Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

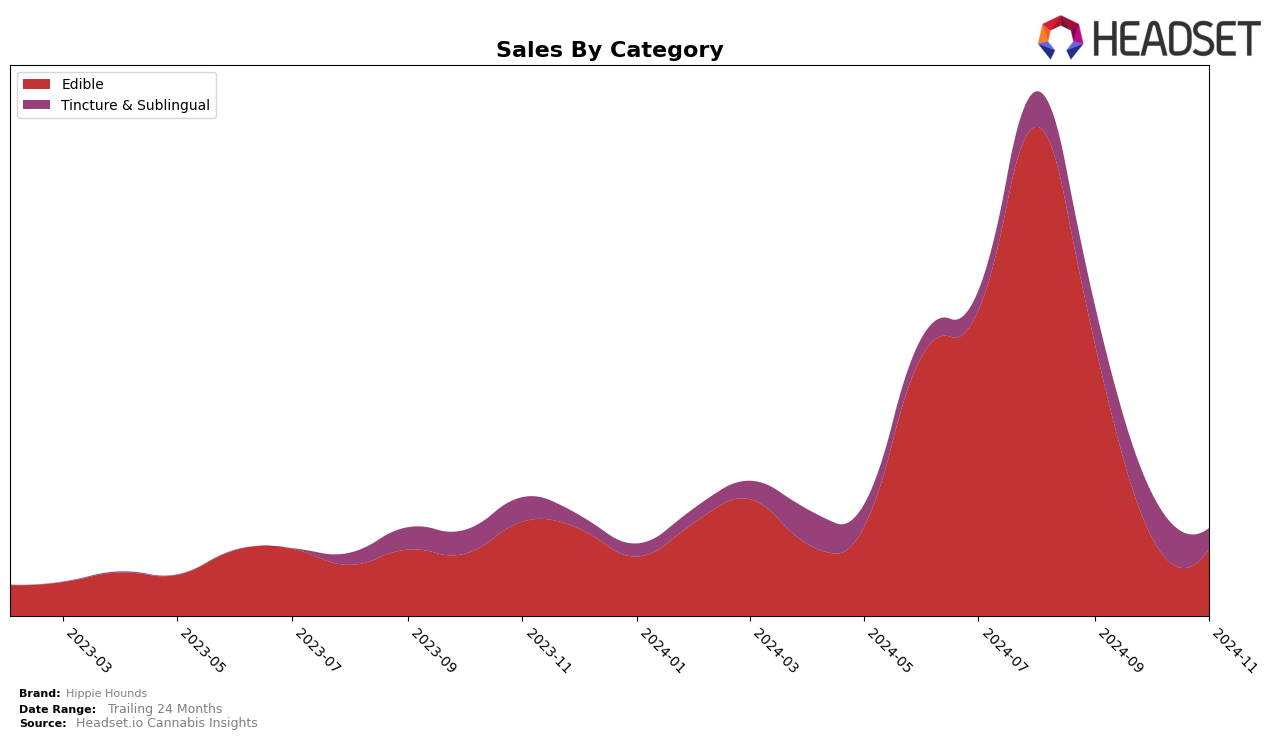

Hippie Hounds has experienced varied performance across different states and product categories, notably in the Edibles category within Missouri. Despite a promising start in August 2024 with a rank of 44, the brand's position slipped to 49 in September, and by October and November, it fell out of the top 30 entirely. This decline in ranking indicates a potential challenge in maintaining market presence or facing increased competition. The sales figures corroborate this trend, showing a noticeable drop from $20,507 in August to $11,400 in September, suggesting a need for strategic adjustments to regain traction.

While the data for other states and categories is not provided here, the absence of rankings in the top 30 for subsequent months in Missouri could imply similar trends in other regions or categories. This lack of presence in the top 30 rankings might highlight areas where Hippie Hounds could focus on improving their market strategy or product offerings. Understanding these dynamics is crucial for the brand to enhance its competitive edge and ensure sustainable growth in the cannabis market.

Competitive Landscape

In the Missouri edible cannabis market, Hippie Hounds has faced significant competition, particularly from brands like Camino and Monopoly Melts. While Hippie Hounds did not rank in the top 20 from August to November 2024, it maintained a presence with a rank of 44 in August and 49 in September. This indicates a slight decline in rank, which could be attributed to the stronger performance of competitors. For instance, Camino consistently held a top 20 position in August, suggesting a robust market presence and potentially higher sales. Meanwhile, Monopoly Melts, although not in the top 20, showed a decline in rank from 35 to 41 between August and September, yet still maintained higher sales than Hippie Hounds. These dynamics highlight the competitive pressure on Hippie Hounds, emphasizing the need for strategic marketing and product differentiation to improve its market position and sales trajectory.

Notable Products

In November 2024, the top-performing product from Hippie Hounds was the CBD K9 Treats 30-Pack (300mg CBD), maintaining its consistent number 1 ranking since August 2024, although sales have decreased to 80 units. The CBD Hemp infused Pet Treats (10mg CBD) held the second position, showing a steady increase in sales over the months. Notably, the CBD/CBG 1:1 K9 Tincture (500mg CBD, 500mg CBG) rose to the third position from fifth in October, reflecting a growing interest in tincture products. The K9 High CBD Full Spectrum Tincture (1000mg CBD, 30ml) experienced a decline in sales, dropping to the fourth position in November. Lastly, the CBD Feline Full Spectrum Pet Tincture (125mg CBD) entered the rankings in October and maintained the fourth position, indicating a potential new trend in feline-focused products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.