Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

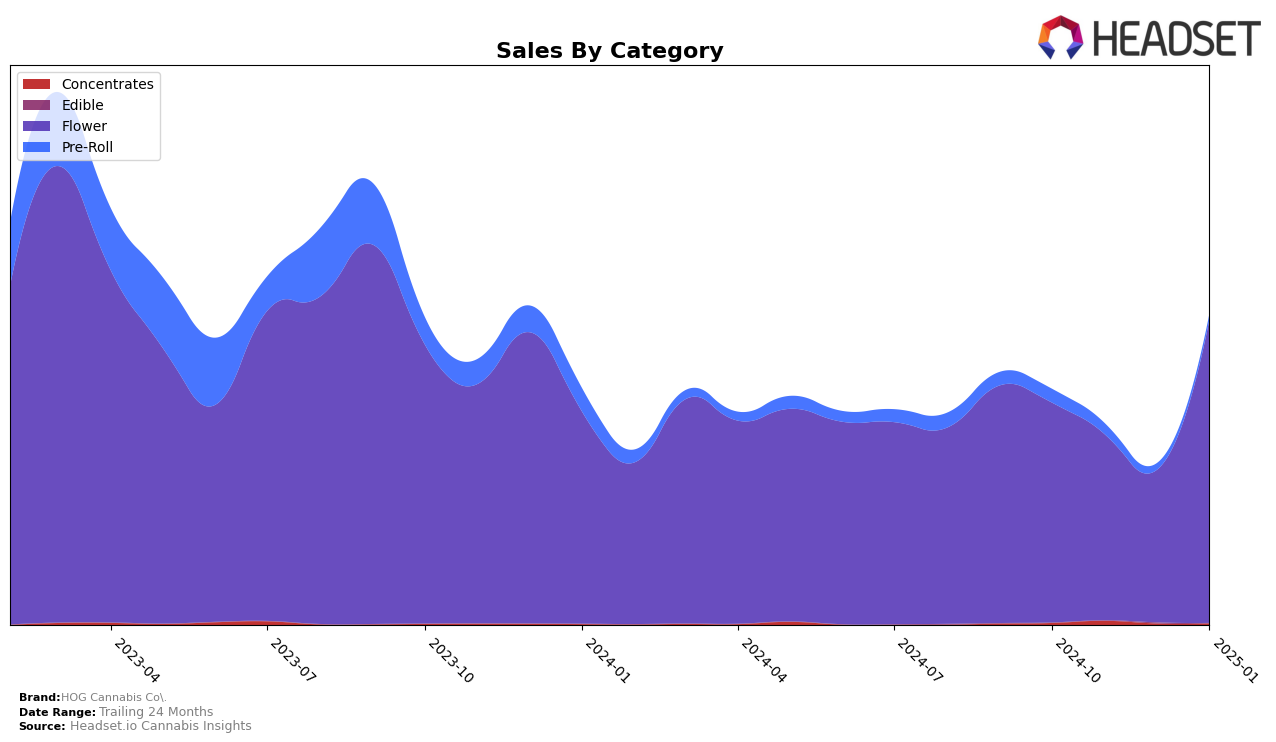

HOG Cannabis Co. has shown a significant upward trajectory in the Michigan market, particularly within the Flower category. Notably, the brand made a remarkable leap from being ranked 65th in December 2024 to securing the 28th position by January 2025. This substantial improvement indicates a robust increase in market presence and consumer preference, which is further supported by a notable rise in sales, reaching $837,113 in January. The brand's ability to break into the top 30 is a promising sign of its growing influence and competitiveness in the Michigan Flower market, suggesting effective strategies in product offerings or marketing efforts.

However, the absence of HOG Cannabis Co. from the top 30 rankings in previous months highlights areas for potential concern or opportunities for growth. Their rankings in October, November, and December 2024, where they did not make it to the top 30, suggest that while they have recently gained traction, consistent performance remains a challenge. This fluctuation in rankings could be attributed to various factors such as market competition, seasonal demand variations, or internal company changes. Understanding these dynamics can provide insights into how HOG Cannabis Co. can maintain its upward momentum and stabilize its market performance across different periods.

Competitive Landscape

In the competitive landscape of the Michigan flower category, HOG Cannabis Co. has shown a remarkable turnaround in its market position from October 2024 to January 2025. Initially ranked 53rd in October, HOG Cannabis Co. experienced a decline to 65th place by December. However, a significant rebound occurred in January 2025, with the brand climbing to 28th place. This upward movement contrasts with competitors like NOBO, which saw a decline from 21st to 30th, and Candela, which maintained a relatively stable position around the mid-20s. Notably, Glorious Cannabis Co. showed a strong performance, improving from 52nd to 19th before settling at 26th. The sales trajectory of HOG Cannabis Co. indicates a positive trend, with January sales significantly higher than the previous months, suggesting effective strategies that have bolstered its market presence and competitiveness.

Notable Products

In January 2025, Pineapple Burst (3.5g) maintained its position as the top-performing product for HOG Cannabis Co., with sales reaching 3801 units. Hypno Stank (Bulk) moved up to the second position, showing a recovery in sales compared to previous months. Triangle Mints (3.5g) entered the rankings for the first time in January, securing the third spot. Peels (Bulk) experienced a slight drop, moving from second place in December to fourth in January. Duct Tape (3.5g) made its debut in the rankings at fifth place, indicating a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.