Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

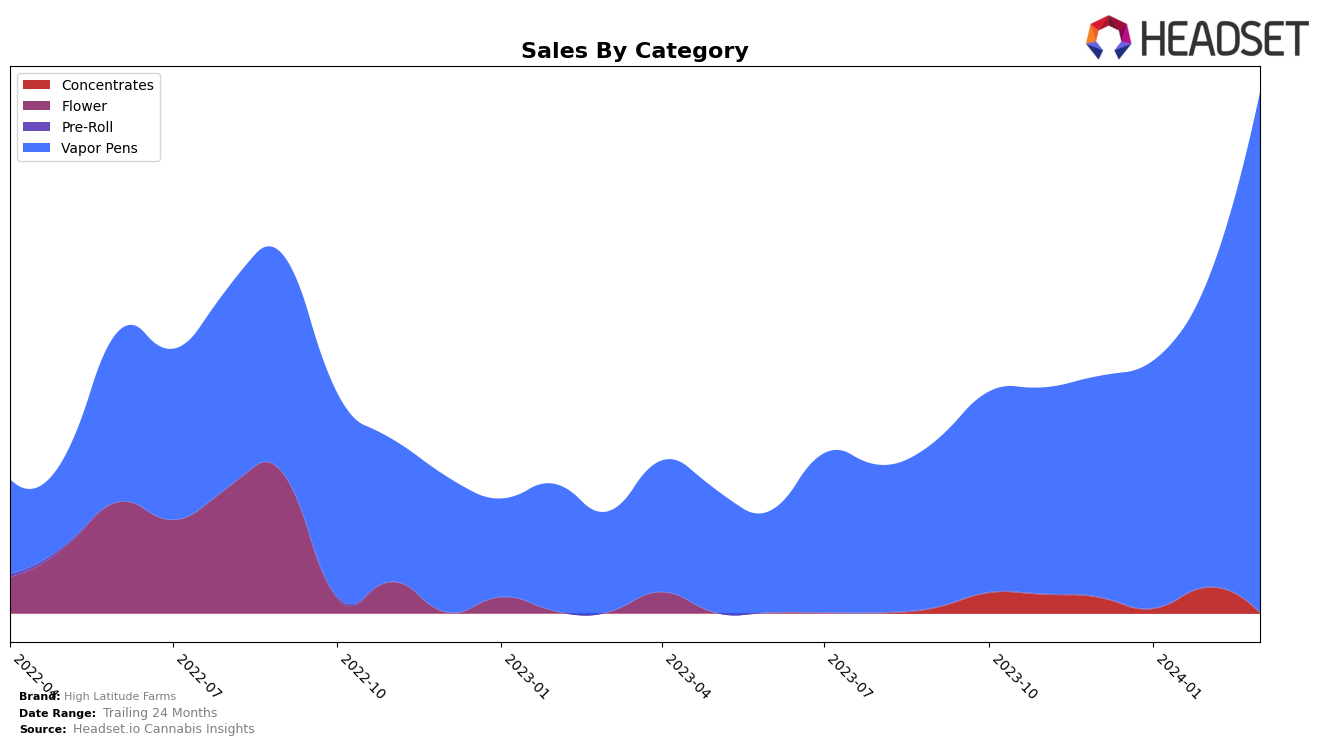

In Oregon, High Latitude Farms has shown a notable presence in the cannabis market, particularly in the Vapor Pens category. The brand's ranking in this category has seen a consistent improvement over the recent months, moving from the 46th position in December 2023 to the 30th position by March 2024. This upward trajectory is significant, indicating a growing consumer preference and market share within the state's Vapor Pens sector. Sales figures support this positive movement, with a remarkable increase from 63,546 in December 2023 to 150,287 by March 2024. Such performance highlights High Latitude Farms' strengthening position and potential in Oregon's competitive cannabis market.

However, the brand's performance in the Concentrates category within the same state tells a different story. High Latitude Farms did not rank in the top 30 brands for December 2023, January 2024, and February 2024, finally making an appearance at the 95th position in March 2024. This entry into the rankings, albeit at a lower position, could be seen as a positive development, yet the absence in the preceding months suggests challenges in gaining a foothold in this particular market segment. The sales figure for March 2024, standing at 7,423, while indicating some level of consumer interest, also points to the need for strategic adjustments to improve market performance and competitiveness in Oregon's Concentrates category.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Oregon, High Latitude Farms has shown a notable upward trajectory in its ranking and sales over the recent months, moving from a rank of 46 in December 2023 to 30 by March 2024. This improvement is significant when compared to its competitors, such as Hush and Dr. Jolly's, which have seen a decline or stagnation in their rankings within the same period. Specifically, Dr. Jolly's experienced a slight drop to rank 29 in March 2024, from its consistent position at rank 23 in the preceding months. Meanwhile, Disco Dabs and Afterglow have been jockeying for positions close to High Latitude Farms, with Disco Dabs slightly ahead in March 2024 at rank 31, and Afterglow trailing at rank 32. The sales growth of High Latitude Farms, which saw a significant increase from December 2023 to March 2024, suggests a growing consumer preference and market share within Oregon's Vapor Pens category, positioning it as a brand to watch amidst its competitors.

Notable Products

In March 2024, High Latitude Farms saw the Gelato Breeze Cured Resin Cartridge (1g) from the Vapor Pens category take the top spot with impressive sales of 940 units. Following closely was the Jealous Bananas Distillate Cartridge (1g), also a Vapor Pen, securing the second position. The third place was claimed by Zero Gravity Distillate Cartridge (1g), marking a strong presence of Vapor Pens in the top sales rankings for the month. Notably, the Leftovers CO2 Cartridge (1g), which consistently held the second rank in the previous two months, dropped to the fourth position in March. The Gelonade Distillate Cartridge (1g), which led the sales in January and February, experienced a significant drop, landing in the fifth spot by March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.