Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

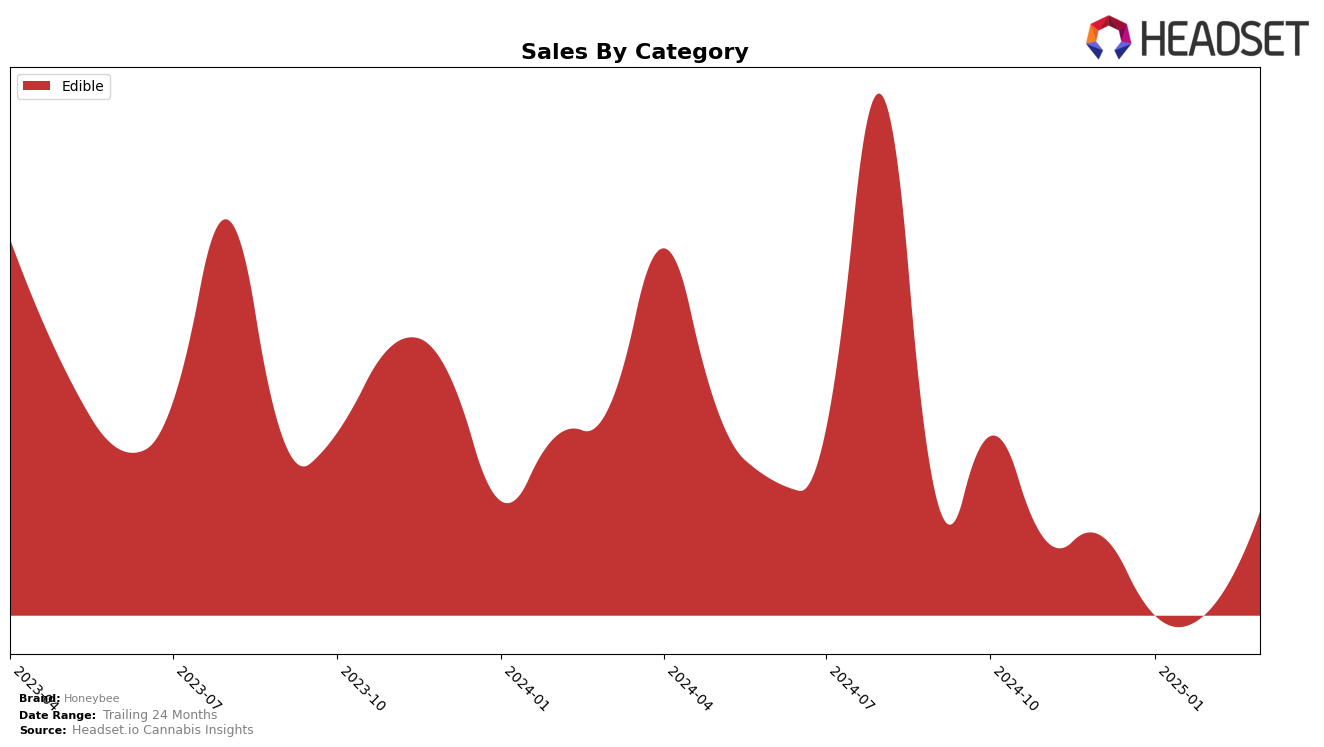

In the state of Missouri, Honeybee has shown a dynamic performance in the Edible category. Starting from a rank of 15 in December 2024, the brand experienced a slight dip to 17 in January 2025 but quickly regained momentum, climbing up to 13 by February and further improving to 12 in March. This upward trend in rankings is accompanied by a notable increase in sales, with March figures reaching $475,724, indicating a strong recovery and growth in consumer preference for Honeybee's edible products.

It's important to note that Honeybee's presence in Missouri's edible market is significant, as they have consistently maintained a position within the top 15 brands, suggesting a stable consumer base and effective market strategies. The absence of rankings in other states or categories might indicate areas for potential growth or diversification, as expanding their footprint beyond Missouri could provide additional revenue streams and brand recognition. However, the consistent improvement within Missouri's edible market suggests that Honeybee is capitalizing effectively on its current strengths.

Competitive Landscape

In the competitive landscape of the Missouri edible cannabis market, Honeybee has shown a notable upward trajectory in rankings over the first quarter of 2025. Starting from a rank of 15 in December 2024, Honeybee improved to 12 by March 2025. This positive shift is indicative of a strategic gain in market share, despite the competitive pressures from brands like DOSD Edibles, which consistently ranked higher, peaking at 10 in March 2025. Meanwhile, Dixie Elixirs and Greenlight experienced more volatile rankings, with Greenlight dropping from 11 in December 2024 to 13 in March 2025, and Dixie Elixirs maintaining a steady yet lower rank. Honeybee's sales figures also reflect a significant recovery and growth, particularly in March 2025, where they nearly matched those of Tsunami, a consistently higher-ranking competitor. This suggests that Honeybee's strategies in product offerings or marketing may be effectively resonating with consumers, positioning them as a rising contender in the Missouri edibles market.

Notable Products

In March 2025, the top-performing product from Honeybee was the Grape Soda Gummies 20-Pack (100mg), which reclaimed its top position from January after a slight dip in February, achieving sales of 1720 units. The Blood Orange Strawberry Gumdrops 20-Pack (100mg) followed closely in second place, maintaining a strong performance throughout the months despite dropping from first in February. The Blood Orange Strawberry High Potency Gumdrops 20-Pack (300mg) secured the third spot, showing a consistent presence in the top five over the past months. Sour Raspberry Lemonade Gumdrops 20-Pack (100mg) entered the rankings in fourth place, marking its first appearance since January. Finally, the Tangerine Dream Rosin Infused Gumdrops 20-Pack (100mg) debuted in fifth place, rounding out Honeybee's top products for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.