Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

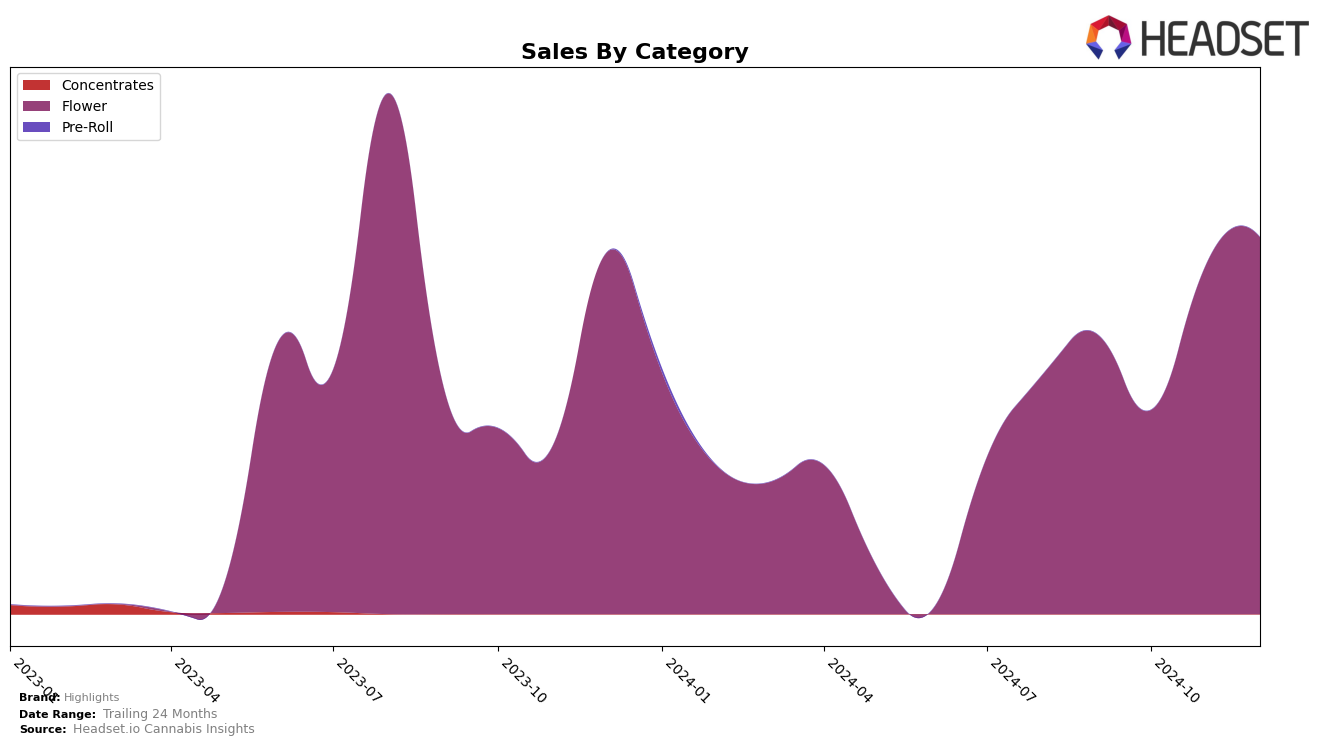

Highlights has shown a dynamic performance across different categories and states, particularly in the flower category within Nevada. In September 2024, Highlights was ranked 29th in the flower category, but by December 2024, it had climbed to 17th place. This upward movement reflects a positive trend and suggests a growing consumer preference for Highlights' flower products in Nevada. The brand's sales in this category also increased significantly from October to December, indicating a successful strategy in capturing market share. However, the October 2024 rank of 31st indicates a brief period where the brand fell out of the top 30, highlighting a potential challenge that was quickly overcome in the following months.

While the flower category in Nevada shows promising growth, it is noteworthy that Highlights' performance in other states and categories is not detailed here, suggesting that the brand might not have made it into the top 30 rankings elsewhere during this period. This absence could indicate areas where Highlights has room for improvement or expansion. The focus on Nevada's flower market might be part of a strategic decision to concentrate resources and efforts where they have already established a foothold. Observing the trends in Nevada could provide insights into how Highlights might approach other markets in the future, potentially replicating successful strategies to elevate their rankings and sales in additional states and categories.

Competitive Landscape

In the Nevada flower category, Highlights has shown a notable upward trend in rankings from September to December 2024, moving from 29th to 17th place. This improvement is significant, especially when compared to competitors like CAMP (NV), which experienced a decline from 9th to 18th place in the same period. While Good Green also saw a positive trend, climbing from 27th to 15th, Highlights' consistent sales growth from November to December suggests a strengthening market position. Meanwhile, High Heads and Flower House displayed fluctuating ranks, indicating potential volatility. Highlights' ability to increase sales and improve its rank amidst such competitive dynamics highlights its growing appeal and market penetration in Nevada's flower segment.

Notable Products

In December 2024, Chipz Ahoy (3.5g) emerged as the top-performing product for Highlights, climbing from third place in November to secure the number one rank with a notable sales figure of 1209.0. Mac 1 (14g) made a remarkable entry into the rankings at the second position, showcasing its instant popularity. Topanga Cake (3.5g) maintained a strong presence, although it slipped to third place from its previous unranked status. Ice Cream Cake (3.5g) experienced a significant drop from its leading position in November to fourth place in December. Runtz (14g) rounded out the top five, making its debut in the rankings this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.