Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

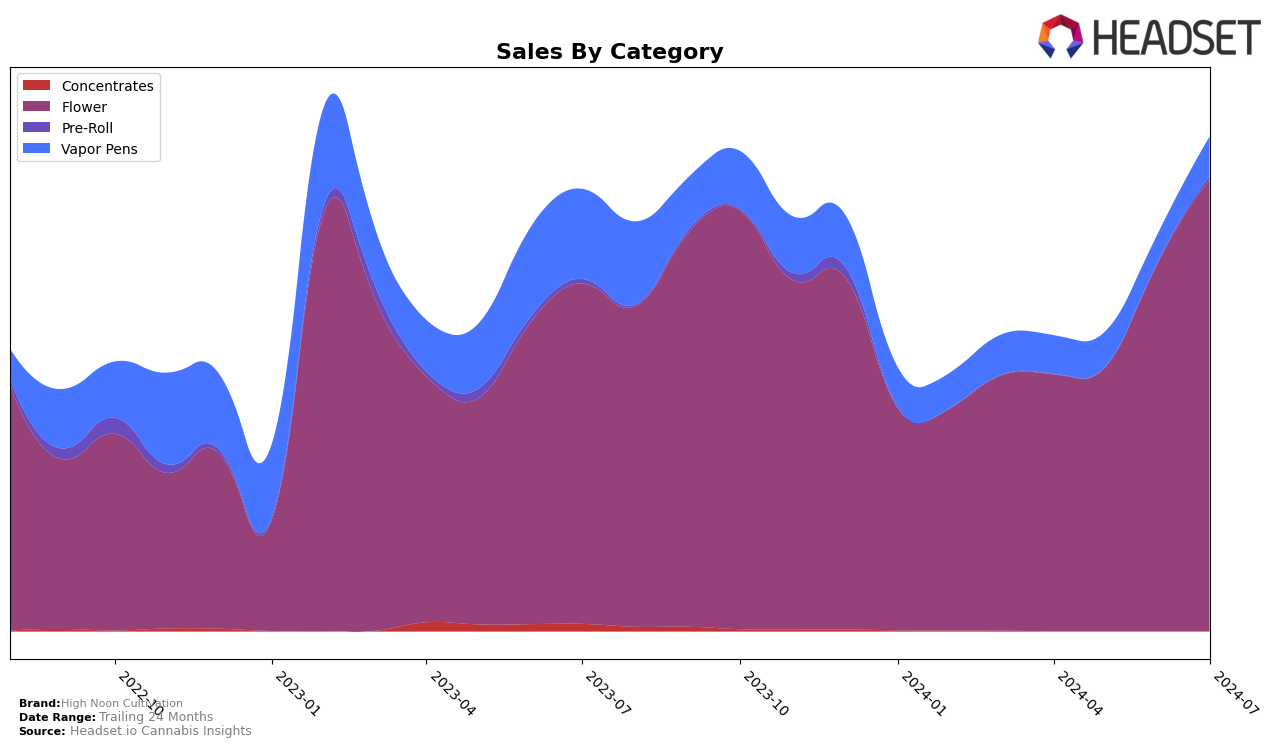

High Noon Cultivation has shown noteworthy progress in the Oregon market, particularly in the Flower category. In April 2024, the brand was ranked 51st, but by July 2024, it had ascended to the 30th position. This upward trajectory over four months is indicative of a strong performance and growing consumer preference. The sales figures reflect this trend, with a significant increase from $140,105 in April to $246,192 in July. This movement into the top 30 is a positive indicator of the brand's expanding footprint in the Oregon Flower market.

However, it's important to note that High Noon Cultivation's presence in other states and categories outside of Oregon and Flower is either minimal or non-existent, as they do not appear in the top 30 rankings elsewhere. This could be seen as a limitation in their market penetration and diversification strategy. While their performance in Oregon is commendable, the lack of visibility in other states and categories suggests potential areas for growth and expansion. Further analysis could reveal more about their strategic focus and opportunities for scaling their operations.

Competitive Landscape

In the competitive landscape of Oregon's flower category, High Noon Cultivation has demonstrated a notable upward trend in rank and sales over the past few months. From April to July 2024, High Noon Cultivation's rank improved from 51st to 30th, indicating a significant rise in market presence. This positive trajectory is particularly impressive when compared to competitors such as Noblecraft / Chill Farms, which also saw an increase but remained slightly behind at 29th in July. Meanwhile, The Heights Co. outpaced High Noon Cultivation by reaching 28th, although both brands show strong competitive momentum. On the other hand, Derby's Farm experienced a decline, dropping from 22nd to 36th, which may present an opportunity for High Noon Cultivation to capture more market share. Additionally, Lofty has been steadily climbing but still trails behind High Noon Cultivation, ranking 37th in July. These dynamics suggest that High Noon Cultivation is well-positioned for continued growth in the Oregon flower market.

Notable Products

For Jul-2024, the top-performing product from High Noon Cultivation is Real McCoy (3.5g) in the Flower category, achieving the number one rank with sales of 1168 units. Pinesicle Helen Back (3.5g), also in the Flower category, follows in second place with notable sales figures. Butterscotch Bacio (1g) dropped from the first position in Jun-2024 to third place in Jul-2024. Biscotti Pie (Bulk) has shown consistency, moving from fifth place in May-2024 to fourth in Jul-2024. Triple Chocolate Chip (1g) made an entry into the top five, securing the fifth rank.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.