Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

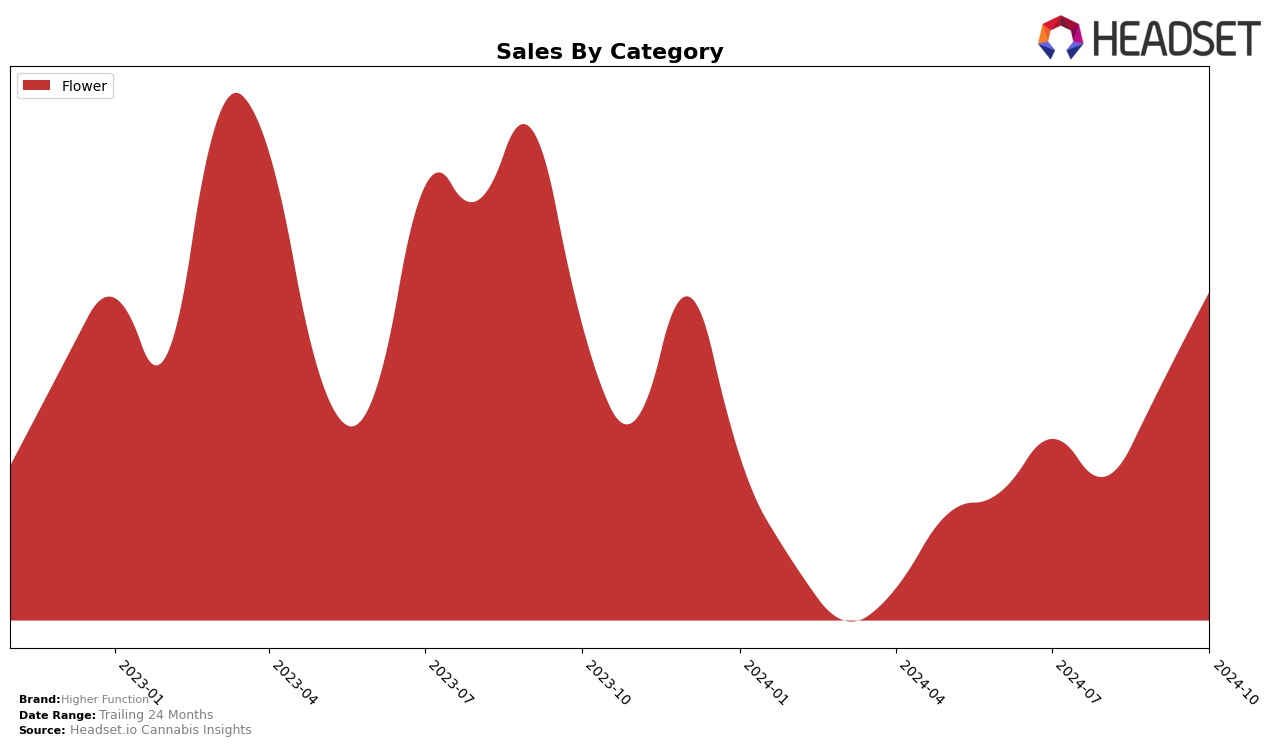

Higher Function has shown notable progress in the Colorado market, particularly in the Flower category. After starting outside the top 30 brands in July and August 2024, ranked at 49th and 54th respectively, Higher Function made significant strides by climbing to 28th place by October 2024. This upward movement indicates a strong performance trajectory and suggests increased consumer preference or improved distribution strategies. The sales figures support this trend, with October sales reaching a peak, demonstrating a substantial growth from previous months. This improvement in ranking and sales reflects a positive momentum for Higher Function in the competitive Colorado cannabis market.

While the Flower category in Colorado shows promising signs for Higher Function, it's important to note that their absence from the top 30 in earlier months could imply challenges in market penetration or competition. However, the brand's ability to break into the top 30 by October suggests that they have successfully addressed some of these challenges. It is also worth considering how this performance might translate to other states or categories, where the brand might face different competitive dynamics. The insights into Colorado's market could serve as a valuable benchmark for Higher Function as they strategize for expansion or improvement in other regions. Further analysis would be necessary to understand how these dynamics play out in other states or categories.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Higher Function has demonstrated a notable upward trajectory in its rankings over the past few months. Starting from a rank of 49 in July 2024, Higher Function improved to a rank of 28 by October 2024. This positive shift suggests a significant increase in market presence and consumer preference. In comparison, Canna Botica (Personalized Organic Treatments) also showed a strong improvement, moving from rank 59 to 29, indicating a competitive push in the market. Meanwhile, Indico and Vera experienced fluctuations, with Indico rising from 35 to 26 and Vera dropping from 28 to 30, suggesting varying consumer preferences. Hi-Fuel maintained a relatively stable position, ending at rank 27 in October. These dynamics highlight Higher Function's growing competitiveness and potential for increased sales, as it continues to climb the ranks amidst strong contenders in the Colorado flower market.

Notable Products

In October 2024, Higher Function's top-performing product was Gelato Popcorn (Bulk) in the Flower category, securing the number one rank with sales of 9,057 units. Lemon Cherry Pie Popcorn (1g) maintained its strong performance, holding steady at the second rank with a notable increase in sales from August. Sugar Cane Popcorn (1g) climbed to the third position, showing significant improvement from its fourth-place ranking in September. MAC Popcorn (1g) entered the rankings for the first time in October, securing the fourth spot. Pineapple Burst (1g) remained consistent at fifth place, demonstrating stable sales figures over the past two months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.