Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

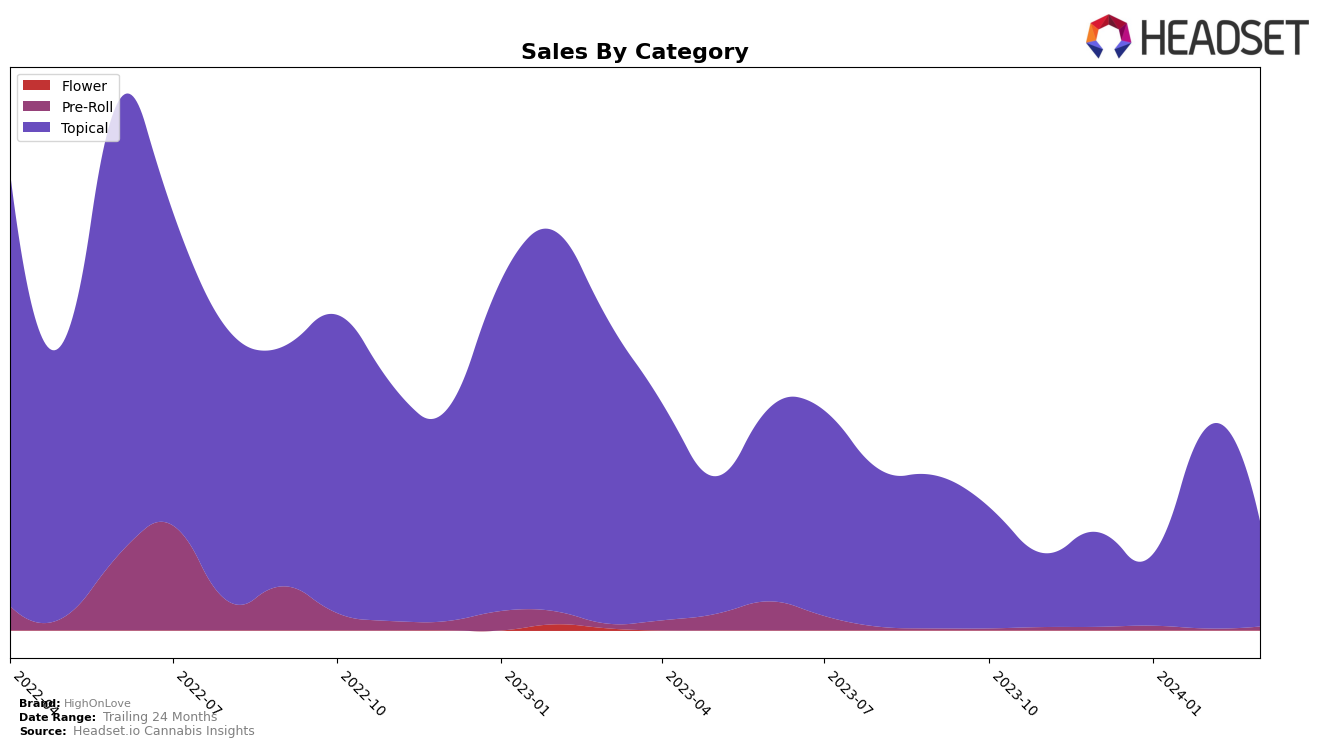

In Colorado, HighOnLove has shown a notable performance within the Topical category over the recent months. Starting in December 2023, the brand ranked 16th, and despite a slight dip to 17th in January 2024, it impressively climbed to 13th in February before settling at 14th in March 2024. This fluctuation in rankings indicates a competitive stance in the Colorado market, with February marking a peak in both rank and sales, the latter reaching 6,857 units sold. The slight decrease in ranking from February to March, despite a decrease in sales to 3,586 units, suggests a dynamic market environment where minor shifts can impact rankings significantly. The brand's ability to maintain a position within the top 20 throughout these months highlights its resilience and consumer demand for its topical products in Colorado.

However, the absence of HighOnLove from the top 30 brands in other states or provinces for the same period suggests a concentration of its market presence and efforts within Colorado. This could be interpreted in several ways; either the brand is focusing on establishing a strong foothold in a single market before expanding or it faces challenges in breaking into other markets. The data presented does not include performance metrics outside of Colorado, which leaves room for speculation on the brand's overall strategy and market penetration efforts. For stakeholders and potential investors, the consistent performance in Colorado's Topical category might be a point of interest, signaling a strong brand affinity and consumer base in that state. Nonetheless, the lack of visibility in other regions could also be a point for further investigation and strategic evaluation for HighOnLove.

Competitive Landscape

In the competitive landscape of the topical cannabis category in Colorado, HighOnLove has shown a notable fluctuation in its market position from December 2023 through March 2024. Initially ranked 16th in December, it experienced a slight dip to 17th in January before climbing to 13th in February and settling at 14th in March. This trajectory indicates a volatile yet overall positive trend in its market standing, especially considering its significant sales jump in February. Competitors like Betty, consistently ranking higher, show a more stable performance, yet HighOnLove's February sales surge suggests it's a brand with potential for growth and market disruption. Other brands such as CannaPunch and Dixie Elixirs have also experienced fluctuations, but none as pronounced as HighOnLove's leap in February. This dynamic indicates that while HighOnLove is not yet leading in sales or rank, its significant month-to-month sales increase positions it as a brand to watch in the evolving competitive landscape of Colorado's topical cannabis market.

Notable Products

In Mar-2024, HighOnLove's top-selling product was the Stimulating Sensual Oil (38mg CBD, 100mg THC, 10ml), maintaining its number one rank since Dec-2023 with 57 units sold. Following closely, the Stimulating Sensual Oil (100mg CBD, 300mg THC, 30ml) also held its position at second place, showcasing consistent consumer preference in the Topical category. The CBD/THC 1:1 Bath and Body Sensual Oil (100mg CBD, 100mg THC) saw a return to the rankings in third place, indicating a fluctuating but strong demand for bath and body oils. The Sensual Coupe Deville Pre-Roll 3-Pack (3g) remained steady at fourth, highlighting a consistent choice among Pre-Roll enthusiasts. Notably, the rankings have shown remarkable stability over the past months, with the top products firmly holding their positions and indicating a loyal customer base for their preferred selections.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.