Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

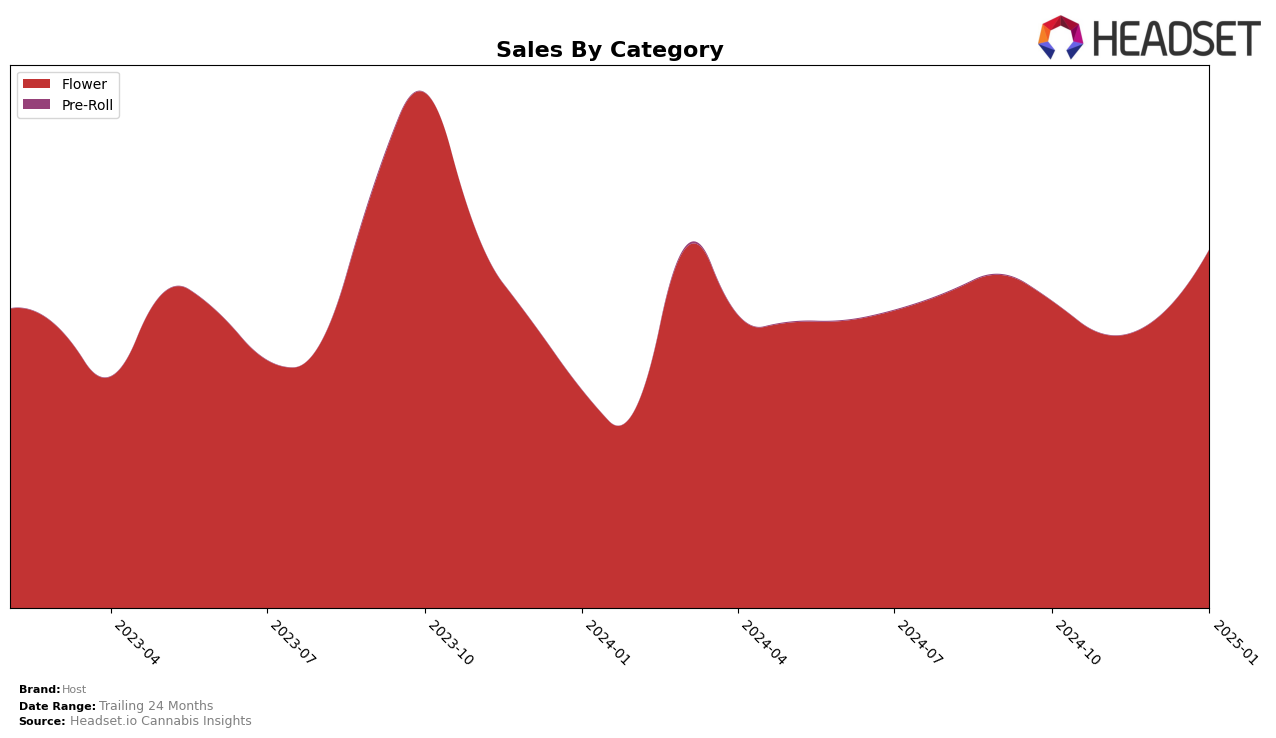

In the state of Colorado, Host has demonstrated a notable upward trajectory in the Flower category over the past few months. Starting from a rank of 28 in October 2024, Host managed to climb to the 20th position by January 2025. This consistent improvement highlights a growing consumer preference or successful strategic positioning within the state's competitive cannabis market. Interestingly, while Host was ranked 31st in November 2024, which indicates a brief dip, the brand quickly rebounded, suggesting resilience and possibly effective marketing or distribution adjustments during the holiday season.

Despite the positive movement in Colorado, Host was not listed in the top 30 brands in any other state or category during the same period, which could be seen as a limitation in their market reach or category penetration. This absence from other rankings might indicate a need for Host to explore expansion opportunities or to strengthen their presence in other states or categories. The increase in sales from $254,915 in October to $297,743 in January within Colorado's Flower category reflects a solid growth trajectory, which could be leveraged for broader market strategies. However, the absence of Host in other rankings suggests more room for improvement and potential exploration beyond their current stronghold in Colorado's Flower market.

Competitive Landscape

In the competitive landscape of the Colorado flower market, Host has shown a promising upward trajectory in rank from October 2024 to January 2025. Initially ranked at 28th in October, Host climbed to the 20th position by January, indicating a positive trend in consumer preference and market penetration. In contrast, Silver Lake experienced a decline, dropping from 13th in December to 22nd in January, which could suggest a shift in consumer loyalty or market dynamics. Meanwhile, Natty Rems showed a consistent improvement, moving from 37th to 18th, potentially posing a competitive threat to Host. Del Mundo also improved its rank, ending at 19th in January, just ahead of Host, while Dro saw a significant fluctuation, peaking at 9th in December before dropping to 21st in January. Host's sales growth, particularly in January, suggests a strengthening position in the market, but the competition remains fierce, with brands like Natty Rems and Del Mundo also showing strong performances.

Notable Products

In January 2025, Host's top-performing product was Pinky's Advice Popcorn (1g) in the Flower category, climbing to the number one rank with sales reaching 5,486 units. Quattro Kush Popcorn (1g) maintained a strong presence, ranking second, although it dropped from the top spot it held in December 2024. La Bomba (Bulk) secured the third position, marking its debut in the top rankings. Quattro Kush (1g), which started as the leader in October 2024, fell to fourth place, continuing its downward trajectory over the months. Paradise Peach (Bulk) remained consistent, holding the fifth spot for two consecutive months, showing resilience despite fluctuating sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.