Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

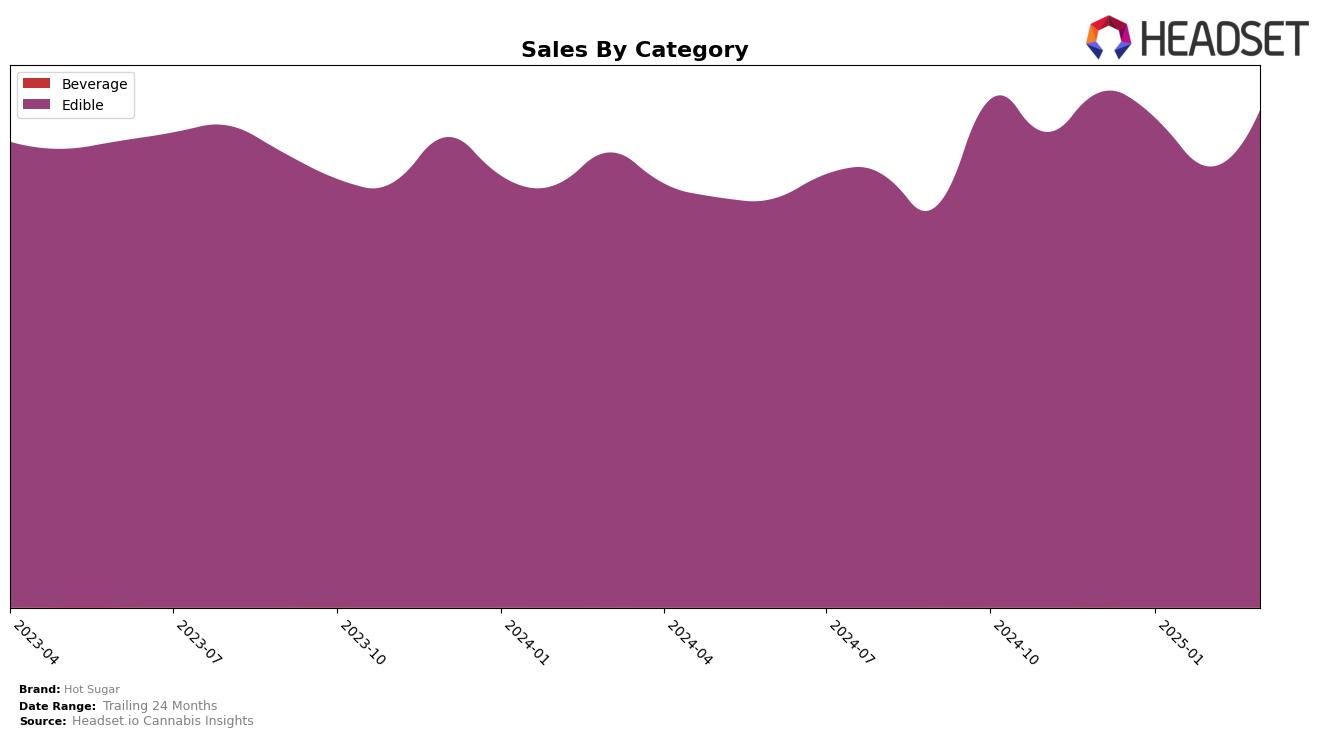

Hot Sugar has shown consistent performance in the Edible category within the state of Washington. Maintaining a steady rank of 3rd place from December 2024 through March 2025, their position reflects a strong foothold in this market. Despite a noticeable dip in sales during February, where figures dropped from January's level, Hot Sugar managed to recover in March, indicating resilience and an ability to rebound in the competitive landscape. This consistent ranking suggests a solid consumer base and effective market strategies that keep them in the top tier of edible brands in Washington.

In contrast, the absence of Hot Sugar from the top 30 rankings in other states and categories might be a point of concern, suggesting areas where the brand has yet to establish a significant presence. This absence indicates potential growth opportunities if strategic adjustments are made to penetrate these markets. While their performance in Washington is commendable, understanding the dynamics that contribute to their success there could provide insights for expansion strategies in other regions. The data hints at a brand with potential, yet one that might need to diversify its market reach to enhance its overall footprint across the cannabis industry.

Competitive Landscape

In the Washington edible market, Hot Sugar consistently maintained its position as the third-ranked brand from December 2024 through March 2025. Despite a steady rank, Hot Sugar faces stiff competition from brands like Wyld, which dominates the market with a consistent first-place ranking and significantly higher sales figures. Meanwhile, Green Revolution holds a firm second place, also outperforming Hot Sugar in sales. Although Hot Sugar's sales dipped slightly in February 2025, it rebounded in March, indicating resilience in a competitive landscape. Brands like Craft Elixirs and Journeyman alternated between fourth and fifth positions, trailing behind Hot Sugar, which suggests that while Hot Sugar is not leading, it remains a strong contender in the mid-tier of the market.

Notable Products

In March 2025, Sour Watermelon Fruit Drop 10-Pack (100mg) maintained its top position as the leading product for Hot Sugar, with a notable sales figure of 5789 units. Consistently holding the second spot was CBN/THC 1:1 Huckleberry Gummies 10-Pack (100mg CBN, 100mg THC), demonstrating stable demand across the months. Peach Mango Fruit Drop 10-Pack (100mg) remained third, showing steady sales performance since December 2024. Blue Raspberry Fruit Drop 10-Pack (100mg) also retained its fourth place, with sales figures aligning closely with previous months. Green Apple Fruit Drop 10-Pack (100mg) has consistently held the fifth position since January 2025, indicating a stable market presence.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.