Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

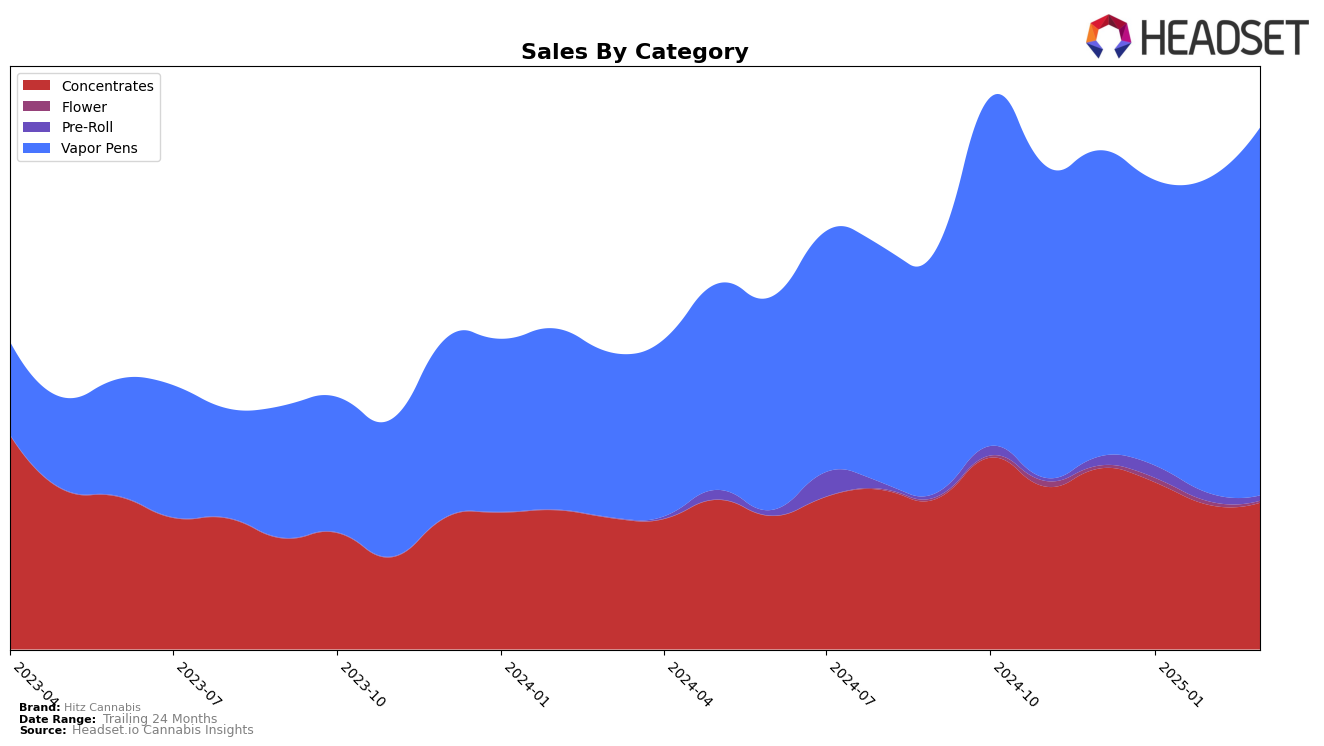

Hitz Cannabis has shown varied performance across different product categories in Washington. In the Concentrates category, the brand experienced a gradual decline in rankings from December 2024 to March 2025, moving from 15th to 20th place. This downward trend is accompanied by a decrease in sales, with a notable drop from December to February, before a slight recovery in March. Such a decline in rank and sales could indicate increased competition or shifting consumer preferences within the Concentrates market. On the other hand, their performance in the Vapor Pens category has been more positive, with Hitz Cannabis improving its position from 30th to 23rd over the same period. This upward movement suggests a growing consumer interest in their vapor pen products, possibly driven by new product offerings or successful marketing strategies.

It is important to note that Hitz Cannabis was not always in the top 30 brands in each category, highlighting areas for potential growth or concern. Their absence from higher rankings in some months might suggest challenges in maintaining a consistent market presence across all categories. However, the improvement in the Vapor Pens category, where sales increased significantly from January to March, suggests that focusing on this category might be a strategic move for the brand. The contrasting trends between Concentrates and Vapor Pens in Washington could provide insights into consumer behavior and preferences, which Hitz Cannabis may leverage to optimize their product offerings and market strategies.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Hitz Cannabis has shown a promising upward trend in its rankings, moving from 30th place in December 2024 to 23rd by March 2025. This improvement indicates a positive trajectory in market presence, despite not being in the top 20 initially. Hitz Cannabis's sales have also increased steadily, aligning with its rise in rank. In comparison, Bodhi High and Lifted Cannabis Co have maintained relatively stable positions, with Bodhi High improving slightly from 23rd to 21st, and Lifted Cannabis Co experiencing a dip in February before recovering to 22nd in March. Meanwhile, Terpnado and Freddy's Fuego (WA) have shown more volatility, with Terpnado dropping to 28th in February and Freddy's Fuego fluctuating between 24th and 28th. These dynamics suggest that Hitz Cannabis is gaining traction and could potentially challenge these competitors if the current trend continues.

Notable Products

In March 2025, the top-performing product for Hitz Cannabis was Bruce Banner RSO Syringe (1g) from the Concentrates category, which climbed to the number one rank with impressive sales of 1500 units. Blackberry Kush Distillate Cartridge (1g) from the Vapor Pens category dropped to the second position, despite a strong performance in February 2025. Wedding Cake Distillate Cartridge (1g) maintained its presence in the top three, ranking third after debuting in February. Meanwhile, Blueberry Frost RSO Syringe (1g) consistently held the fourth position after being the top-ranked product in December 2024. Notably, Blueberry Frost Distillate Cartridge (1g) entered the top five, marking its debut in the rankings for March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.