Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

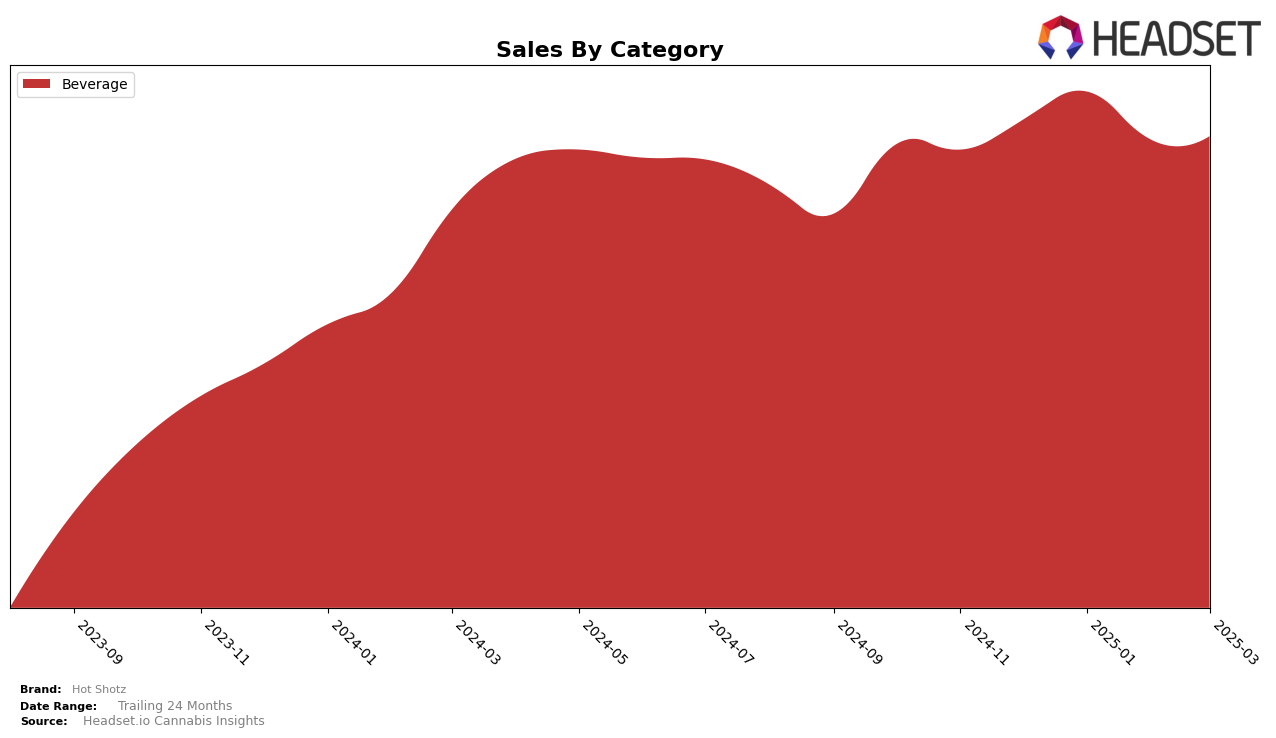

Hot Shotz has shown a consistent presence in the Washington market, particularly in the Beverage category. Over the four-month period from December 2024 to March 2025, the brand maintained positions within the top 10, fluctuating slightly between 7th and 9th place. This stability indicates a strong foothold in the region, with January 2025 marking their peak at 7th position. However, it's important to note a slight decline in sales from January to February, which suggests potential challenges in maintaining growth momentum.

Interestingly, Hot Shotz's performance in other states or provinces is not highlighted in the available data, suggesting that the brand did not make it into the top 30 in those regions for the Beverage category during this period. This absence could indicate either a strategic focus on Washington or a need to bolster their presence elsewhere to achieve a broader market reach. The brand's performance in Washington serves as a benchmark for potential expansion strategies, as they seem to have a successful model that could be replicated in other markets.

Competitive Landscape

In the competitive landscape of the Washington beverage category, Hot Shotz has demonstrated a dynamic presence, though it faces stiff competition. Over the four-month period from December 2024 to March 2025, Hot Shotz experienced fluctuations in its rank, starting at 8th, peaking at 7th in January, and then slipping to 9th by March. This movement indicates a competitive struggle, particularly with brands like Constellation Cannabis, which consistently held a higher rank, and Ratio (WA), which improved its rank to surpass Hot Shotz by March. Despite these challenges, Hot Shotz maintained a relatively stable sales performance, closely trailing Constellation Cannabis and outpacing Blaze Soda and Doja Trees in sales. The competitive pressure from these brands suggests that while Hot Shotz is a strong contender, strategic marketing and product differentiation could be key to regaining and maintaining a higher rank in this competitive market.

Notable Products

In March 2025, the top-performing product from Hot Shotz was the Blue Raspberry Energy Drink (100mg THC, 2oz) in the Beverage category, maintaining its number one rank consistently since December 2024, with sales reaching 5166 units. The CBD/THC 1:1 Watermelon Energy Drink (100mg CBD, 100mg THC, 2oz) held steady at the second position, showing strong performance with sales figures close to previous months. The Dragon Fruit Energy Shot (100mg THC, 2oz) maintained its third-place ranking, demonstrating stable sales. The Green Apple Energy Drink (100mg THC, 2oz) remained in fourth place, with sales slightly declining from the previous month. Notably, the Fruit Punch Energy Drink (100mg THC, 2oz), which had dropped to fifth place in January, continued to hold that position in March, despite a decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.