Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

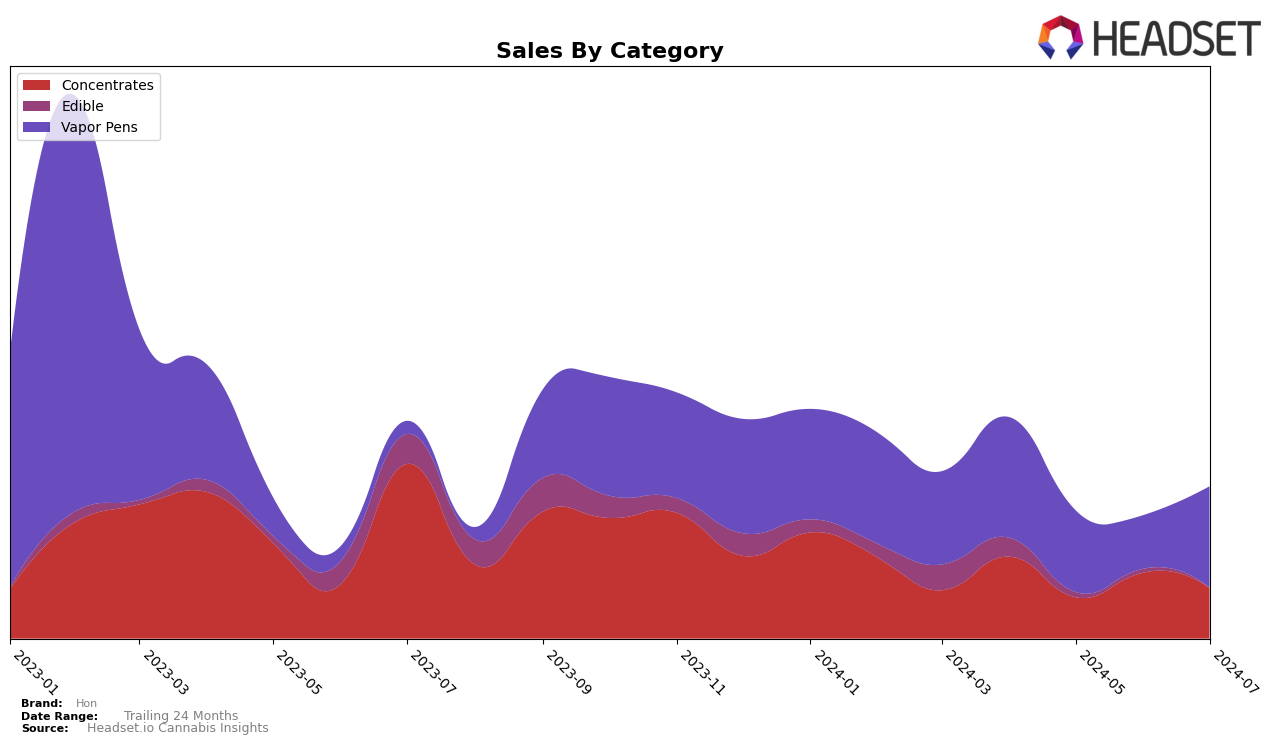

Hon's performance across different categories in Ohio has shown varied results over recent months. In the Concentrates category, Hon managed to secure the 28th rank in both April and June 2024 but failed to make it into the top 30 in May and July. This fluctuation suggests a need for more consistent market presence or possibly a response to competitive pressures. On the other hand, the Vapor Pens category saw Hon ranked 49th in April, slipping slightly to 51st in May, and then not placing in June, only to reappear at 52nd in July. This indicates some volatility, but also a resilience in maintaining a presence in a competitive market.

When examining sales trends, Hon's Concentrates saw a decline from $13,254 in April to $10,796 in June, reflecting the brand's struggle to maintain its ranking. In the Vapor Pens category, although Hon did not rank in June, the sales data shows a recovery in July with $16,255, up from $13,222 in May. This indicates a potential rebound or successful promotional efforts. The absence of rankings in certain months highlights areas for improvement, but the overall trend suggests that Hon has the capability to regain and potentially improve its market position if strategic adjustments are made.

Competitive Landscape

In the competitive landscape of Vapor Pens in Ohio, Hon has experienced fluctuating rankings and sales over the past few months. Notably, Hon's rank dropped from 49th in April 2024 to 51st in May 2024, and it was not in the top 20 in June 2024, before slightly improving to 52nd in July 2024. This volatility contrasts with competitors like Pure Ohio Wellness, which consistently maintained higher ranks, albeit with a downward trend from 34th in April to 46th in July 2024. Meanwhile, brands such as Revel and Wellspring Fields have not been in the top 20 for any of these months, indicating a similar struggle in market presence. The data suggests that while Hon is facing challenges in maintaining a stable rank, there is potential for improvement, especially when compared to other brands that have also seen fluctuating sales and rankings.

Notable Products

In July 2024, the top-performing product from Hon was Mohican Mints Distillate Zico Cartridge (0.84g) in the Vapor Pens category, which achieved the first rank with sales of 119 units. Problem Child Live Badder (1.68g) in the Concentrates category secured the second position, moving up from the third rank in June 2024. Phun Yunz Distillate Cartridge (0.84g) entered the rankings for the first time in July 2024, achieving the third position. Skunkberry Distillate Cartridge (0.84g) was ranked fourth, while Phun Yunz Distillate Luster Pod (0.85g) dropped to the fourth position from the first rank in June 2024. This shift in rankings indicates a dynamic market with significant changes in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.