Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

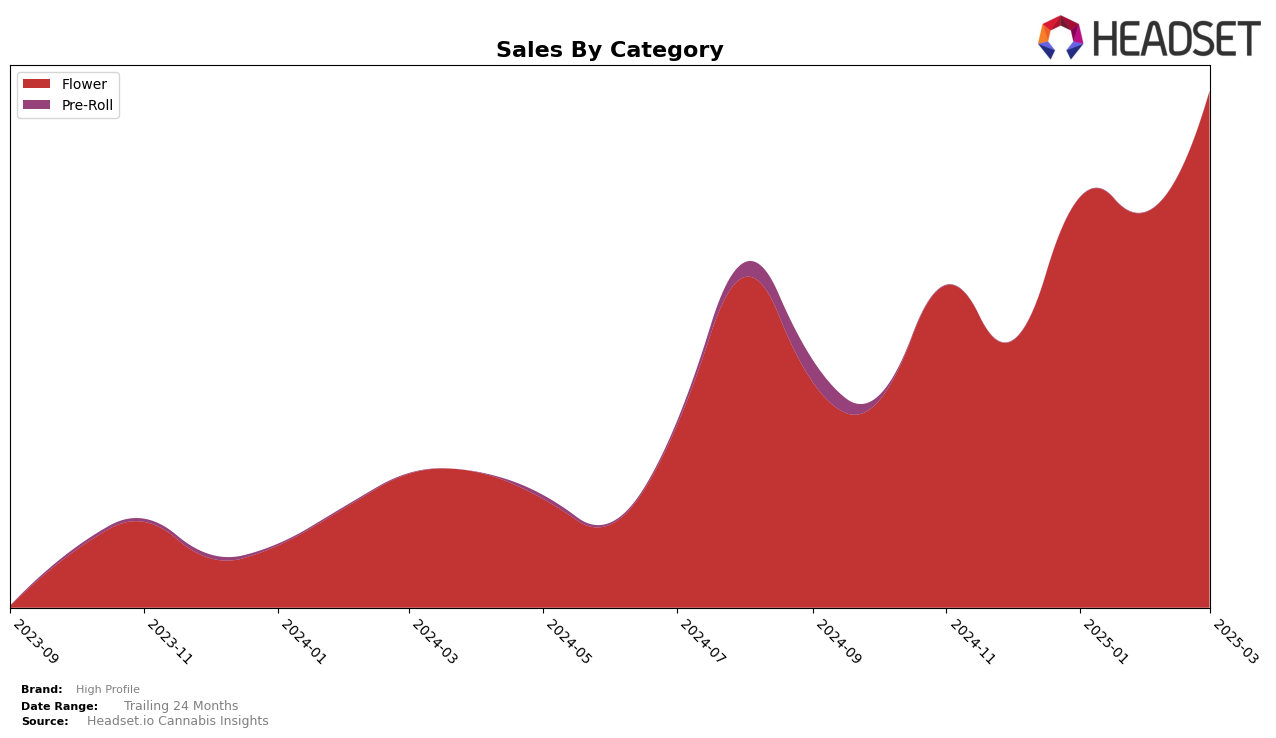

In the Michigan market, High Profile has shown a noteworthy upward trajectory in the Flower category. Starting from outside the top 30 in December 2024, the brand made a significant leap to rank 30th in January 2025. Despite a slight dip to 32nd place in February, High Profile rebounded to 27th by March 2025. This movement indicates a strong performance, especially considering the competitive nature of the Flower category in Michigan. The brand's ability to climb the ranks reflects positively on its market presence and consumer appeal.

Although High Profile's performance in Michigan's Flower category is commendable, the absence of rankings in other states or categories is a potential area of concern. Not being in the top 30 in other regions or product segments might suggest limited geographical reach or a narrower product focus. However, the consistent growth in Michigan could imply strategic investments or consumer loyalty building efforts that might eventually translate to broader market penetration. Monitoring these trends could provide insights into High Profile's future strategies and potential market expansions.

Competitive Landscape

In the competitive Michigan flower market, High Profile has demonstrated a notable upward trajectory in its rankings from December 2024 to March 2025. Starting at rank 57 in December 2024, High Profile climbed to rank 27 by March 2025, indicating a significant improvement in market presence. This ascent is particularly impressive when compared to competitors such as Fluresh, which saw a decline from rank 13 in December 2024 to 26 by March 2025, and Glacier Cannabis, whose rankings fluctuated but ultimately dropped to 25 in March 2025. Meanwhile, Euphoria (MI) and NOBO remained outside the top 20 throughout this period, indicating a less competitive stance. High Profile's sales growth aligns with its improved ranking, suggesting effective market strategies and consumer engagement, positioning it as a rising contender in Michigan's flower category.

Notable Products

In March 2025, Pina Grande Popcorn (28g) emerged as the top-performing product for High Profile, climbing from its previous fourth position in February to secure the number one rank with impressive sales of 2822.0. Cookiehead Smalls (28g) maintained its strong performance, holding steady at the second position with consistent sales growth over the months. Lemon Fire MAC Popcorn (28g), which was the leader in February, dropped to the third position, indicating a slight decrease in its sales momentum. Honeydew (3.5g) saw a decline in its rank, moving from third in February to fourth in March, suggesting a need for strategic adjustments to regain its earlier standing. Lastly, Old Dirty Biker Popcorn (28g) made its debut on the top five list in March, securing the fifth position, which highlights its growing popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.