Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

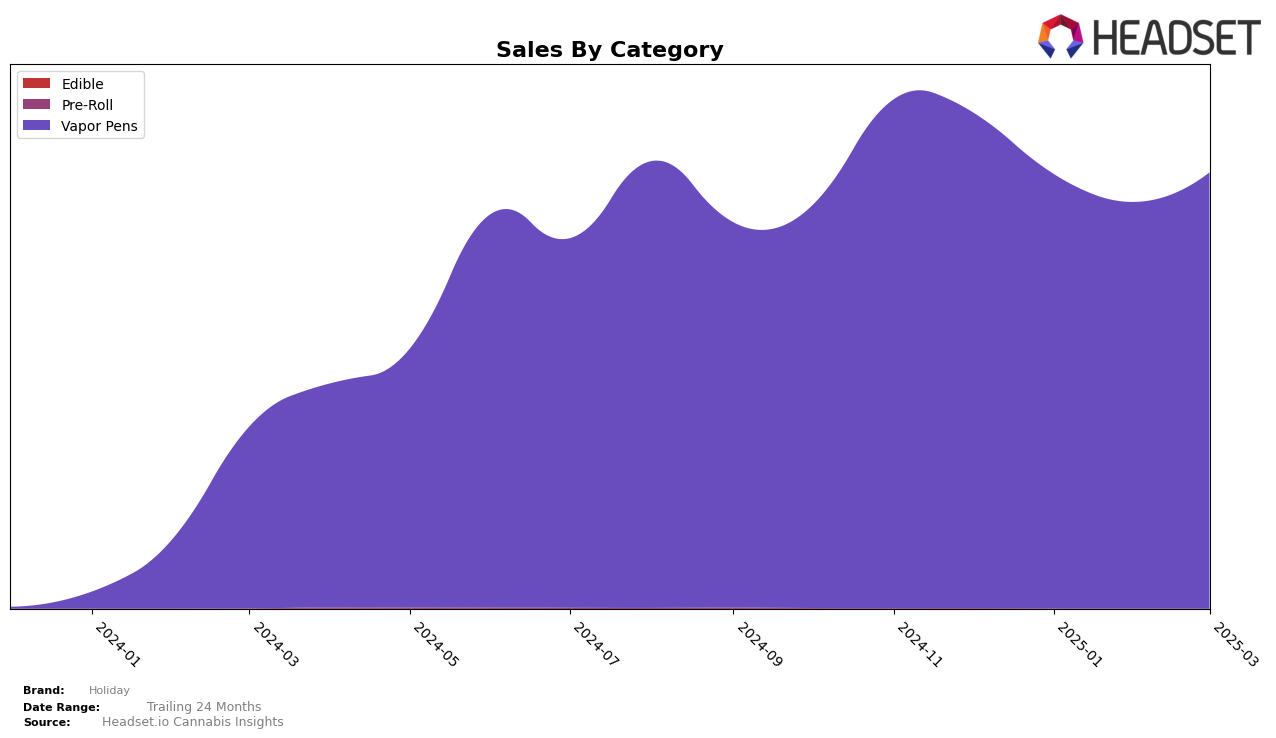

In the vapor pens category, Holiday has demonstrated a consistent performance across different states, with notable activity in both Massachusetts and New York. In Massachusetts, the brand maintained a steady position, ranking 8th in December 2024 and March 2025, with a slight dip to 9th in January 2025. Despite this minor fluctuation, the brand's sales figures indicate a general stability, suggesting a solid consumer base. On the other hand, in New York, Holiday has consistently held the 7th rank from December 2024 through February 2025, before slipping to 8th in March 2025. This slight drop in ranking could be indicative of increased competition within the state, despite a rebound in sales in March 2025. Such trends highlight the brand's resilience and ability to maintain a strong presence in competitive markets.

While Holiday's performance in the vapor pens category shows a commendable consistency, it's important to note the absence of top 30 rankings in other categories or states, which suggests areas for potential growth or increased competition. The brand's ability to remain within the top 10 in both Massachusetts and New York underscores its strong positioning and consumer loyalty in these markets. However, the lack of visibility in other states or categories could be seen as a limitation, indicating either a strategic focus or a need for diversification. These insights offer a glimpse into the brand's regional strengths and potential opportunities for expansion, providing a nuanced view of its current market standing.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Holiday has shown consistent performance, maintaining a steady rank of 7th place from December 2024 through February 2025, before slightly dropping to 8th place in March 2025. This minor decline in rank could be attributed to the competitive pressures from brands like STIIIZY, which entered the top 20 in March 2025 at 7th place, and Mfused, which consistently held a higher rank despite a sales dip in early 2025. Meanwhile, Magnitude closely trails Holiday, maintaining a stable presence just behind it. The fluctuations in sales figures for these competitors highlight the dynamic nature of the market, suggesting that Holiday's strategic focus should be on differentiating its offerings to sustain and potentially improve its market position amidst rising competition.

Notable Products

In March 2025, Golden Hour Distillate H-Bar Disposable (1g) continued its streak as the top-selling product for Holiday, maintaining its number one position for the fourth consecutive month with sales of $7,303. Happy Camper Distillate H-Bar Disposable (1g) also held steady in second place, showing a consistent performance over the months. Leisure Distillate H-Bar Disposable (1g) remained in third place, reflecting stable demand within the Vapor Pens category. Notably, Staycation Distillate H-Bar Disposable (1g) improved its ranking from fifth in February to fourth in March. Meanwhile, THC/CBG 2:1 Airplane Mode Hybrid Distillate H-Bar Disposable (1g) dropped one spot to fifth, indicating a slight decrease in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.