Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

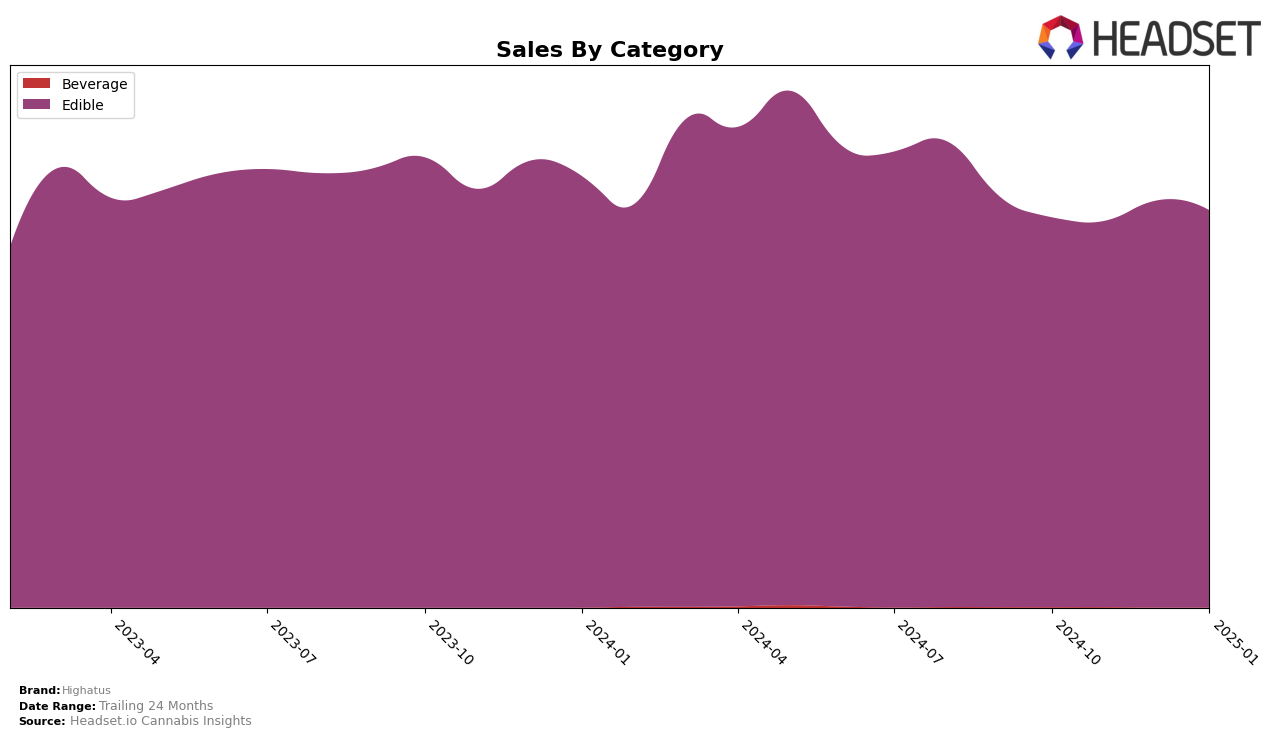

Highatus has shown a consistent performance in the Edible category in California. Over the observed months, the brand has improved its ranking from 13th in October and November 2024 to 12th in December 2024, and further to 11th in January 2025. This upward movement suggests a strengthening position in the competitive edible market. Despite a slight dip in sales in November 2024, Highatus managed to recover and even surpass its October sales figures by December, indicating resilience and effective market strategies.

It is noteworthy that Highatus has not appeared in the top 30 rankings in other states or categories, which could be seen as a limitation in their market penetration outside of California. This absence might highlight areas for growth or suggest a strategic focus on maintaining and expanding their success within the California market. The brand's focused presence in California's edible category could imply a targeted approach, capitalizing on a specific consumer base or regional preference. The lack of presence in other markets might be a strategic decision or an area ripe for exploration in future expansions.

Competitive Landscape

In the competitive landscape of the edible category in California, Highatus has shown a steady improvement in its ranking, moving from 13th place in October 2024 to 11th place by January 2025. This upward trend indicates a positive reception and growing market presence, despite facing strong competition. Notably, Smokiez Edibles has consistently maintained a higher rank, although it experienced a significant drop to 12th place in January 2025, which could suggest a potential opportunity for Highatus to capitalize on any shifts in consumer preferences. Meanwhile, Drops and Emerald Sky have remained stable in their rankings, with Drops slightly improving to 9th place, indicating that Highatus needs to strategize effectively to surpass these competitors. Kiva Chocolate maintains a steady 14th place, suggesting that while it is a competitor, it currently poses less of a threat to Highatus's upward trajectory. Overall, Highatus's consistent sales growth and improved ranking highlight its potential to further climb the ranks in the California edible market.

Notable Products

In January 2025, Highatus's CBD/CBN/THC 1:1:1 Blueberry Sour Gummies 10-Pack maintained its top position, leading the sales with 12,626 units sold. The Sour Strawberry Lemonade Gummies 10-Pack climbed to second place, continuing its upward trend from fourth in October to second in December. Sour Pineapple Gummies 10-Pack remained steady in third place, while Sour Watermelon Gummies 10-Pack held onto the fourth spot, showing a slight increase in sales from December. Sour L'Orange Gummies 10-Pack consistently ranked fifth, experiencing a slight drop in sales compared to the previous month. Overall, Highatus's edible products demonstrated strong and stable performance, with minor shifts in rankings over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.