Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

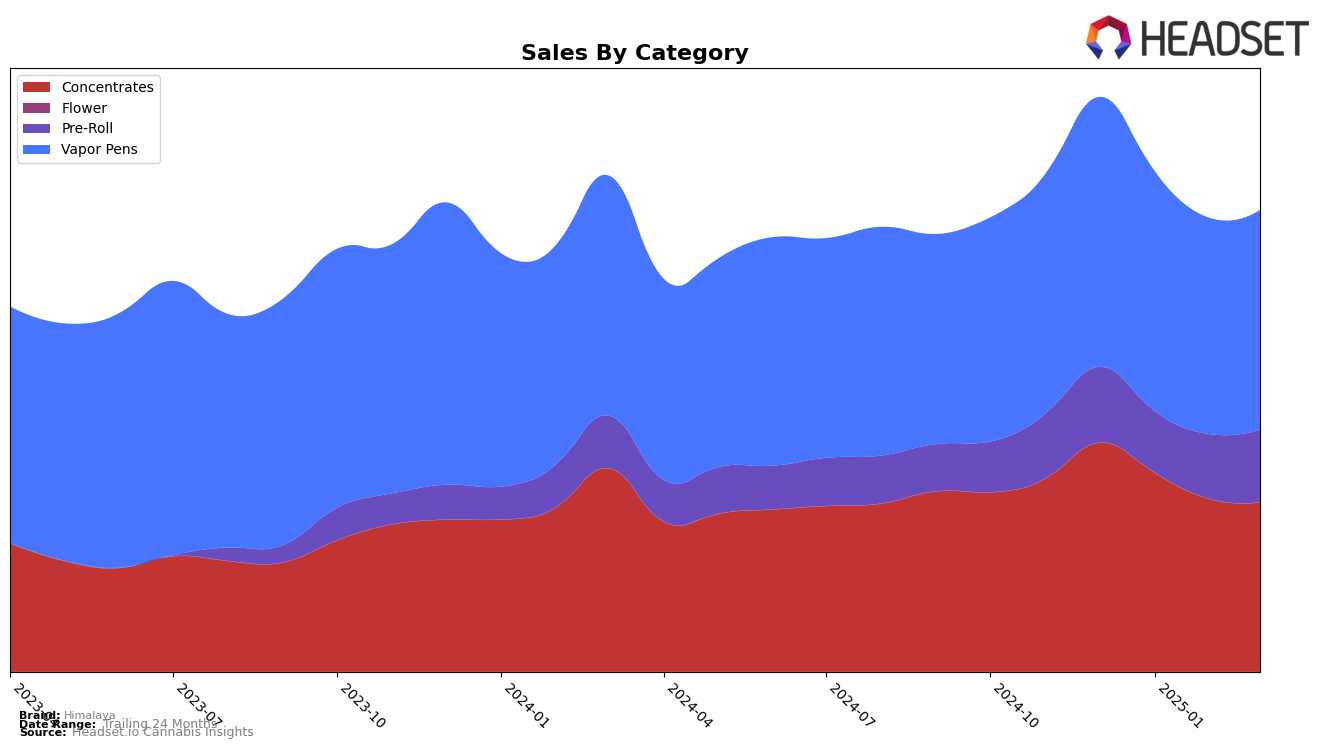

Himalaya's performance in the California market shows a varied trajectory across different product categories. In the Concentrates category, the brand maintained a strong presence, although its rank slightly declined from 5th in December 2024 to 8th by March 2025. This decline in ranking corresponds with a gradual decrease in sales over the same period, indicating potential challenges in maintaining market share. Conversely, in the Pre-Roll category, Himalaya did not make it into the top 30 brands, suggesting a weaker position in this segment. However, the brand's sales in Pre-Rolls experienced a slight uptick from February to March 2025, which may hint at potential growth or strategic adjustments in this category.

In the Vapor Pens category, Himalaya's ranking slipped from 29th in December 2024 to 34th by March 2025. This downward trend in rankings suggests increasing competition or a shift in consumer preferences within the California market. Despite this, the brand's sales figures showed a minor rebound from February to March 2025, indicating a possible stabilization or recovery effort. Overall, while Himalaya faces challenges in maintaining its rankings across categories, the fluctuations in sales suggest that there may be strategic opportunities for the brand to capitalize on, particularly in the Concentrates and Vapor Pens segments.

Competitive Landscape

In the competitive landscape of the California Vapor Pens category, Himalaya has shown a steady upward trajectory in its rankings, moving from 29th in December 2024 to 34th by March 2025. This progression is noteworthy, especially when compared to competitors like Kingpen, which experienced a decline from 28th to 36th over the same period. Himalaya's sales figures have also demonstrated resilience, with a slight increase from February to March 2025, contrasting with the declining sales trend of Almora Farms, which dropped from 26th to 31st in rank. Meanwhile, Oakfruitland has emerged as a strong competitor, climbing from 47th to 33rd, surpassing Himalaya in March 2025. These dynamics suggest that while Himalaya is improving its market position, it faces growing competition from brands like Oakfruitland, which could impact its future sales and rank.

Notable Products

In March 2025, the top-performing product for Himalaya was Log Cabin Diamond Infused Pre-Roll (1g) in the Pre-Roll category, maintaining its leading position from February with sales of 3800 units. Blue Dream Infused Pre-Roll (1g) secured the second spot, marking its debut in the rankings. Banana Runtz Infused Pre-Roll (1g) was ranked third, showing a recovery from its absence in February. Hash Burger Infused Pre-Roll (1g) entered the rankings in fourth place. Funky Charms Infused Pre-Roll (1g) rounded out the top five, also making its first appearance in the monthly rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.