Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

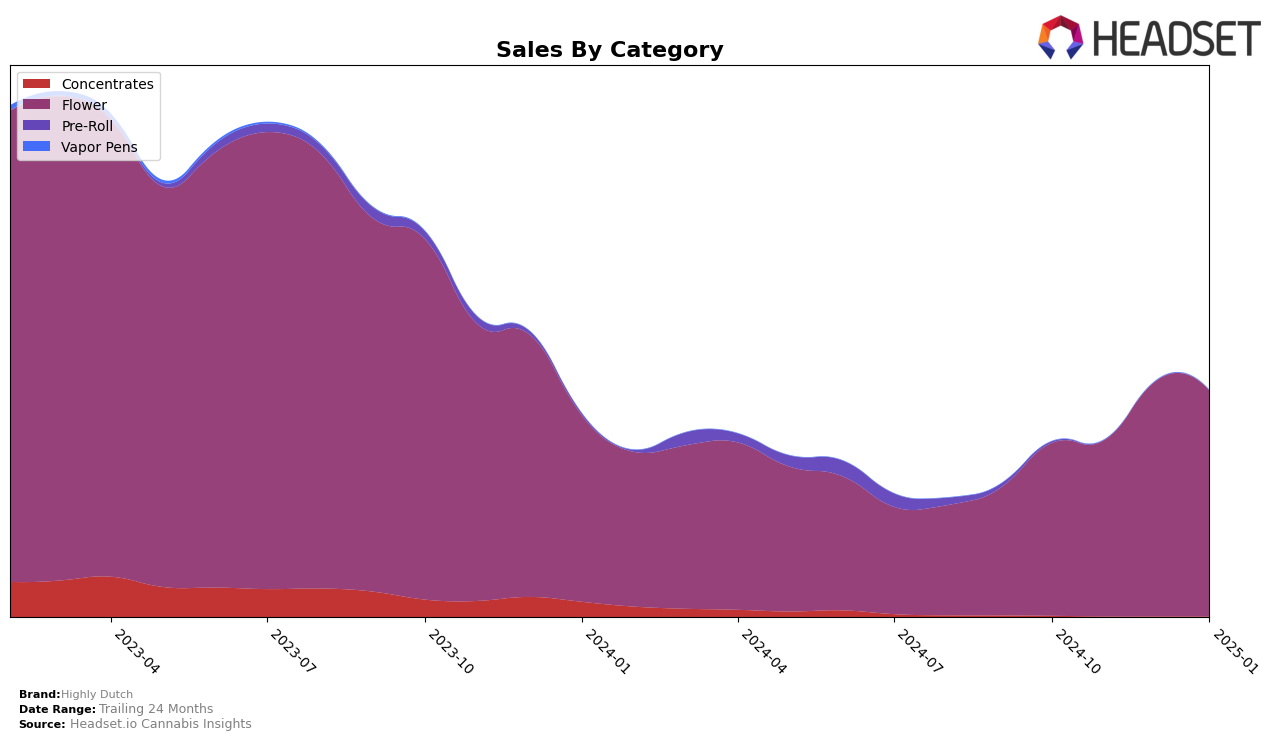

Highly Dutch has demonstrated varied performance across different provinces in Canada, with notable shifts in their rankings in the Flower category. In Alberta, the brand experienced a downward trend, dropping from the 28th position in October 2024 to 54th by January 2025, indicating a significant decline in their market presence. This may suggest challenges in maintaining competitiveness or consumer interest in this province. Conversely, in British Columbia, Highly Dutch maintained a relatively stable position, hovering around the top 20, although they saw a slight drop from 16th in December 2024 to 19th in January 2025. This stability amidst slight fluctuations suggests a consistent consumer base or effective market strategies in this region.

In Ontario, Highly Dutch showed a positive trajectory, climbing from 28th in October 2024 to 17th by January 2025. This upward movement indicates successful market penetration or increased consumer preference in Ontario, contrasting with their performance in Alberta. The sales figures also reflect this trend, with a noticeable increase in sales in Ontario during this period. However, it's important to note that despite the growth in Ontario, Highly Dutch was not among the top 30 brands in Alberta by January 2025, highlighting the brand's varied performance across different regions. This disparity in rankings across provinces could be attributed to regional market dynamics or differences in consumer preferences.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Highly Dutch has demonstrated a significant upward trajectory in its market rank over the past few months. Starting from a position outside the top 20 in October 2024, Highly Dutch climbed to 24th in November, 18th in December, and reached 17th by January 2025. This ascent is indicative of a robust growth in sales, surpassing brands like 1964 Supply Co and Tribal, which have shown more static or fluctuating rankings. Notably, Highly Dutch's sales in January 2025 exceeded those of 1964 Supply Co and Tribal, despite these brands maintaining a more consistent presence in the rankings. However, Highly Dutch still trails behind leading competitors like Versus and LowKey, which have sustained higher sales and ranks. This data suggests that while Highly Dutch is gaining momentum, there remains a competitive gap to close with the top-tier brands in the Ontario Flower market.

Notable Products

In January 2025, the top-performing product from Highly Dutch was Amsterdam Sativa (28g), maintaining its consistent first-place ranking since October 2024 with sales of 4961 units. The Organic Minis (14g) emerged as a strong contender, securing the second position, a new entry in the rankings. Rotterdam Indica (28g) held steady in third place, showing stable performance throughout the previous months. Organic Butter Cookies x Organic NYC Juggernaut (28g) climbed to fourth place, continuing its upward trajectory from December 2024. Amsterdam Sativa (7g) saw a decline, dropping from second place in December 2024 to fifth in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.