Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

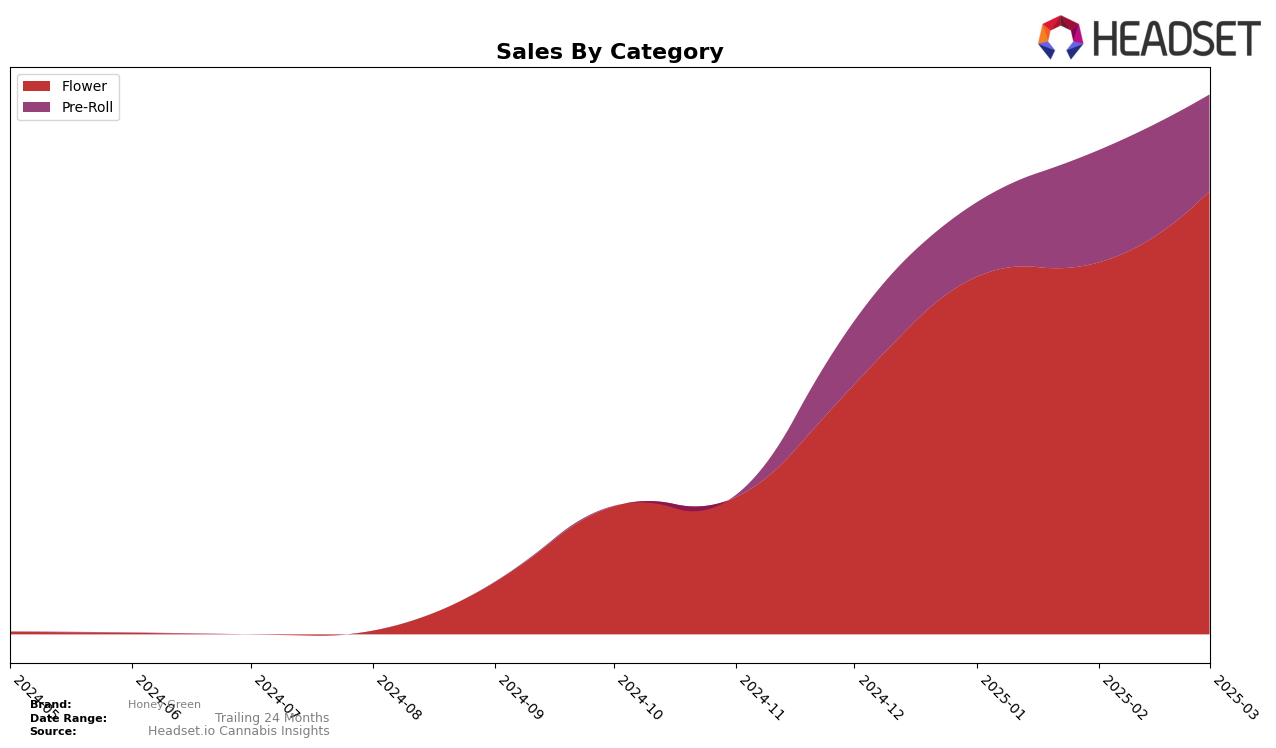

Honey Green has shown a notable upward trajectory in the Missouri market, particularly in the Flower category. Starting from a December 2024 rank of 35, Honey Green improved its standing to 29 by January 2025 and further climbed to 27 by February, maintaining that rank through March. This consistent rise is underpinned by a steady increase in sales, culminating in a March 2025 sales figure of $526,111. Such performance indicates a strengthening presence in Missouri's Flower market, suggesting that the brand's offerings are resonating well with consumers. However, Honey Green is not yet in the top 30 in other states, which presents both a challenge and an opportunity for expansion.

The Pre-Roll category in Missouri presents a more mixed picture for Honey Green. While the brand did not make it into the top 30 in December 2024, it managed to secure the 32nd position in January 2025 and impressively jumped to 23rd in February. However, this momentum was not sustained, as it fell back to 34th in March. Despite this fluctuation, the brand experienced a peak in sales in February, indicating potential for growth if the right strategies are implemented. The challenge remains for Honey Green to stabilize its rank and capitalize on the promising sales figures to secure a more consistent position in the top 30 across different categories and states.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Honey Green has shown a promising upward trajectory in its rankings and sales, indicating a strengthening market presence. From December 2024 to March 2025, Honey Green improved its rank from 35th to 27th, showcasing a consistent rise in market position. This positive trend is further underscored by a steady increase in sales, culminating in March 2025 with a notable performance. In contrast, Elevate Cannabis Co experienced a decline, dropping out of the top 20 by December 2024 and maintaining a lower rank through March 2025. Similarly, Nugz saw a downward shift from 13th in December 2024 to 25th by March 2025, reflecting a significant decrease in sales. Meanwhile, Sublime and Galactic showed fluctuating ranks, with Sublime making a notable recovery in March 2025. These dynamics suggest that Honey Green's strategic initiatives may be effectively capturing market share from competitors, positioning it as a rising player in Missouri's Flower category.

Notable Products

In March 2025, Honey Green's top-performing product was Coffee Creamer (3.5g) in the Flower category, securing the number one rank with sales of 2286 units. This was followed by Runtz on Runtz (3.5g) and Dulce de Fresca (3.5g), which ranked second and third, respectively. Marilyn Monroe (3.5g) experienced a slight dip, moving from first in January to fourth in March, indicating a decrease in its sales momentum. Permanent Marker Pre-Roll (1g) held the fifth position, making a notable entry into the rankings for the first time. Overall, the Flower category dominated the top ranks, showcasing strong consumer preference for these products in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.