Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

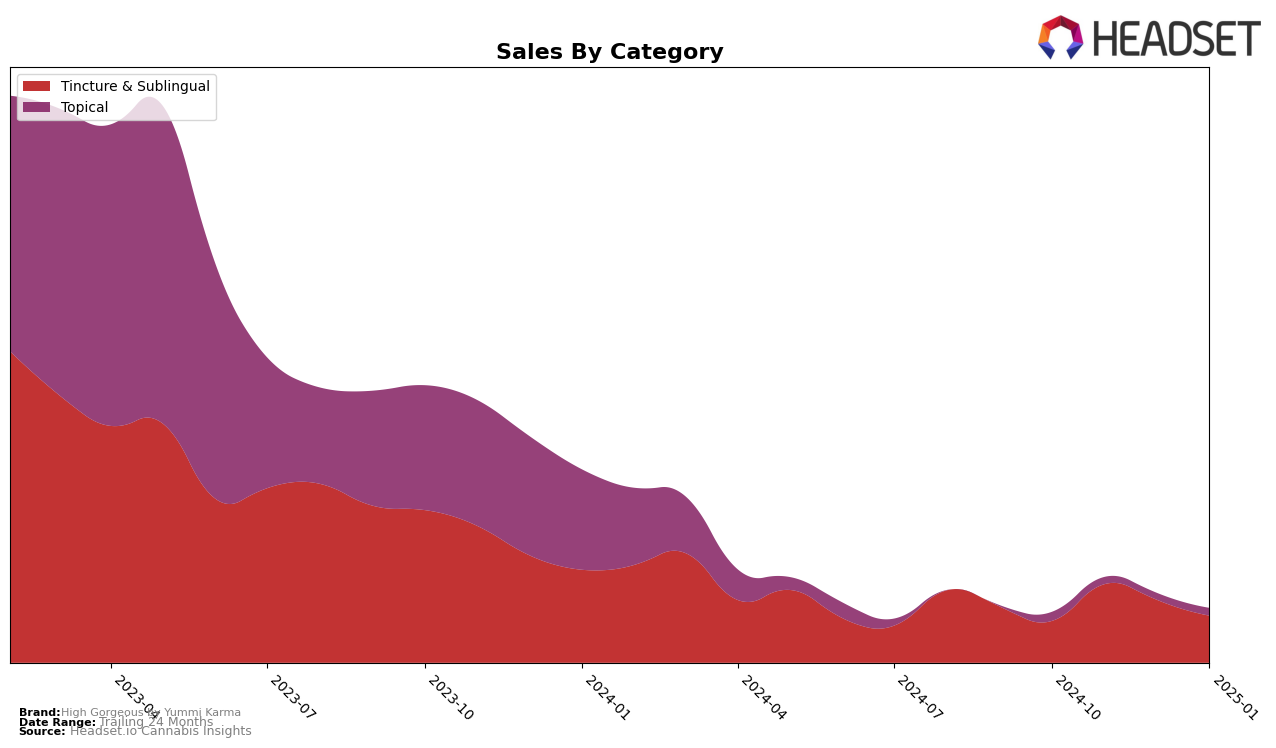

High Gorgeous by Yummi Karma has shown notable performance fluctuations across different categories and states. In the California market, the brand managed to secure the 21st position in the Tincture & Sublingual category as of November 2024. This marks a significant achievement, considering the brand was not ranked in the top 30 in October 2024. Such a movement indicates a positive trend and growing consumer interest in their products within this category. However, the absence of a ranking for December 2024 and January 2025 suggests that maintaining or improving this position is a challenge that the brand may need to address. This fluctuation can be indicative of either increased competition or a need for strategic adjustments in their market approach.

While the California market presents a mixed bag of results for High Gorgeous by Yummi Karma, the lack of data for other states or provinces could imply that the brand either does not have a significant presence or has not yet broken into the top 30 rankings in these regions. The absence of rankings in other states could be seen as a potential area for growth, suggesting that the brand might benefit from expanding its outreach and marketing efforts beyond its current stronghold. Understanding the dynamics of different markets and consumer preferences could be crucial for High Gorgeous by Yummi Karma to replicate its success in California across other regions. This analysis highlights the importance of strategic positioning and market penetration for continued success in the competitive cannabis industry.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, High Gorgeous by Yummi Karma has faced notable shifts in its market presence. While it did not rank in the top 20 from October 2024 to January 2025, competitors like My Blue Dove consistently maintained a strong position, ranking between 18th and 19th during this period. Meanwhile, Dr. May showed a slight decline from 16th to 19th, and Opi-Not appeared in the rankings only in November and December. Kind Medicine was also absent from the top 20 after October 2024. The absence of High Gorgeous by Yummi Karma from the top 20 suggests a need for strategic adjustments to regain competitive standing, particularly as brands like My Blue Dove continue to capture a significant share of the market.

Notable Products

In January 2025, the top-performing product for High Gorgeous by Yummi Karma was the CBD Plain Jane Tincture (1000mg CBD, 30ml), maintaining its first-place ranking consistently since October 2024 with a sales figure of 131 units. The CBD Plain Jane Tincture (600mg CBD, 30ml) also held onto its second-place position, showing stable performance over the months. The CBD/THC 2:1 Ice Queen Cooling Roll-On (300mg CBD, 150mg THC, 89ml) remained in third place, indicating a consistent demand for this topical product. Notably, the CBD Plain Jane Body Creme (200mg CBD, 120ml, 4oz) re-entered the rankings in fourth place for January 2025 after not being ranked in the previous months. Meanwhile, the CBD/THC 1:1 Cheeky Minx Body Lotion (250mg CBD, 250mg THC, 100ml, 3.4oz) also appeared in the rankings, tying for fourth place in January 2025, suggesting a renewed interest in topical products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.