Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

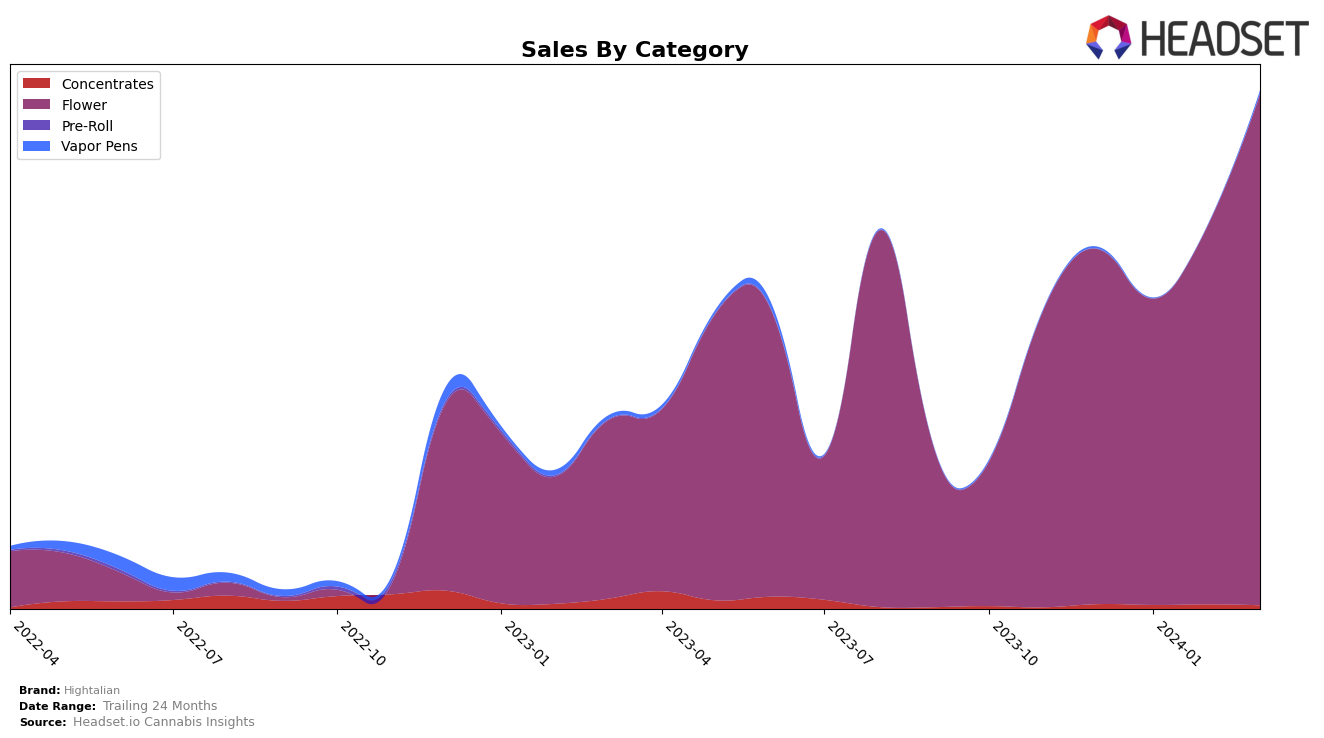

In the competitive cannabis market of Michigan, Hightalian has made a notable impact within the Flower category. Over the recent months, from December 2023 to March 2024, Hightalian has shown a positive trajectory in its rankings, moving from 19th position in December 2023 and January 2024, to 16th in February, and further climbing to 15th by March 2024. This upward movement is a strong indicator of the brand's growing popularity and acceptance among consumers in Michigan. Interestingly, while the brand's sales dipped slightly in January 2024 to 999,350, it rebounded significantly in the following months, with March 2024 sales peaking at 1,668,813. This fluctuation in sales, alongside the improvement in rankings, suggests a dynamic market presence, likely influenced by strategic marketing efforts, product quality, and consumer preferences.

Despite the absence of data for other states or provinces, the performance of Hightalian in Michigan's Flower category can serve as a valuable case study for its potential in similar markets. The consistent improvement in rankings, coupled with the significant increase in sales, especially from February to March 2024, highlights the brand's resilience and adaptability in a competitive landscape. This performance might also reflect broader trends within the cannabis industry in Michigan, such as consumer shifts towards premium or niche brands, or perhaps Hightalian's effective engagement with its target market. However, without comparing to other states or categories, it's challenging to fully gauge the brand's market position or to predict future performance. Nonetheless, Hightalian's current trajectory in Michigan is promising and warrants attention from both consumers and industry analysts alike.

Competitive Landscape

In the competitive landscape of the Flower category within Michigan's cannabis market, Hightalian has shown a notable trajectory in terms of rank and sales. Starting from a rank of 19 in December 2023, it maintained its position in January 2024, improved to 16th in February, and further climbed to 15th in March 2024. This steady ascent is indicative of Hightalian's growing presence and consumer preference in the market. Competitors such as Grown Rogue and Mooon Juice have shown fluctuations in their rankings, with Grown Rogue experiencing a decline from 4th to 13th and Mooon Juice moving up to 14th in March 2024, slightly ahead of Hightalian. Notably, High Life Farms and Glo Farms have made significant leaps in their rankings, with High Life Farms jumping from 55th to 16th and Glo Farms from 30th to 17th in the same period. These movements suggest a highly competitive and dynamic market, where Hightalian's consistent improvement in rank and sales positions it as a brand to watch, amidst aggressive competition and shifting consumer preferences.

Notable Products

In March 2024, Hightalian's top-performing product was Hashbar (1g) within the Flower category, securing the number one spot with remarkable sales of 11,673 units. Following closely, Gorilla Zkittlez (1g) maintained a strong presence in the rankings, moving from the top position in February to the second position in March. Jokerz #31 (1g) showed significant improvement, climbing from the fifth position in February to the third in March, indicating a growing consumer preference. Grandi Guava (1g), despite being the leader in the previous months, experienced a decline, dropping to the fourth position in March. Grape Pie (1g) rounded out the top five, maintaining a steady performance but falling two spots from its previous third-place position in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.