference for High Garden's vapor pens, as evidenced by their sales figures, which show an increase from November to January.

While High Garden has maintained a presence in the top 30 for vapor pens in New York, the absence of their ranking in other states or categories indicates areas where the brand may not yet have a strong foothold. This could be seen as an opportunity for High Garden to expand its market reach and explore new regions or product lines. The brand's ability to climb the rankings in New York could serve as a model for strategic growth in other markets. As the cannabis industry continues to evolve, High Garden's performance in New York may offer insights into potential strategies for success in other states and categories.

Competitive Landscape

In the competitive landscape of vapor pens in New York, High Garden has shown a steady improvement in its rankings from October 2025 to January 2026, moving from 27th to 25th place. This upward trend is notable given the fluctuating performances of its competitors. For instance, Brass Knuckles experienced significant volatility, peaking at 7th place in November 2025 but dropping to 27th by January 2026. Meanwhile, Dime Industries maintained a consistent 24th rank, slightly ahead of High Garden, yet with a narrower sales margin over time. Nanticoke also demonstrated variability, ranking as high as 17th in October 2025 but falling to 22nd by January 2026. The consistent ranking of Off Hours near High Garden underscores the competitive pressure in the mid-tier segment. High Garden's sales trajectory, with a notable increase in January 2026, suggests a positive reception and potential for further growth in the New York vapor pen market.

Notable Products

In January 2026, the top-performing product from High Garden was the Blue Dream Live Resin Cartridge (1g) in the Vapor Pens category, which ascended to the number one position with sales reaching 1855 units. This product showed a significant improvement from its fifth-place ranking in December 2025. The Granddaddy Purple Live Resin Cartridge (1g) also performed well, climbing to second place from fourth the previous month. Acapulco Gold Live Resin Cartridge (1g), which held the top spot in December, fell to third place in January. The new entry, Berry Trainwreck Live Resin Reload Cartridge (1g), debuted at the fifth position, indicating strong initial consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.