Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

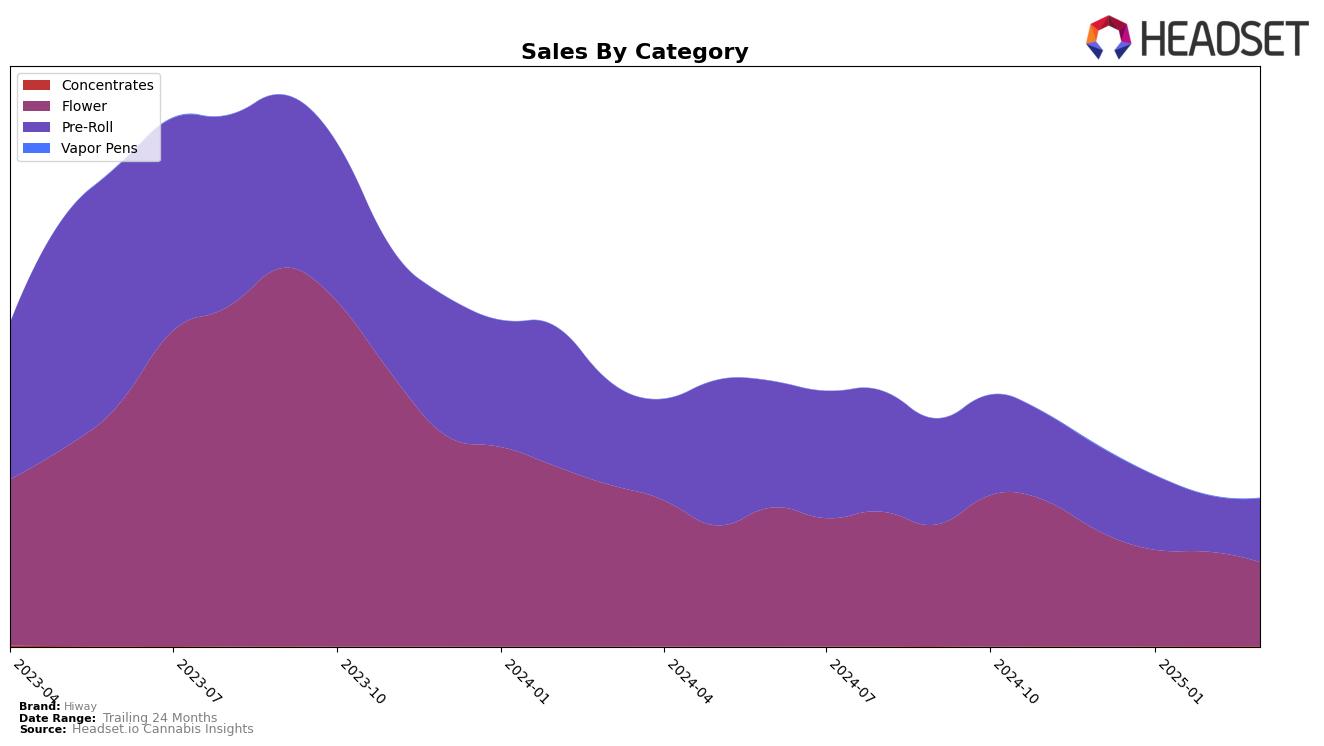

Hiway's performance across various categories and provinces reveals intriguing dynamics. In Alberta, the brand's Flower category experienced a notable fluctuation, peaking at rank 58 in January 2025 before dropping to 92 by March. In contrast, their Pre-Roll category maintained a steadier presence, consistently ranking within the top 30, though it slipped slightly from 24th in December 2024 to 28th by March 2025. Meanwhile, in British Columbia, Hiway's Flower category showed resilience, achieving a rank of 23 in February 2025, while the Pre-Roll category struggled, remaining outside the top 30 throughout the period.

In Ontario, Hiway's Flower category saw a downward trend, moving from 56th in December 2024 to 72nd by March 2025, indicating challenges in maintaining market position. Similarly, their Pre-Roll category faced difficulties, dropping out of the top 100 in February 2025 before recovering slightly in March. Conversely, in Saskatchewan, Hiway's Flower category consistently performed well, maintaining a rank within the top 25, showcasing a stable presence in the market. These movements hint at varying levels of competition and market dynamics across provinces, providing insights into Hiway's strategic positioning and potential areas for improvement.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, Hiway has experienced fluctuating rankings over the months from December 2024 to March 2025. Hiway maintained a steady position at 24th in December 2024 and January 2025, but saw a slight decline to 26th in February and 28th in March. This trend suggests a need for strategic adjustments to regain momentum. In comparison, Tweed started at 19th in December but dropped out of the top 20 by March, indicating a sharper decline in rank. Meanwhile, Broken Coast showed improvement, climbing from 33rd in December to 26th in March, potentially posing a growing threat to Hiway's market share. Freedom Cannabis also demonstrated resilience, peaking at 20th in January before settling at 27th in March, indicating a competitive edge over Hiway in certain months. DEBUNK experienced a similar downward trend as Hiway, starting at 21st and ending at 29th. These insights highlight the dynamic nature of the Alberta Pre-Roll market and underscore the importance for Hiway to innovate and adapt to maintain and improve its standing.

Notable Products

In March 2025, Hiway's top-performing product remained the Sativa Pre-Roll 2-Pack (2g) in the Pre-Roll category, consistently holding the number one rank since December 2024, with sales of 17,509 units. The Indica Pre-Roll 2-Pack (2g) maintained its second position across the same period. Fast Lane Sativa (3.5g) rose to third place in March, improving from its previous fourth position in December and January. Fast Lane Sativa (14g) and Slow Lane Indica (3.5g) both secured the fourth and fifth ranks respectively, with Slow Lane Indica moving down from third place in February. Notably, the rankings for the top two products have remained stable, while the Flower category showed more variation in product performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.