Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

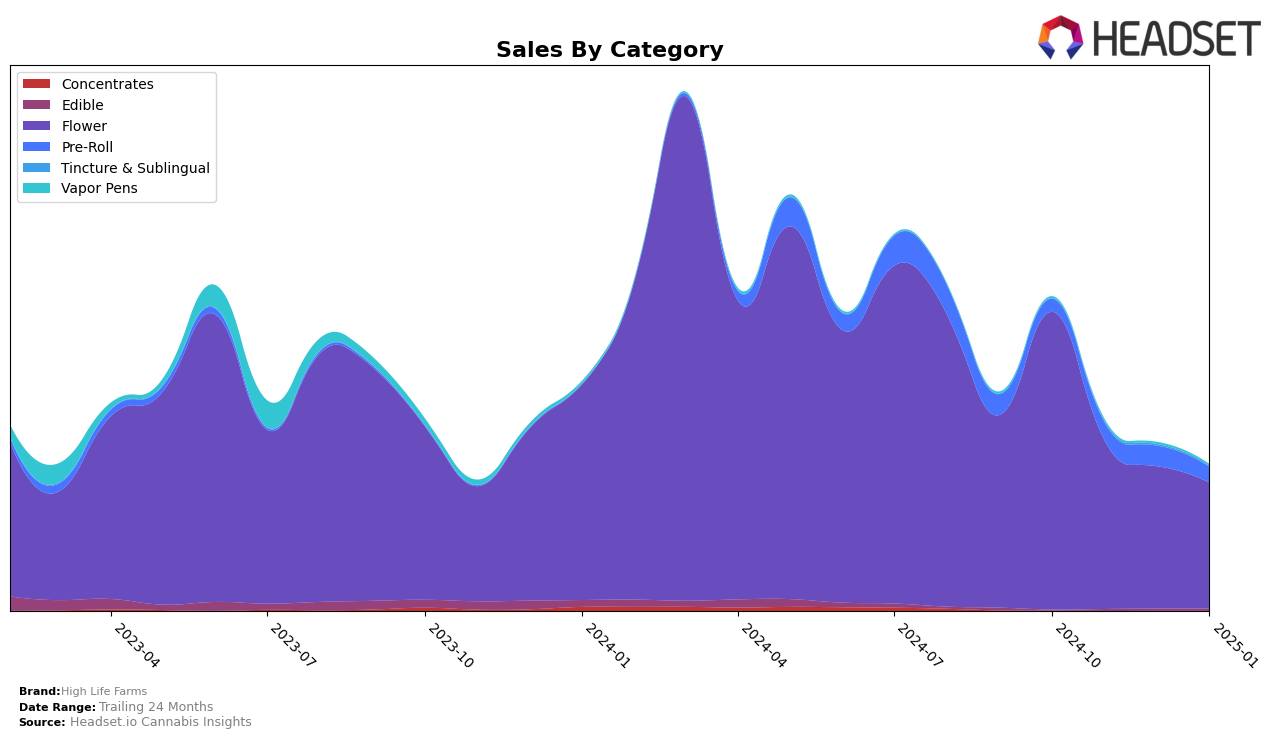

High Life Farms has shown notable performance variations across different states and product categories. In Michigan, the brand's presence in the Flower category has experienced a downward trend from October 2024 through January 2025. Starting at the 35th rank in October 2024, High Life Farms dropped out of the top 30 by November and continued to slide to the 66th position by January 2025. This decline in ranking signifies a challenging market environment in Michigan's Flower category, highlighting potential areas for strategic focus or reevaluation.

Despite the downward trend in Michigan, High Life Farms' overall sales figures provide an interesting perspective. The sales in October 2024 were recorded at $889,805, which decreased progressively over the months to $377,065 by January 2025. This consistent decline in sales aligns with the brand's slipping rank, pointing to potential market shifts or increased competition within the region. While the data highlights some challenges, it also offers a glimpse into the competitive dynamics in Michigan, suggesting that High Life Farms may need to adapt its strategies to regain its foothold in the Flower category.

Competitive Landscape

In the competitive landscape of the Michigan flower category, High Life Farms has experienced a notable decline in rank from October 2024 to January 2025, moving from 35th to 66th place. This downward trend in rank is mirrored by a consistent decrease in sales over the same period. In contrast, North Cannabis Co., while also experiencing a decline, maintained a higher rank than High Life Farms throughout the period, ending at 61st in January 2025. Strane showed a significant improvement, moving up from being unranked in October to 67th in January, indicating a potential rise in market presence. Meanwhile, Rare Michigan Genetics demonstrated a fluctuating performance, ultimately surpassing High Life Farms by January. Muha Meds also showed volatility but ended close to High Life Farms at 68th. These shifts highlight the competitive pressures High Life Farms faces, suggesting a need for strategic adjustments to regain market share and improve sales performance in the Michigan flower market.

Notable Products

In January 2025, Stankonya (3.5g) emerged as the top-performing product for High Life Farms, climbing from its previous third-place rank in October 2024 to first, with sales reaching $2,756. Sub Zero Pre-Roll (1g) maintained its consistent performance, holding the second rank in both November 2024 and January 2025. White Truffle Cheese (3.5g) secured the third position, showing a slight decline from its third-place rank in December 2024. Hooch (3.5g) debuted at fourth place, indicating a new entry into the top rankings. Ice Cream Cake (3.5g) dropped from fourth in December 2024 to fifth in January 2025, suggesting a slight decrease in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.